Answered step by step

Verified Expert Solution

Question

1 Approved Answer

pls answer all parts 15. APV To finance the Madison County project (see Problem 10), Wishing Well needs to arrange an additional $80 million of

pls answer all parts

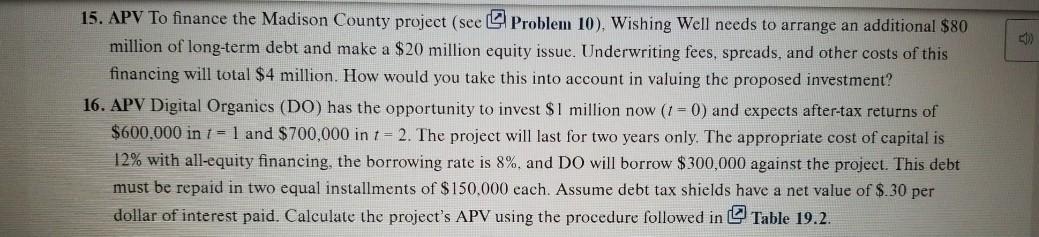

15. APV To finance the Madison County project (see Problem 10), Wishing Well needs to arrange an additional $80 million of long-term debt and make a $20 million equity issue. Underwriting fees, spreads, and other costs of this financing will total $4 million. How would you take this into account in valuing the proposed investment? 16. APV Digital Organics (DO) has the opportunity to invest $1 million now (1 - 0) and expects after-tax returns of $600,000 in 1 = 1 and $700,000 in t = 2. The project will last for two years only. The appropriate cost of capital is 12% with all-equity financing, the borrowing rate is 8%, and DO will borrow $ 300,000 against the project. This debt must be repaid in two equal installments of $150,000 each. Assume debt tax shields have a net value of $.30 per dollar of interest paid. Calculate the project's APV using the procedure followed in Table 19.2. 15. APV To finance the Madison County project (see Problem 10), Wishing Well needs to arrange an additional $80 million of long-term debt and make a $20 million equity issue. Underwriting fees, spreads, and other costs of this financing will total $4 million. How would you take this into account in valuing the proposed investment? 16. APV Digital Organics (DO) has the opportunity to invest $1 million now (1 - 0) and expects after-tax returns of $600,000 in 1 = 1 and $700,000 in t = 2. The project will last for two years only. The appropriate cost of capital is 12% with all-equity financing, the borrowing rate is 8%, and DO will borrow $ 300,000 against the project. This debt must be repaid in two equal installments of $150,000 each. Assume debt tax shields have a net value of $.30 per dollar of interest paid. Calculate the project's APV using the procedure followed in Table 19.2Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started