Answered step by step

Verified Expert Solution

Question

1 Approved Answer

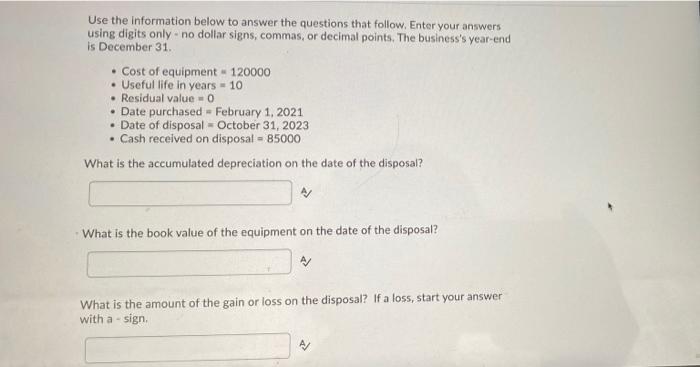

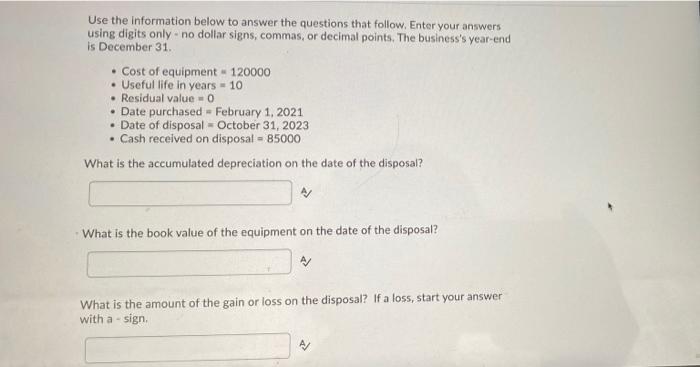

pls answer asap Use the information below to answer the questions that follow. Enter your answers using digits only.no dollar signs, commas, or decimal points.

pls answer asap

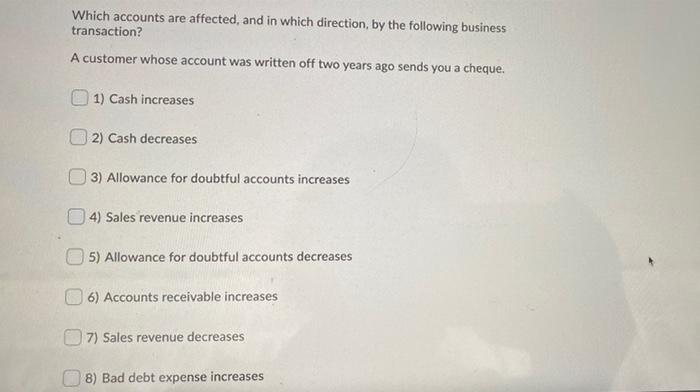

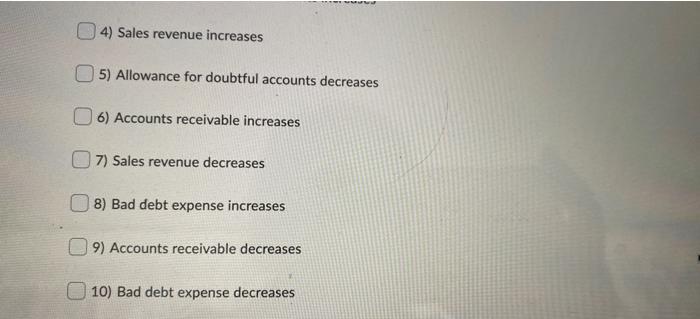

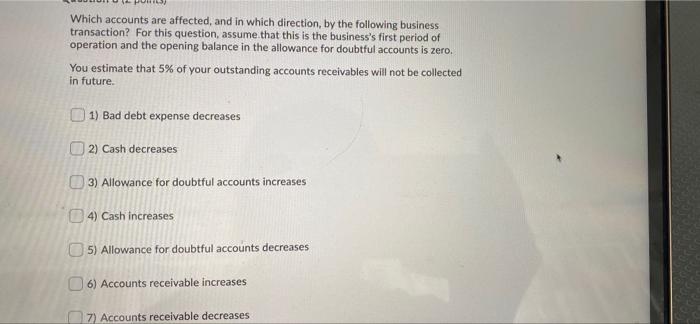

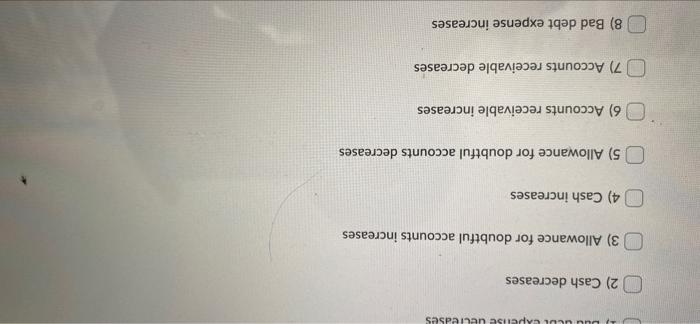

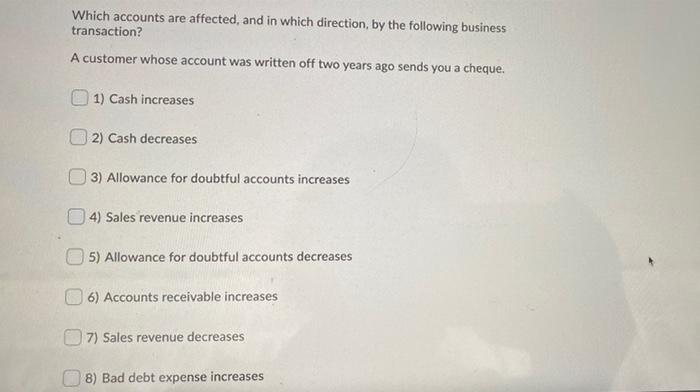

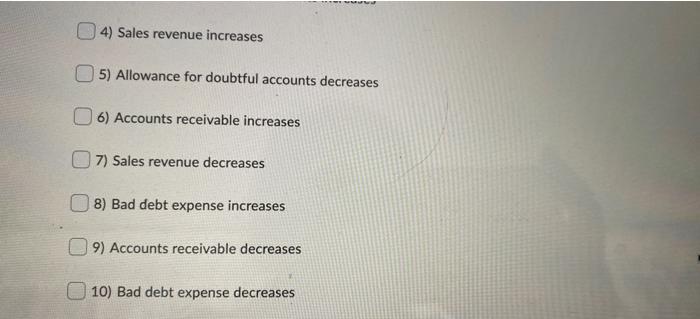

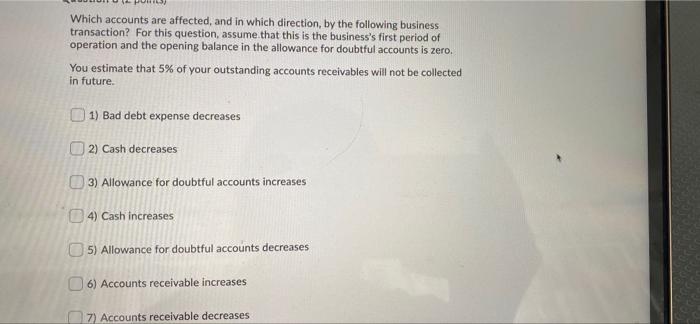

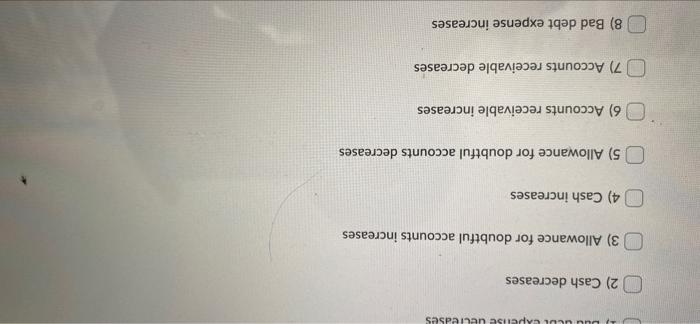

Use the information below to answer the questions that follow. Enter your answers using digits only.no dollar signs, commas, or decimal points. The business's year-end is December 31 Cost of equipment - 120000 Useful life in years = 10 Residual value - 0 Date purchased - February 1, 2021 Date of disposal - October 31, 2023 Cash received on disposal - 85000 What is the accumulated depreciation on the date of the disposal? What is the book value of the equipment on the date of the disposal? What is the amount of the gain or loss on the disposal? If a loss, start your answer with a - sign Which accounts are affected, and in which direction, by the following business transaction? A customer whose account was written off two years ago sends you a cheque. 1) Cash increases 2) Cash decreases 3) Allowance for doubtful accounts increases 4) Sales revenue increases 5) Allowance for doubtful accounts decreases 6) Accounts receivable increases 7) Sales revenue decreases 8) Bad debt expense increases 4) Sales revenue increases 5) Allowance for doubtful accounts decreases 6) Accounts receivable increases 7) Sales revenue decreases 8) Bad debt expense increases 9) Accounts receivable decreases 10) Bad debt expense decreases Which accounts are affected, and in which direction, by the following business transaction? For this question, assume that this is the business's first period of operation and the opening balance in the allowance for doubtful accounts is zero, You estimate that 5% of your outstanding accounts receivables will not be collected in future. 1) Bad debt expense decreases 2) Cash decreases 3) Allowance for doubtful accounts increases 4) Cash increases 5) Allowance for doubtful accounts decreases 6) Accounts receivable increases 7) Accounts receivable decreases * LOL CAPse ecreases 2) Cash decreases 3) Allowance for doubtful accounts increases 4) Cash increases 5) Allowance for doubtful accounts decreases 06) Accounts receivable increases 7) Accounts receivable decreases 8) Bad debt expense increases

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started