Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Pls answer I will upvote 21.2. Assignment 2 Both Senior and Junior has a wealth today of 1 each. The investment universe comprise of a

Pls answer I will upvote

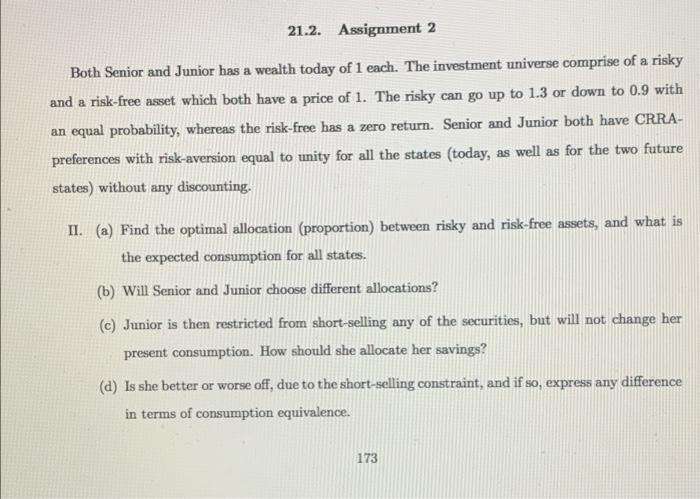

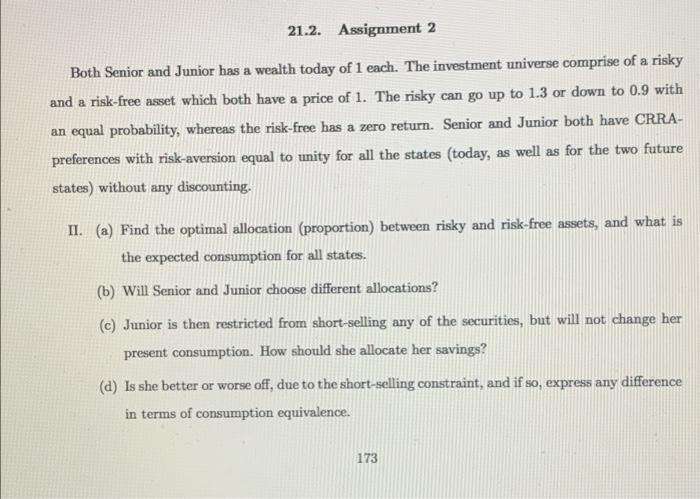

21.2. Assignment 2 Both Senior and Junior has a wealth today of 1 each. The investment universe comprise of a risky and a risk-free asset which both have a price of 1. The risky can go up to 1.3 or down to 0.9 with an equal probability, whereas the risk-free has a zero return. Senior and Junior both have CRRA- preferences with risk-aversion equal to unity for all the states (today, as well as for the two future states) without any discounting. II. (a) Find the optimal allocation (proportion) between risky and risk-free assets, and what is the expected consumption for all states. (b) Will Senior and Junior choose different allocations? (c) Junior is then restricted from short-selling any of the securities, but will not change her present consumption. How should she allocate her savings? (a) Is she better or worse off, due to the short-selling constraint, and if so, express any difference in terms of consumption equivalence. 173 21.2. Assignment 2 Both Senior and Junior has a wealth today of 1 each. The investment universe comprise of a risky and a risk-free asset which both have a price of 1. The risky can go up to 1.3 or down to 0.9 with an equal probability, whereas the risk-free has a zero return. Senior and Junior both have CRRA- preferences with risk-aversion equal to unity for all the states (today, as well as for the two future states) without any discounting. II. (a) Find the optimal allocation (proportion) between risky and risk-free assets, and what is the expected consumption for all states. (b) Will Senior and Junior choose different allocations? (c) Junior is then restricted from short-selling any of the securities, but will not change her present consumption. How should she allocate her savings? (a) Is she better or worse off, due to the short-selling constraint, and if so, express any difference in terms of consumption equivalence. 173

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started