Answered step by step

Verified Expert Solution

Question

1 Approved Answer

pls answer asap!!!!!! a Coco de Coco Company acquired forest assets for a basket price of P30,000,000 which is equal to the lump- sum value

pls answer asap!!!!!!

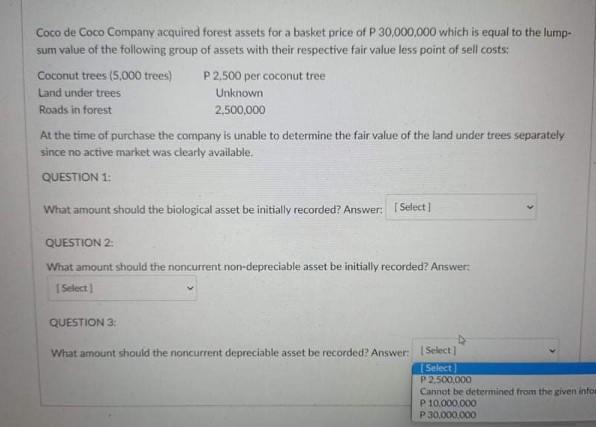

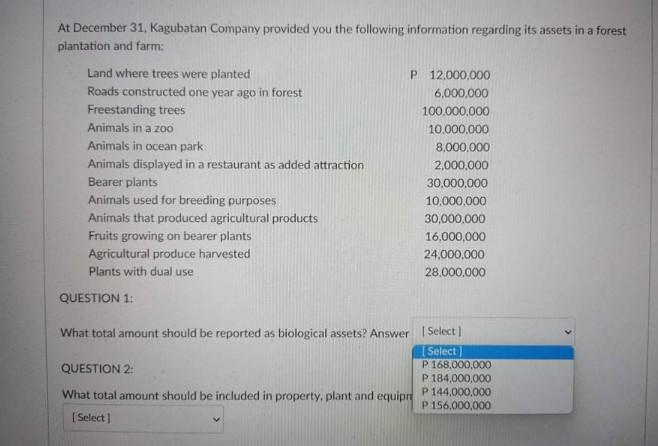

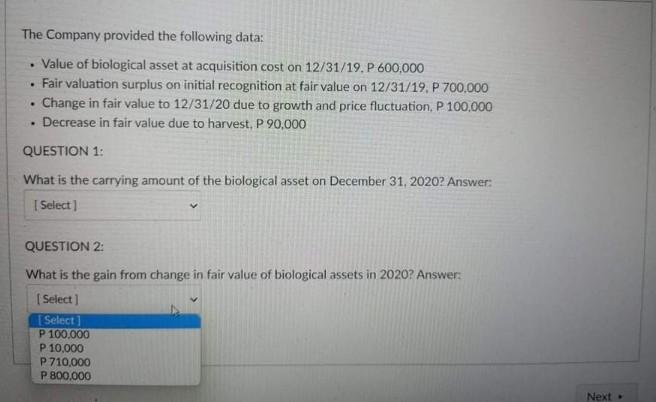

a Coco de Coco Company acquired forest assets for a basket price of P30,000,000 which is equal to the lump- sum value of the following group of assets with their respective fair value less point of sell costs; Coconut trees (5,000 trees) P2,500 per coconut tree Land under trees Unknown Roads in forest 2,500,000 At the time of purchase the company is unable to determine the fair value of the land under trees separately since no active market was clearly available QUESTION 1: What amount should the biological asset be initially recorded? Answer: Select] QUESTION 2: What amount should the rioncurrent non-depreciable asset be initially recorded? Answers Select QUESTION 3 What amount should the noncurrent depreciable asset be recorded? Answer: Select Select P2.500.000 Cannot be determined from the given into P 10.000.000 P30,000.000 At December 31, Kagubatan Company provided you the following information regarding its assets in a forest plantation and farm: Land where trees were planted Roads constructed one year ago in forest Freestanding trees Animals in a 200 Animals in ocean park Animals displayed in a restaurant as added attraction Bearer plants Animals used for breeding purposes Animals that produced agricultural products Fruits growing on bearer plants Agricultural produce harvested Plants with dual use QUESTION 1: P 12,000,000 6.000.000 100.000.000 10,000,000 8,000,000 2,000,000 30.000.000 10,000,000 30,000,000 16,000,000 24,000,000 28,000,000 What total amount should be reported as biological assets? Answer QUESTION 2: What total amount should be included in property, plant and equip Select] Select 1 Select P 168,000,000 P 184,000,000 P 144,000,000 P 156,000,000 . The Company provided the following data: Value of biological asset at acquisition cost on 12/31/19, P 600,000 Fair valuation surplus on initial recognition at fair value on 12/31/19. P 700.000 Change in fair value to 12/31/20 due to growth and price fluctuation, P 100,000 Decrease in fair value due to harvest, P 90,000 QUESTION 1: What is the carrying amount of the biological asset on December 31, 2020? Answer: Select QUESTION 2: What is the gain from change in fair value of biological assets in 2020? Answer: Select] Select P 100.000 P 10.000 P 710,000 P 800,000 Next

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started