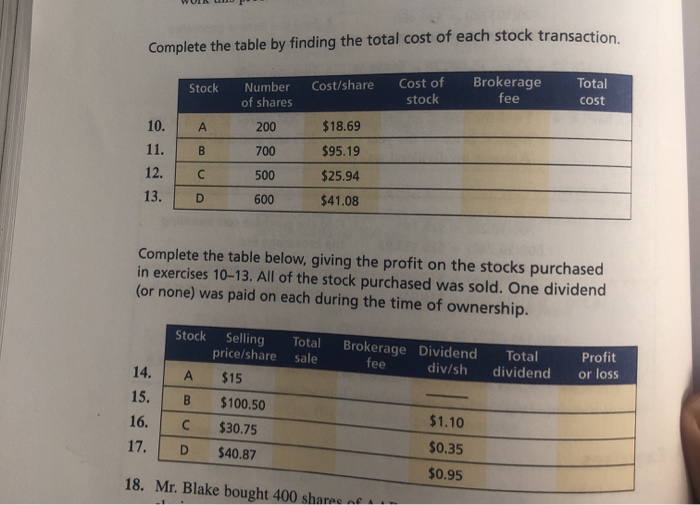

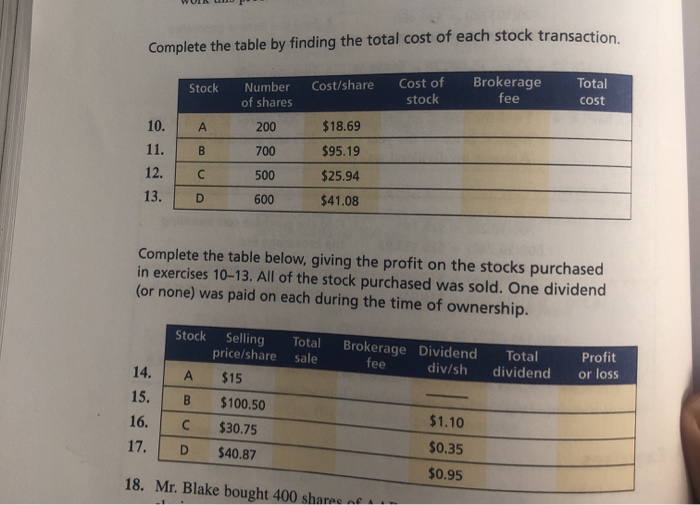

pls answer numbers 10,12,14, and 16 only

here are the notes

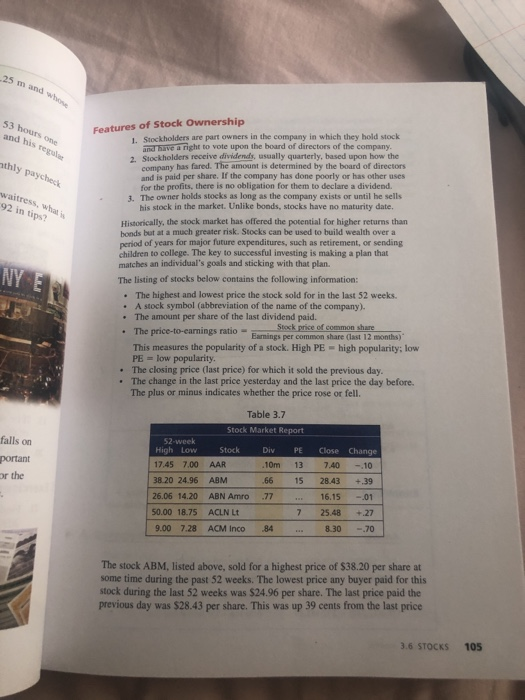

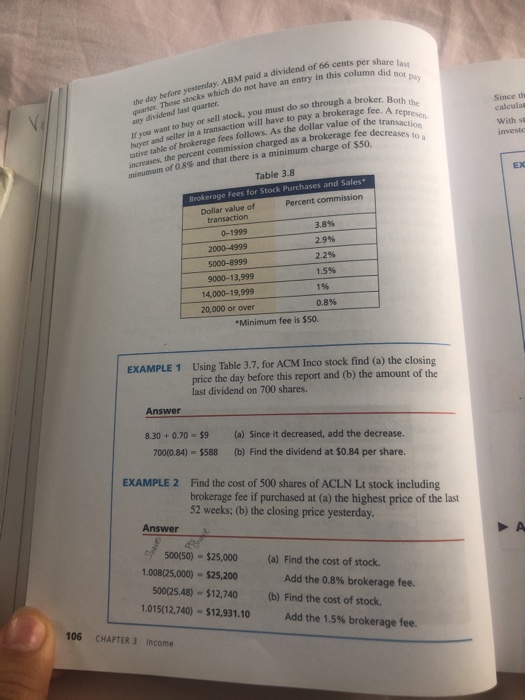

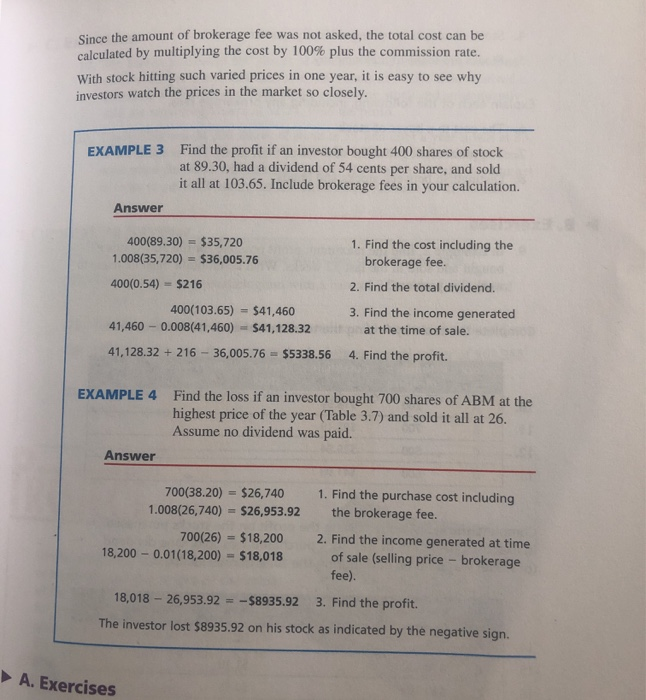

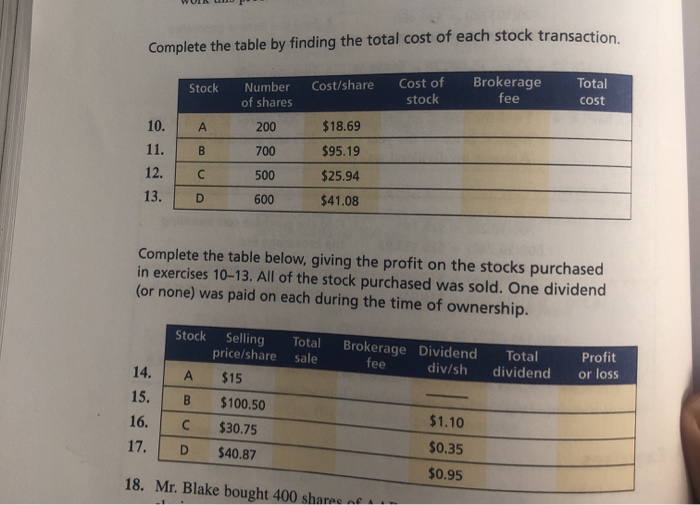

25 m and who 53 hours on and his tegulee thly paycheck waitress, what 92 in tips? Features of Stock Ownership Stockholders are part owners in the company in which they hold stock and have a right to vote upon the board of directors of the company. 7 Stockholders receive dividends, usually quarterly, based upon how the company has fared. The amount is determined by the board of directors and is paid per share. If the company has done poorly or has other uses for the profits, there is no obligation for them to declare a dividend. 3. The owner holds stocks as long as the company exists or until he sells his stock in the market. Unlike bonds, stocks have no maturity date. Historically, the stock market has offered the potential for higher returns than hands but at a much greater risk. Stocks can be used to build wealth over a period of years for major future expenditures, such as retirement, or sending children to college. The key to successful investing is making a plan that matches an individual's goals and sticking with that plan. The listing of stocks below contains the following information: The highest and lowest price the stock sold for in the last 52 weeks. A stock symbol (abbreviation of the name of the company). The amount per share of the last dividend paid. Stock price of common share The price-to-earnings ratio- Earnings per common share (last 12 months) This measures the popularity of a stock. High PE - high popularity: low PE = low popularity. The closing price (last price) for which it sold the previous day. The change in the last price yesterday and the last price the day before. The plus or minus indicates whether the price rose or fell falls on portant or the Table 3.7 Stock Market Report 52-week High Low Stock Div PE Close 17.45 7.00 AAR 1 0m 137.40 38.20 24.96 ABM .66 15 28.43 26.06 14.20 ABN Amro .77 ... 16.15 50.00 18.75 ACLN Lt 7 25.48 9.00 7.28 ACM Inco 8 4 ... 8.30 Change - 10 +.39 -.01 +.27 -70 The stock ABM, listed above, sold for a highest price of $38.20 per share at some time during the past 52 weeks. The lowest price any buyer paid for this stock during the last 52 weeks was $24.96 per share. The last price paid the previous day was $28.43 per share. This was up 39 cents from the last price 3.6 STOCKS 105 ents per share la un did not pay day before yesterday. ABM paid a dividend of 66 cents Those stocks which do not have an entry in this column broker. Both the see fee. A represen of the transaction fee decreases to a Since the calculas with se invest any dividend last quarter. If you want to buy or sells buy or sell stock, you must do so through a broker seller in a transaction will have to pay a brokerage fee. A buyer an le table of brokerage fees follows. As the dollar value of the increases the percent commission charged as a brokerage fee de mimum of 0.8% and that there is a minimum charge of $50 Table 3.8 Brokerage Fees for Stock Purchases and Sales Dollar value of Percent commission transaction 0-1999 2000-4999 2 .9% 5000-8999 2.2% 9000-13.999 1.5% 14.000-19,999 1% 20,000 or over 0.8% Minimum fee is $50. EXAMPLE 1 Using Table 3.7. for ACM Inco stock find (a) the closing price the day before this report and (b) the amount of the last dividend on 700 shares. Answer 8.30 + 0.70 - $9 700(0.84) = $588 (a) Since it decreased, add the decrease. (b) Find the dividend at $0.84 per share. EXAMPLE 2 Find the cost of 500 shares of ACLN Lt stock including brokerage fee if purchased at (a) the highest price of the last 52 weeks; (b) the closing price yesterday. Answer 500(50) = $25,000 1.008(25,000) - $25,200 500(25.48) - $12,740 1.015(12,740) - 512,931.10 (a) Find the cost of stock. Add the 0.8% brokerage fee. (b) Find the cost of stock. Add the 1.5% brokerage fee. 106 CHAPTER 3 Income Since the amount of brokerage fee was not asked, the total cost can be calculated by multiplying the cost by 100% plus the commission rate. With stock hitting such varied prices in one year, it is easy to see why investors watch the prices in the market so closely. EXAMPLE 3 Find the profit if an investor bought 400 shares of stock at 89.30, had a dividend of 54 cents per share, and sold it all at 103.65. Include brokerage fees in your calculation. Answer 400(89.30) = $35,720 1.008(35,720) = $36,005.76 400(0.54) = $216 1. Find the cost including the brokerage fee. 2. Find the total dividend. 3. Find the income generated at the time of sale. 4. Find the profit. 400(103.65) = $41,460 41,460 -0.008(41,460) = 541,128.32 41,128.32 +216 - 36,005.76 = $5338.56 EXAMPLE 4 Find the loss if an investor bought 700 shares of ABM at the highest price of the year (Table 3.7) and sold it all at 26. Assume no dividend was paid. Answer 700(38.20) - $26,740 1.008(26,740) - $26,953.92 700(26) = $18,200 18,200 -0.01(18,200) = $18,018 1. Find the purchase cost including the brokerage fee. 2. Find the income generated at time of sale (selling price - brokerage fee) 3. Find the profit. 18,018 - 26,953.92 = - $8935.92 The investor lost $8935.92 on his stock as indicated by the negative sign. A. Exercises