Answered step by step

Verified Expert Solution

Question

1 Approved Answer

pls answer ill give a like thanks :) PROBLEM Larsen Company makes fortilizer a Midwestern state. The company has nearly completed a new plant that

pls answer ill give a like thanks :)

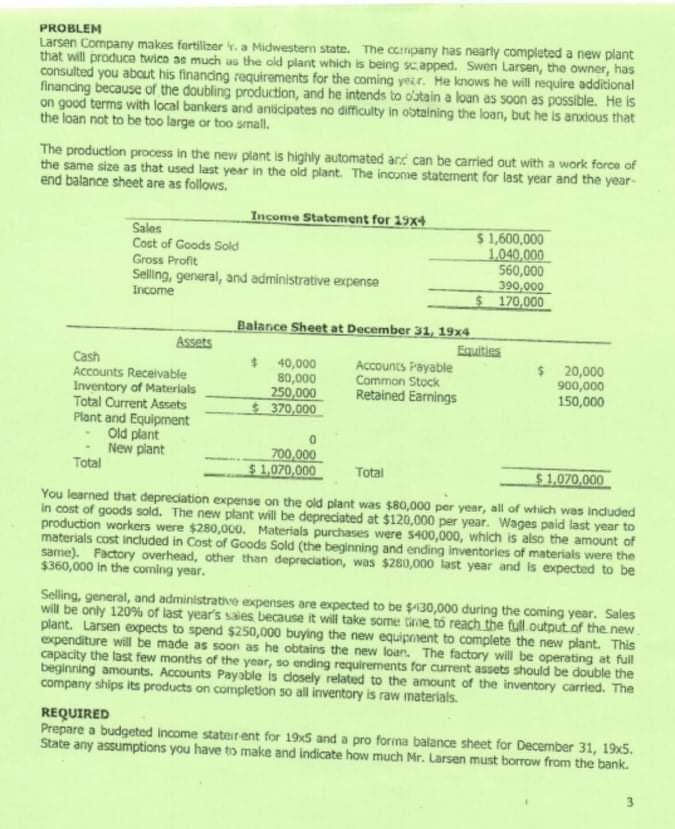

PROBLEM Larsen Company makes fortilizer a Midwestern state. The company has nearly completed a new plant that will produce twice as much as the old plant which is being scapped. Swer Larsen, the owner, has consulted you about his financing requirements for the coming year. He knows he will require additional financing because of the doubling production, and he intends to ostain a loan as soon as possible. He is on good terms with local bankers and anticipates no difficulty in ostalning the loan, but he is anxious that the loan not to be too large or too small. The production process in the new plant is highly automated and can be carried out with a work force of the same size as that used last year in the old plant. The income statement for last year and the year end balance sheet are as follows. Income Statement for 19x+ Sales $1,600,000 Cost of Goods Sold 1,040,000 Gross Profit 560,000 Seling, general, and administrative expense 390,000 Income $ 170,000 Balance Sheet at December 31, 1924 Assets Cash $ 40,000 Accounts Payable $ 20,000 Accounts Receivable 80,000 Common Stock 900,000 Inventory of Materials 250,000 Retained Earnings 150,000 Total Current Assets $_370,000 Plant and Equipment Old plant New plant 700,000 Total $1,070,000 Total $ 1.070,000 You learned that depreciation expense on the old plant was $80,000 per year, all of which was included in cost of goods sold. The new plant will be depreciated at $120,000 per year. Wages paid last year to production workers were $280,000. Materials purchases were 5400,000, which is also the amount of materials cost included in Cost of Goods Sold (the beginning and ending inventories of materials were the same). Factory overhead, other than depreciation, was $280,000 last year and is expected to be $360,000 in the coming year. Selling, general, and administrative expenses are expected to be $130,000 during the coming year. Sales will be only 120% of last year's sales because it will take some time to reach the full output of the new plant. Larsen expects to spend $250,000 buying the new equipment to complete the new plant. This expenditure will be made as soon as he obtains the new loan. The factory will be operating at full capacity the last few months of the year, so ending requirements for current assets should be double the beginning amounts. Accounts Payable is closely related to the amount of the inventory carried. The company ships its products on completion so all inventory is raw materials. REQUIRED Prepare a budgeted income staterent for 195 and a pro forma balance sheet for December 31, 1945. State any assumptions you have to make and indicate how much Mr. Larsen must borrow from the bank. 3 PROBLEM Larsen Company makes fortilizer a Midwestern state. The company has nearly completed a new plant that will produce twice as much as the old plant which is being scapped. Swer Larsen, the owner, has consulted you about his financing requirements for the coming year. He knows he will require additional financing because of the doubling production, and he intends to ostain a loan as soon as possible. He is on good terms with local bankers and anticipates no difficulty in ostalning the loan, but he is anxious that the loan not to be too large or too small. The production process in the new plant is highly automated and can be carried out with a work force of the same size as that used last year in the old plant. The income statement for last year and the year end balance sheet are as follows. Income Statement for 19x+ Sales $1,600,000 Cost of Goods Sold 1,040,000 Gross Profit 560,000 Seling, general, and administrative expense 390,000 Income $ 170,000 Balance Sheet at December 31, 1924 Assets Cash $ 40,000 Accounts Payable $ 20,000 Accounts Receivable 80,000 Common Stock 900,000 Inventory of Materials 250,000 Retained Earnings 150,000 Total Current Assets $_370,000 Plant and Equipment Old plant New plant 700,000 Total $1,070,000 Total $ 1.070,000 You learned that depreciation expense on the old plant was $80,000 per year, all of which was included in cost of goods sold. The new plant will be depreciated at $120,000 per year. Wages paid last year to production workers were $280,000. Materials purchases were 5400,000, which is also the amount of materials cost included in Cost of Goods Sold (the beginning and ending inventories of materials were the same). Factory overhead, other than depreciation, was $280,000 last year and is expected to be $360,000 in the coming year. Selling, general, and administrative expenses are expected to be $130,000 during the coming year. Sales will be only 120% of last year's sales because it will take some time to reach the full output of the new plant. Larsen expects to spend $250,000 buying the new equipment to complete the new plant. This expenditure will be made as soon as he obtains the new loan. The factory will be operating at full capacity the last few months of the year, so ending requirements for current assets should be double the beginning amounts. Accounts Payable is closely related to the amount of the inventory carried. The company ships its products on completion so all inventory is raw materials. REQUIRED Prepare a budgeted income staterent for 195 and a pro forma balance sheet for December 31, 1945. State any assumptions you have to make and indicate how much Mr. Larsen must borrow from the bank. 3Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started