Answered step by step

Verified Expert Solution

Question

1 Approved Answer

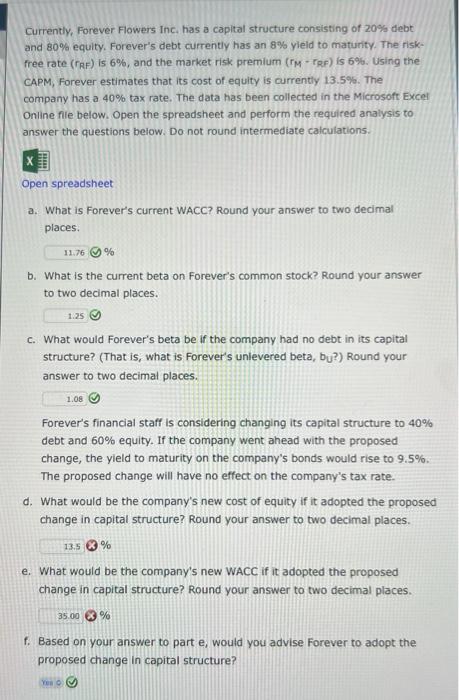

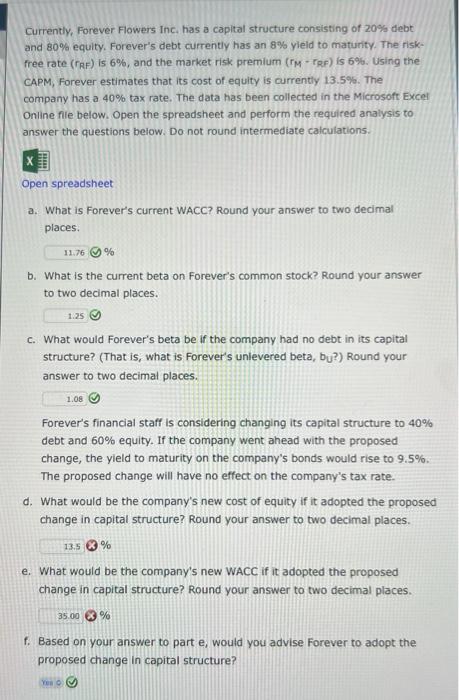

pls answer d. and e.; the rest are correct Currently, Forever Flowers Inc, has a capital structure consisting of 20% debt and 80% equity, Forever's

pls answer d. and e.; the rest are correct

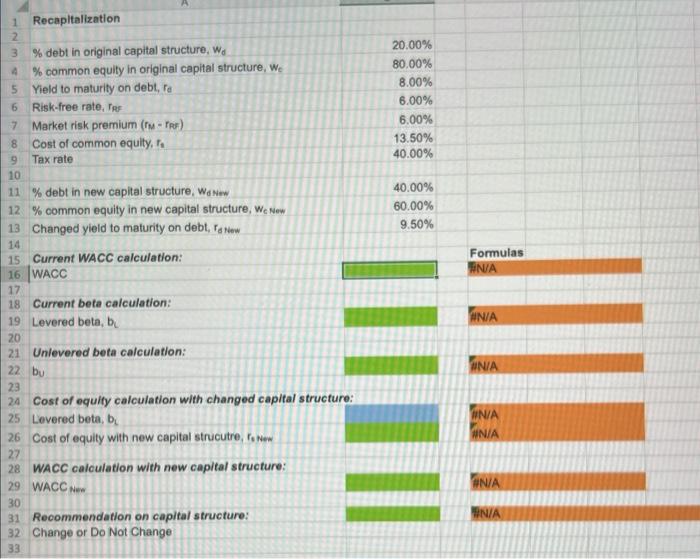

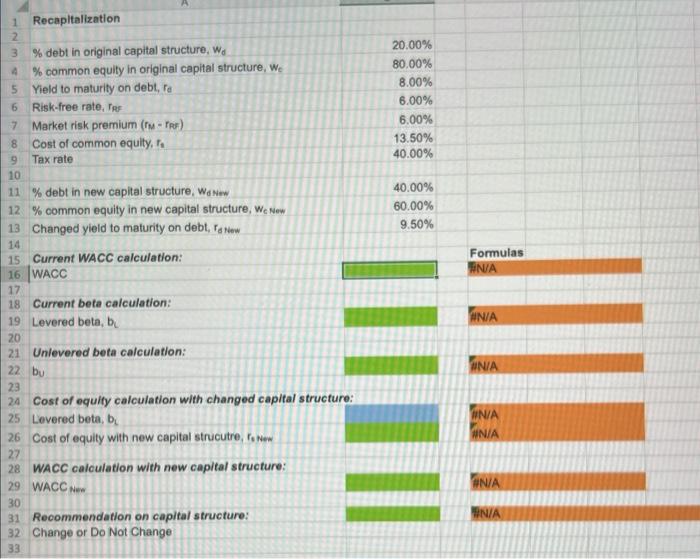

Currently, Forever Flowers Inc, has a capital structure consisting of 20% debt and 80% equity, Forever's debt currently has an 8% yleld to maturity. The riskfree rate (rRF) is 6%, and the market risk premium (rMrRR) is 6%. Using the CAPM, Forever estimates that its cost of equity is currentiy 13.5%. The company has a 40% tax rate. The data has been collected in the Microsoft Excel Onine file below. Open the spreadsheet and perform the required analysis to answer the questions below. Do not round intermediate calculations. Open spreadsheet a. What is Forever's current WACC? Round your answer to two decimal places. % b. What is the current beta on forever's common stock? Round your answer to two decimal places. c. What would Forever's beta be if the company had no debt in its capital structure? (That is, what is Forever's unlevered beta, bu?) Round your answer to two decimal places. Forever's financial staff is considering changing its capital structure to 40% debt and 60% equity. If the company went ahead with the proposed change, the yield to maturity on the company's bonds would rise to 9.5%. The proposed change will have no effect on the company's tax rate. d. What would be the company's new cost of equity if it adopted the proposed change in capital structure? Round your answer to two decimal places. % e. What would be the company's new WACC if it adopted the proposed change in capital structure? Round your answer to two decimal places. % f. Based on your answer to part e, would you advise Forever to adopt the proposed change in capital structure? Recapltalization \begin{tabular}{|c|c|} \hline% debt in original capital structure, wd & 20.00% \\ \hline% common equily in original capital structure, wc & 80.00% \\ \hline Yield to maturity on debt, rd & 8.00% \\ \hline Risk-free rate, rRF & 6.00% \\ \hline Market risk premium ( fmfps) & 6.00% \\ \hline Cost of common equily, r1 & 13.50% \\ \hline Tax rate & 40.00% \\ \hline & 4000% \\ \hline \begin{tabular}{l} % debt in new capital structure, wdNew \\ % common equity in new capital structure, wc New \end{tabular} & 60.00% \\ \hline% common equity in new capital structure, wc New & 9.50% \\ \hline Changed yield to maturity on debt, rs New & 9.50% \\ \hline \end{tabular} Current WACC calculation: WACC Formulas Current beta calculation: Levered beta, bL FNIA Unlevered beta calculation: bu FiN/A Cost of equity calculation with changed capital structure: Levered beta, bl Cost of equity with new capital strucutre, r5 New EN/A WACC calculation with new capital structure: WACC Ner. Recommendation on capital structure: FN/A Change or Do Not Change

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started