Answered step by step

Verified Expert Solution

Question

1 Approved Answer

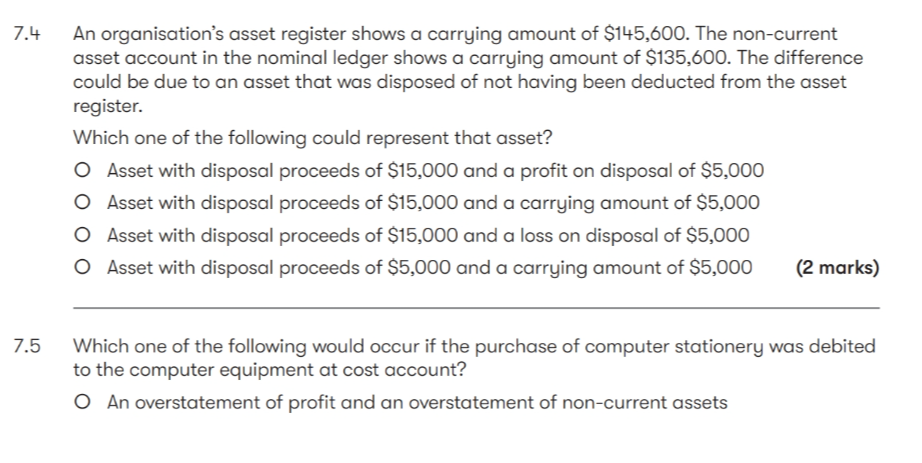

Pls answer the questions 7.47.5&7.6 with your detailed explanations, it's much appreciated! .4 An organisation's asset register shows a carrying amount of $145,600. The non-current

Pls answer the questions 7.47.5&7.6 with your detailed explanations, it's much appreciated!

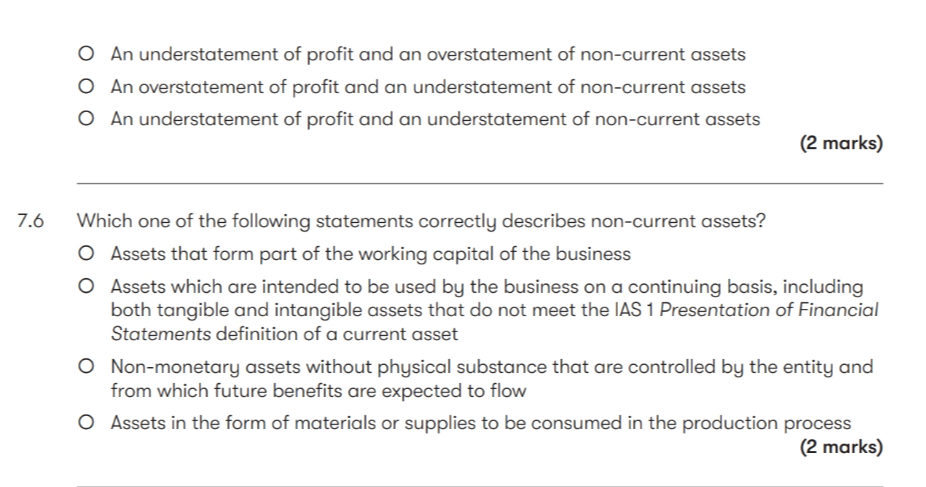

.4 An organisation's asset register shows a carrying amount of $145,600. The non-current asset account in the nominal ledger shows a carrying amount of $135,600. The difference could be due to an asset that was disposed of not having been deducted from the asset register. Which one of the following could represent that asset? Asset with disposal proceeds of $15,000 and a profit on disposal of $5,000 Asset with disposal proceeds of $15,000 and a carrying amount of $5,000 Asset with disposal proceeds of $15,000 and a loss on disposal of $5,000 Asset with disposal proceeds of $5,000 and a carrying amount of $5,000 (2 marks) .5 Which one of the following would occur if the purchase of computer stationery was debited to the computer equipment at cost account? An overstatement of profit and an overstatement of non-current assets An understatement of profit and an overstatement of non-current assets An overstatement of profit and an understatement of non-current assets An understatement of profit and an understatement of non-current assets (2 marks) .6 Which one of the following statements correctly describes non-current assets? Assets that form part of the working capital of the business Assets which are intended to be used by the business on a continuing basis, including both tangible and intangible assets that do not meet the IAS 1 Presentation of Financial Statements definition of a current asset Non-monetary assets without physical substance that are controlled by the entity and from which future benefits are expected to flow Assets in the form of materials or supplies to be consumed in the production process (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started