Answered step by step

Verified Expert Solution

Question

1 Approved Answer

pls answer all or don't take pls answer if you know how to do correctly , pls only do if you know how to solve

pls answer all or don't take pls answer if you know how to do correctly , pls only do if you know how to solve properly ..thanks

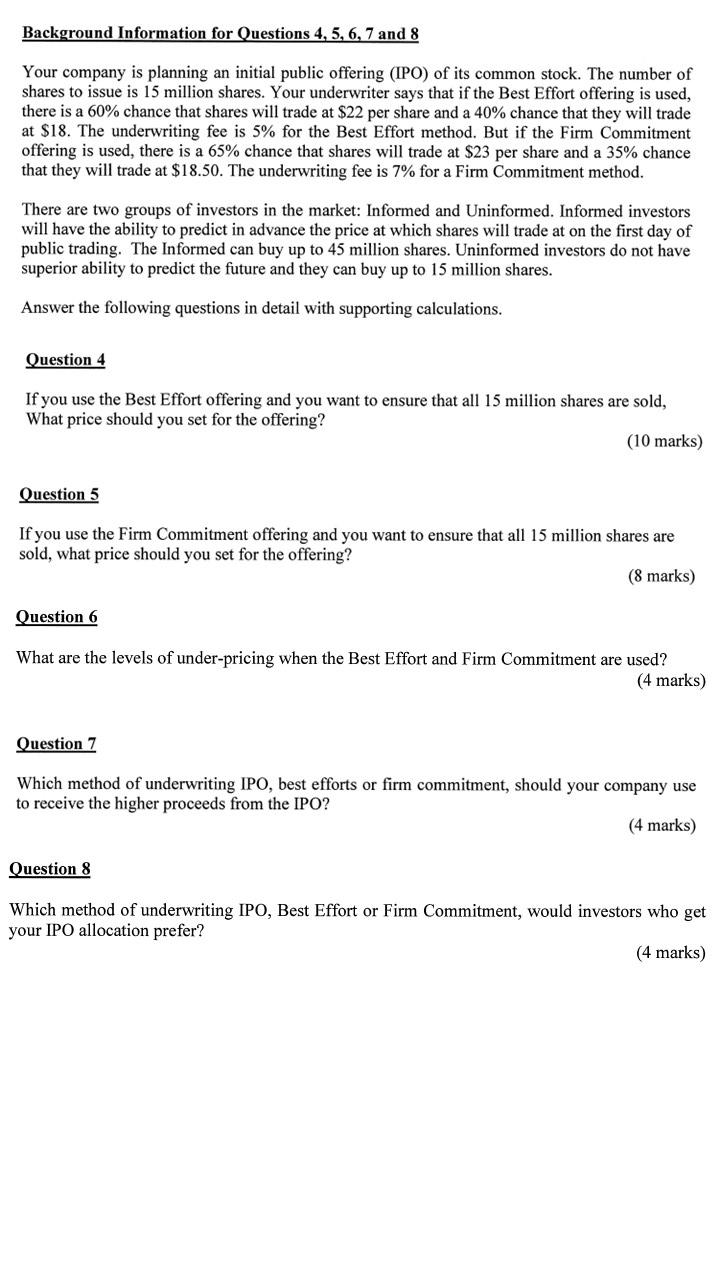

Background Information for Questions 4, 5, 6, 7 and 8 Your company is planning an initial public offering (IPO) of its common stock. The number of shares to issue is 15 million shares. Your underwriter says that if the Best Effort offering is used, there is a 60% chance that shares will trade at $22 per share and a 40% chance that they will trade at $18. The underwriting fee is 5% for the Best Effort method. But if the Firm Commitment offering is used, there is a 65% chance that shares will trade at $23 per share and a 35% chance that they will trade at $18.50. The underwriting fee is 7% for a Firm Commitment method. There are two groups of investors in the market: Informed and Uninformed. Informed investors will have the ability to predict in advance the price at which shares will trade at on the first day of public trading. The Informed can buy up to 45 million shares. Uninformed investors do not have superior ability to predict the future and they can buy up to 15 million shares. Answer the following questions in detail with supporting calculations. Question 4 If you use the Best Effort offering and you want to ensure that all 15 million shares are sold, What price should you set for the offering? (10 marks) Question 5 If you use the Firm Commitment offering and you want to ensure that all 15 million shares are sold, what price should you set for the offering? (8 marks) Question 6 What are the levels of under-pricing when the Best Effort and Firm Commitment are used? (4 marks) Question 7 Which method of underwriting IPO, best efforts or firm commitment, should your company use to receive the higher proceeds from the IPO? (4 marks) Question 8 Which method of underwriting IPO, Best Effort or Firm Commitment, would investors who get your IPO allocation prefer? (4 marks) Background Information for Questions 4, 5, 6, 7 and 8 Your company is planning an initial public offering (IPO) of its common stock. The number of shares to issue is 15 million shares. Your underwriter says that if the Best Effort offering is used, there is a 60% chance that shares will trade at $22 per share and a 40% chance that they will trade at $18. The underwriting fee is 5% for the Best Effort method. But if the Firm Commitment offering is used, there is a 65% chance that shares will trade at $23 per share and a 35% chance that they will trade at $18.50. The underwriting fee is 7% for a Firm Commitment method. There are two groups of investors in the market: Informed and Uninformed. Informed investors will have the ability to predict in advance the price at which shares will trade at on the first day of public trading. The Informed can buy up to 45 million shares. Uninformed investors do not have superior ability to predict the future and they can buy up to 15 million shares. Answer the following questions in detail with supporting calculations. Question 4 If you use the Best Effort offering and you want to ensure that all 15 million shares are sold, What price should you set for the offering? (10 marks) Question 5 If you use the Firm Commitment offering and you want to ensure that all 15 million shares are sold, what price should you set for the offering? (8 marks) Question 6 What are the levels of under-pricing when the Best Effort and Firm Commitment are used? (4 marks) Question 7 Which method of underwriting IPO, best efforts or firm commitment, should your company use to receive the higher proceeds from the IPO? (4 marks) Question 8 Which method of underwriting IPO, Best Effort or Firm Commitment, would investors who get your IPO allocation prefer? (4 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started