Answered step by step

Verified Expert Solution

Question

1 Approved Answer

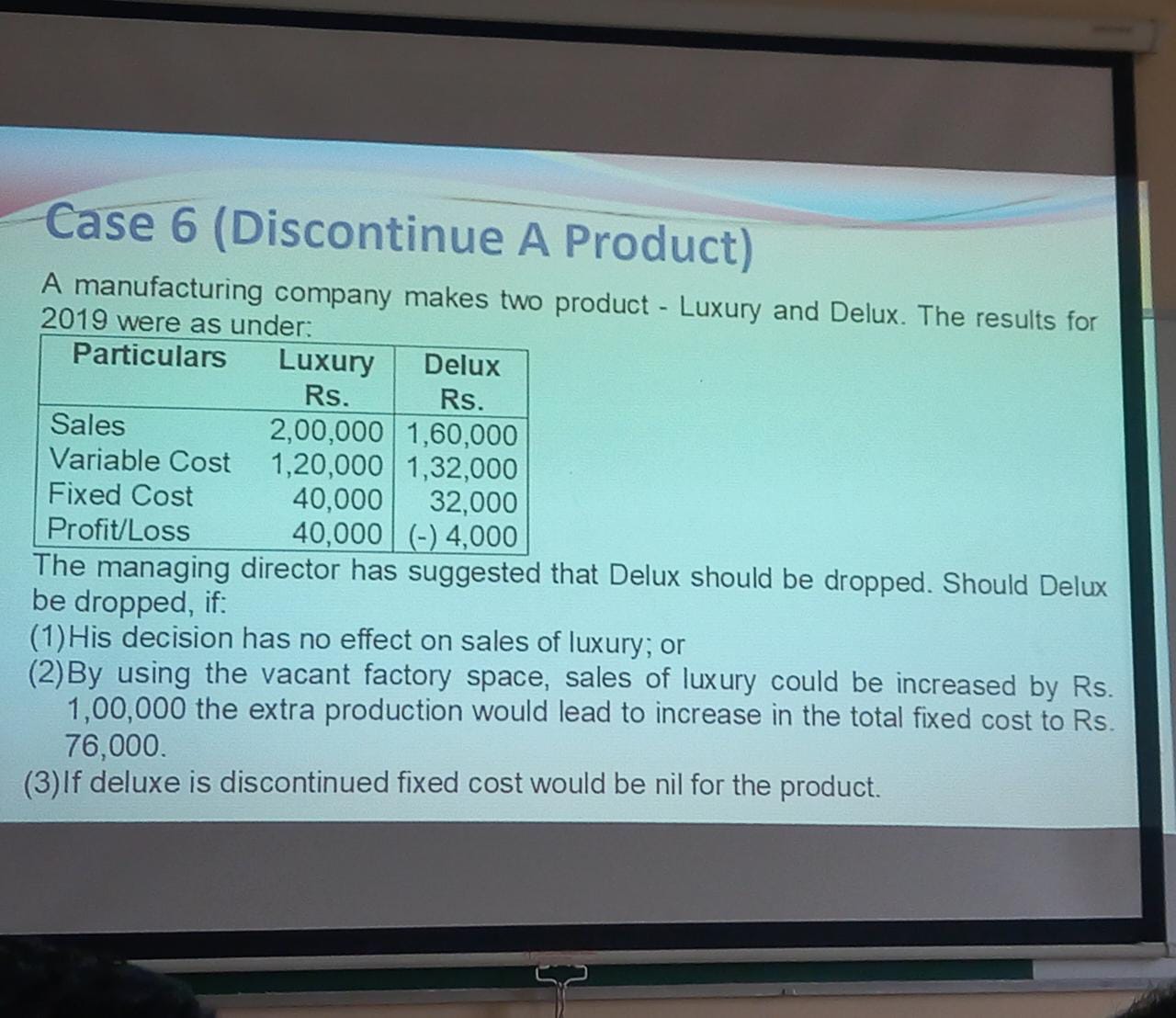

pls answer all the above questions or as many questions as you can. qn 1) a manufacturing company makes two products-luxury and delux.. 2) The

pls answer all the above questions or as many questions as you can. qn 1) a manufacturing company makes two products-luxury and delux..

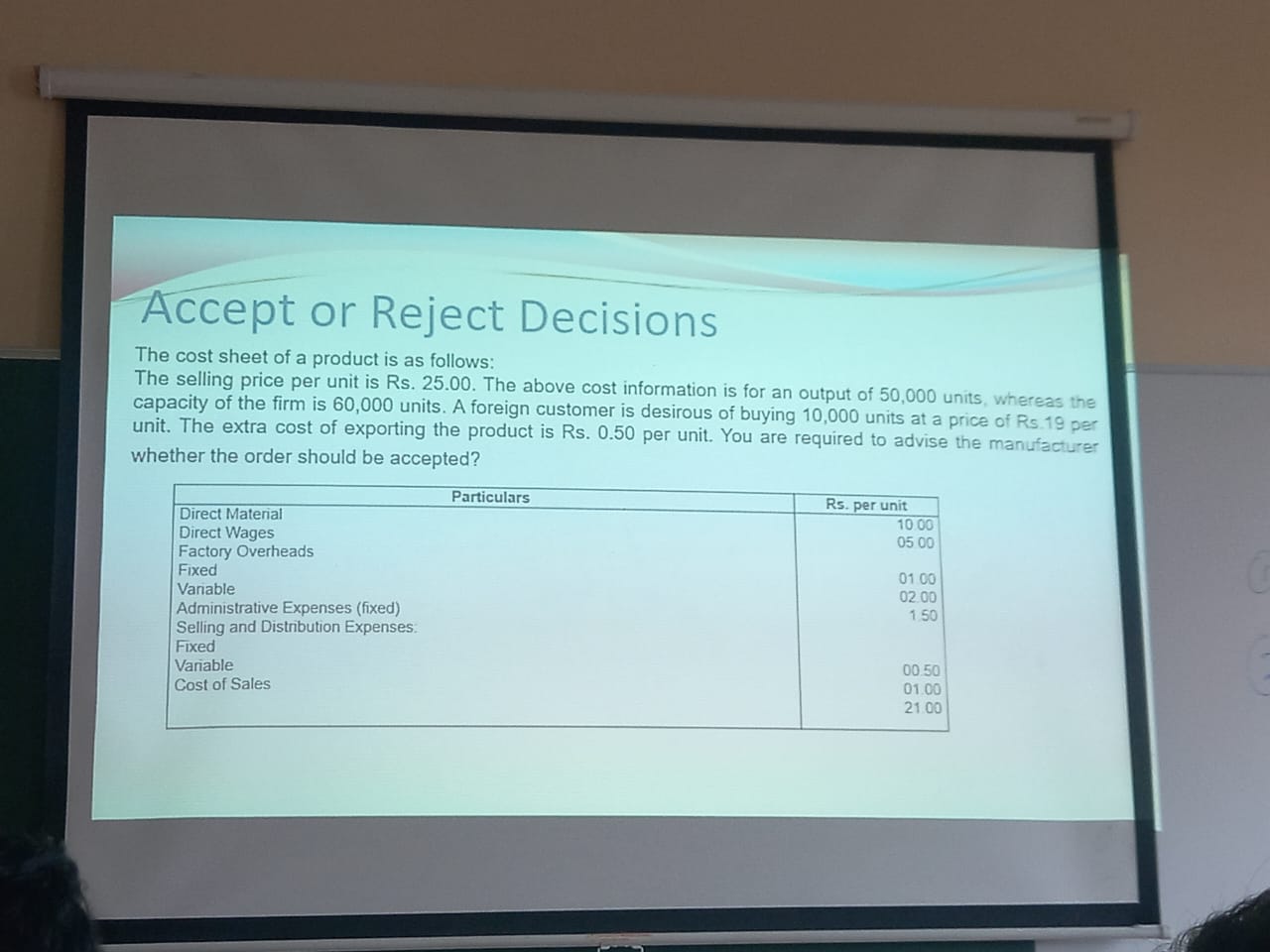

2) The selling price per unit is rs 25. the above cost per unit information is for an output of 50,000 units whereas the capacity of the firm is 60,000 units..

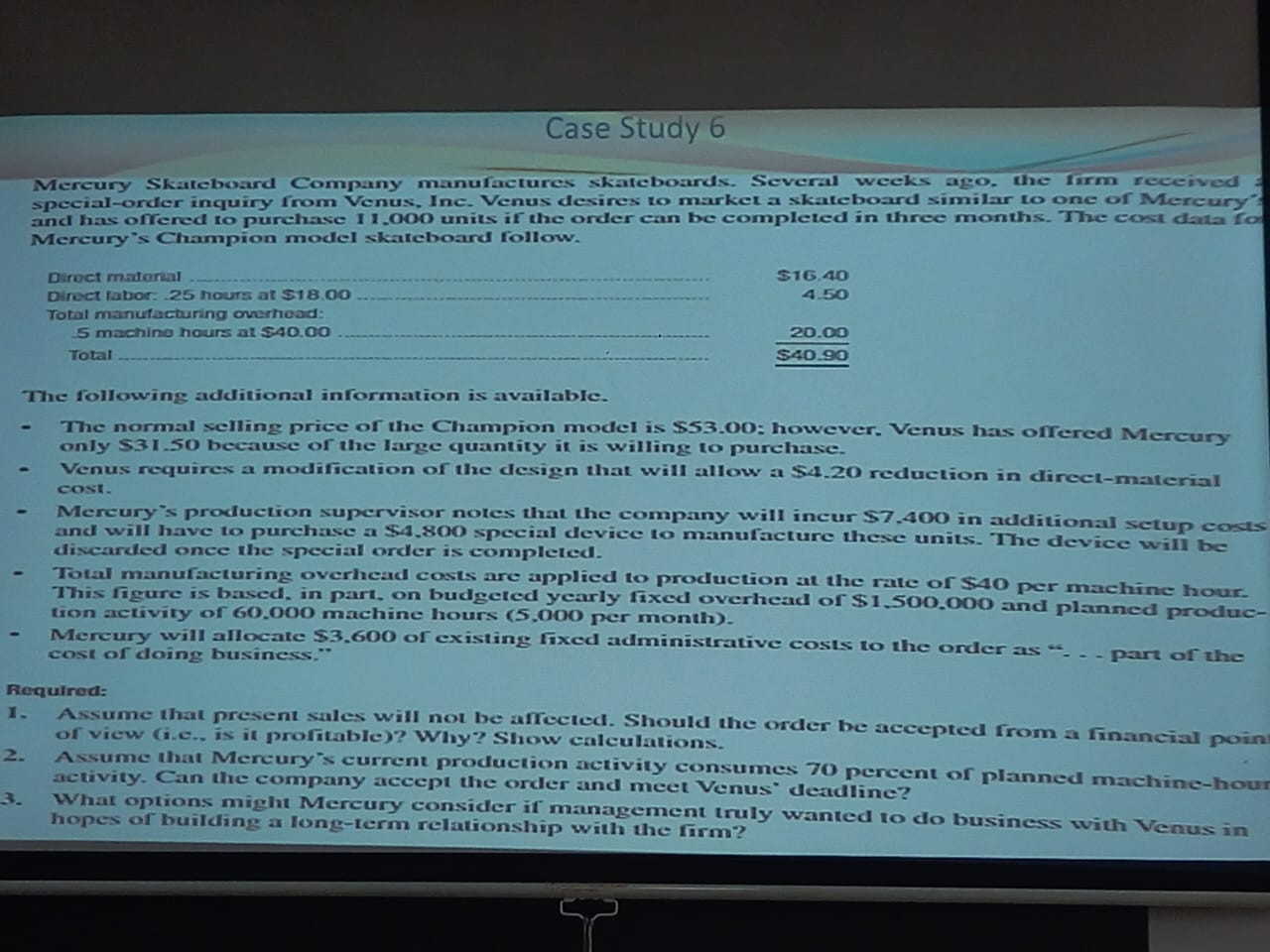

3) mercury skateboard company manufactures skateboard. several weeks ago the firm received..

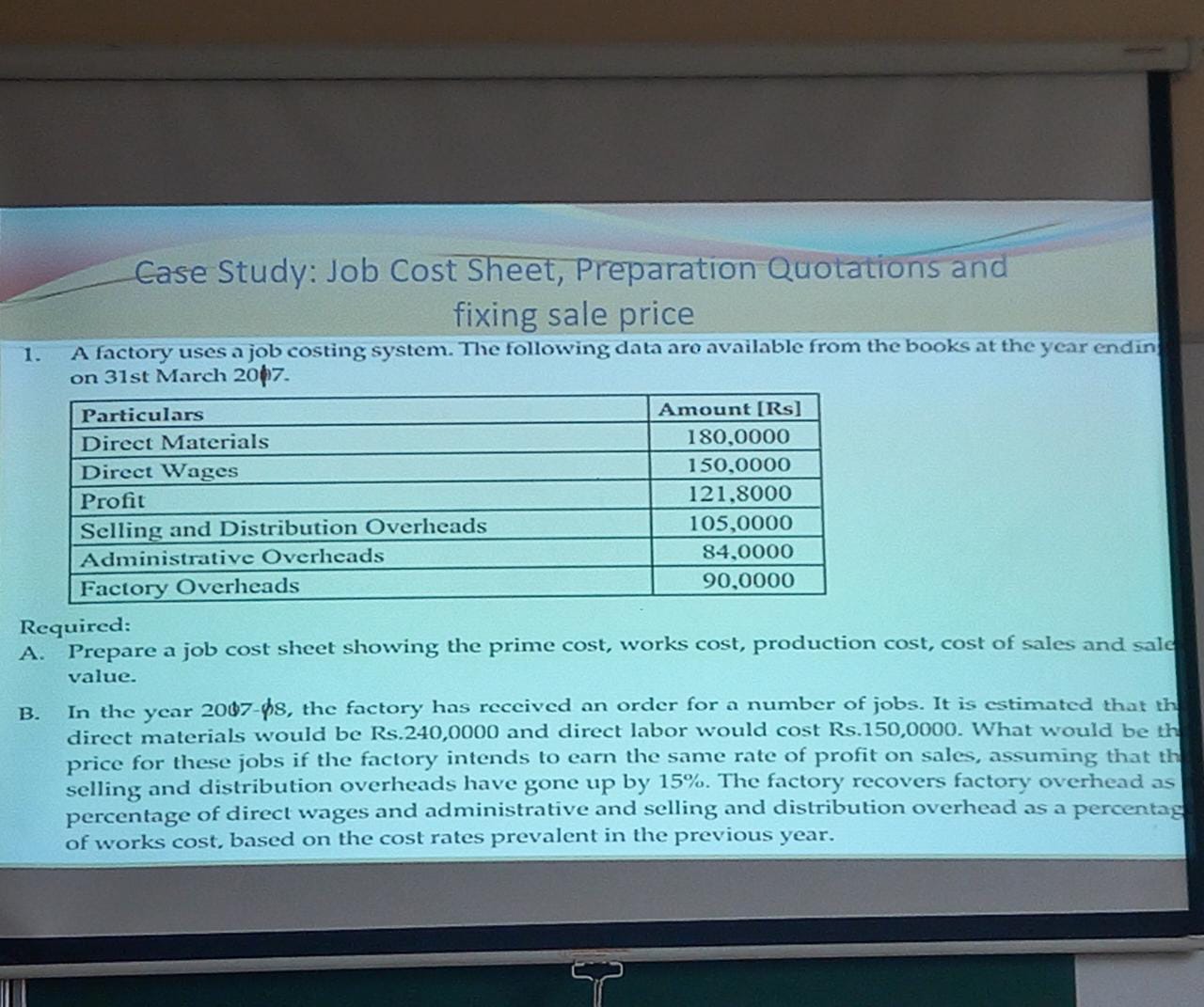

qn 4) a factory uses job costing system. the following data are available from the books at the year ending.

Accept or Reject Decisions The cost sheet of a product is as follows: The selling price per unit is Rs. 25.00. The above cost information is for an output of 50,000 units, whereas the capacity of the firm is 60,000 units. A foreign customer is desirous of buying 10,000 units at a price of Rs. 19 per unit. The extra cost of exporting the product is Rs. 0.50 per unit. You are required to advise the manufacturer whether the order should be accepted? Case Study 6 Mercury Skateboard Company manufactures skateboands. Several weeks ago. He imm received special-onder inquiry from Venus, Inc. Venus desines to market a skateboand similar to one of Mereury' and has ofrered to purchase 11,000 units if the order can be completed in three months. The cost data fod Mencury's Champion model skateboard follow. Direct matorial Direct ratuor: 25 hours at \\( \\$ 18.00 \\) Total manufacturing overnoad: 5 machino hours at \\( \\$ 40.00 \\) Total \\( \\$ 16.40 \\) 4.50 \\( \\frac{20.00}{\\$ 40.90} \\) The following additional information is available. - The normal selling price of the Champion model is \\( \\$ 53.00 \\) : however. Venus has ofrered Mercury only \\( S 31.50 \\) because of the large quantity it is willing to purchase. - Venus requires a modification of the design that will allow a 54 . 20 reduction in direct-material cosr. - Mercury's production supervisor notes that the company will incur \\( \\$ 7.400 \\) in additional setup costs and will have to purchase a \\( \\$ 4.800 \\) special device 10 manufacture these units. The device will be discarded once the special order is completed. - Total manufacturing overhead costs are applied to production at the rate or 540 per machine hour. This figure is based, in part, on budgeted yearly fixed overhead of \\( \\$ 1.500 .000 \\) and planned productron activity of 60.000 machine hours (5,000 per month). - Mercury will allocate \\( \\$ 3.600 \\) or existing rixed administrative costs to the order as \". - pare of the Requirea: 1. Assume that present sales will not be affected. Should the order be aceepted rrom a rinancial poin of view (i.e.. is it profitable)? Why? Show calculations. 2. Assume that Mercury's current production activity consumes 70 percent of planned machine-hour activity. Can the company aceept the order and meet Venus\" deadine? 3. What options might Mercury consider if management truly wanted to do busincss tvith Venus in hopes of building a long-term relationship with the firm? A manufacturing company makes two product - Luxury and Delux. The results for 2019 were as under. I he managing director has suggested that Delux should be dropped. Should Delux be dropped, if: (1) His decision has no effect on sales of luxury; or (2) By using the vacant factory space, sales of luxury could be increased by Rs. \\( 1,00,000 \\) the extra production would lead to increase in the total fixed cost to Rs. 76,000 . (3) If deluxe is discontinued fixed cost would be nil for the product. Case Study: Job Cost Sheet, Preparation Quotations and fixing sale price 1. A factory uses a job costing system. The following data aro available from the books at the year end in on 31st March 20 p. Required: A. Prepare a job cost sheet showing the prime cost, works cost, production cost, cost of sales and sal value. B. In the year \\( 2007-\\phi 8 \\), the factory has received an order for a number of jobs. It is estimated that direct materials would be Rs. 240,0000 and direct labor would cost Rs.150,0000. What would be price for these jobs if the factory intends to earn the same rate of profit on sales, assuming that selling and distribution overheads have gone up by \15. The factory recovers factory overhead percentage of direct wages and administrative and selling and distribution overhead as a percenta of works cost, based on the cost rates prevalent in the previous yearStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started