Pls, answer this!

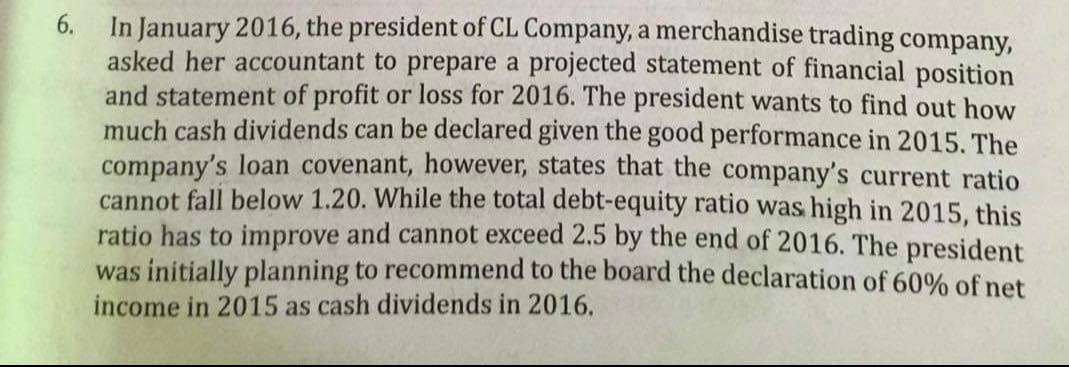

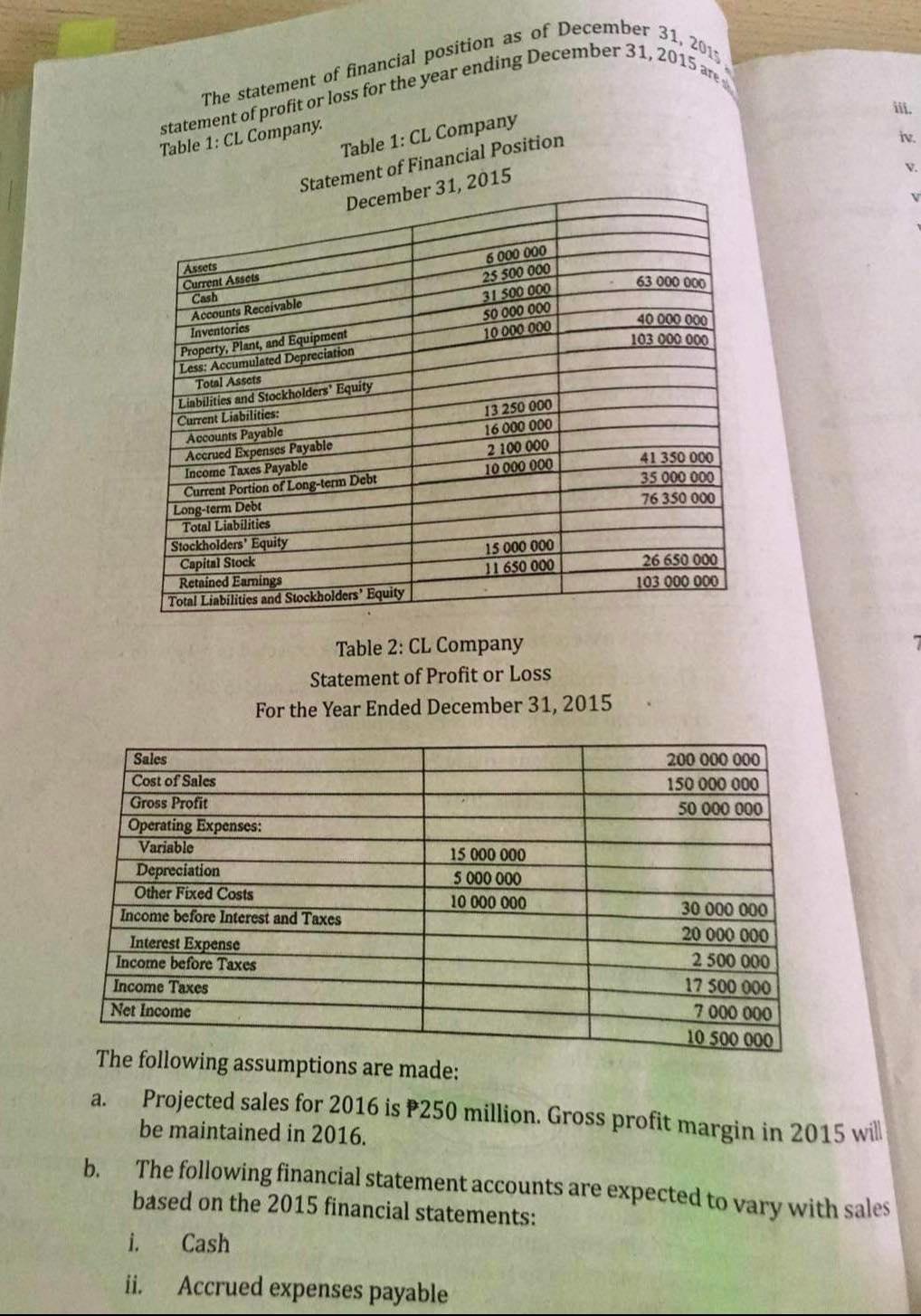

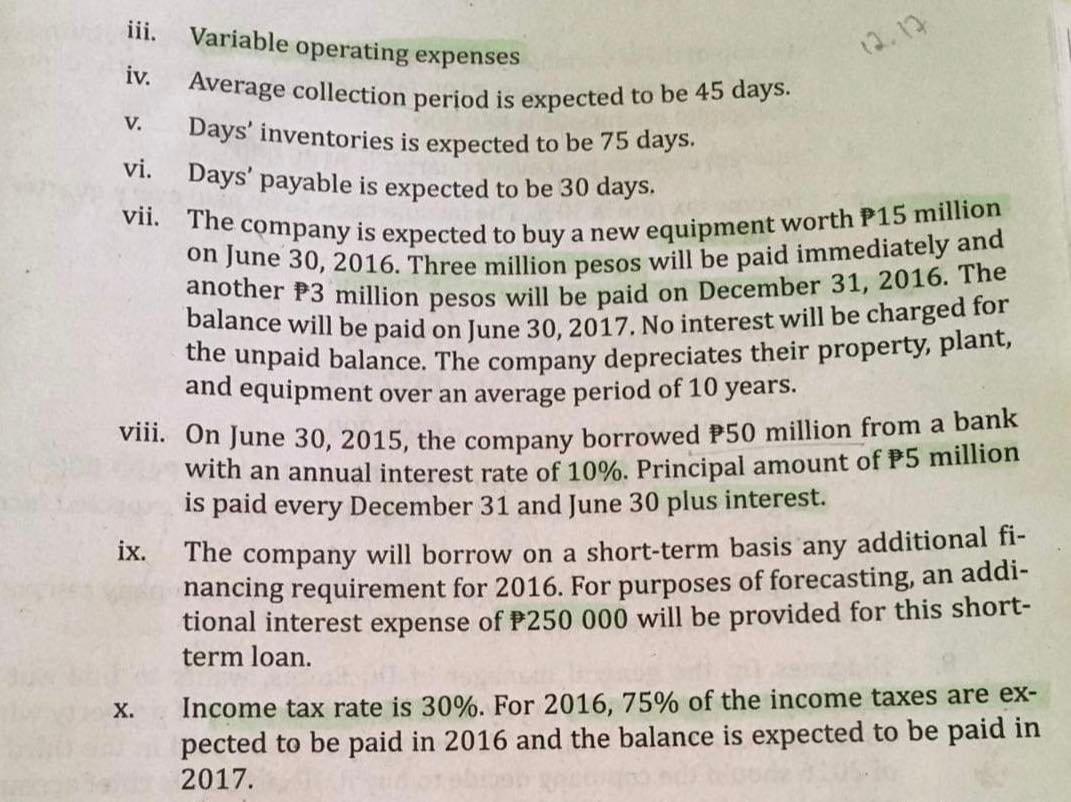

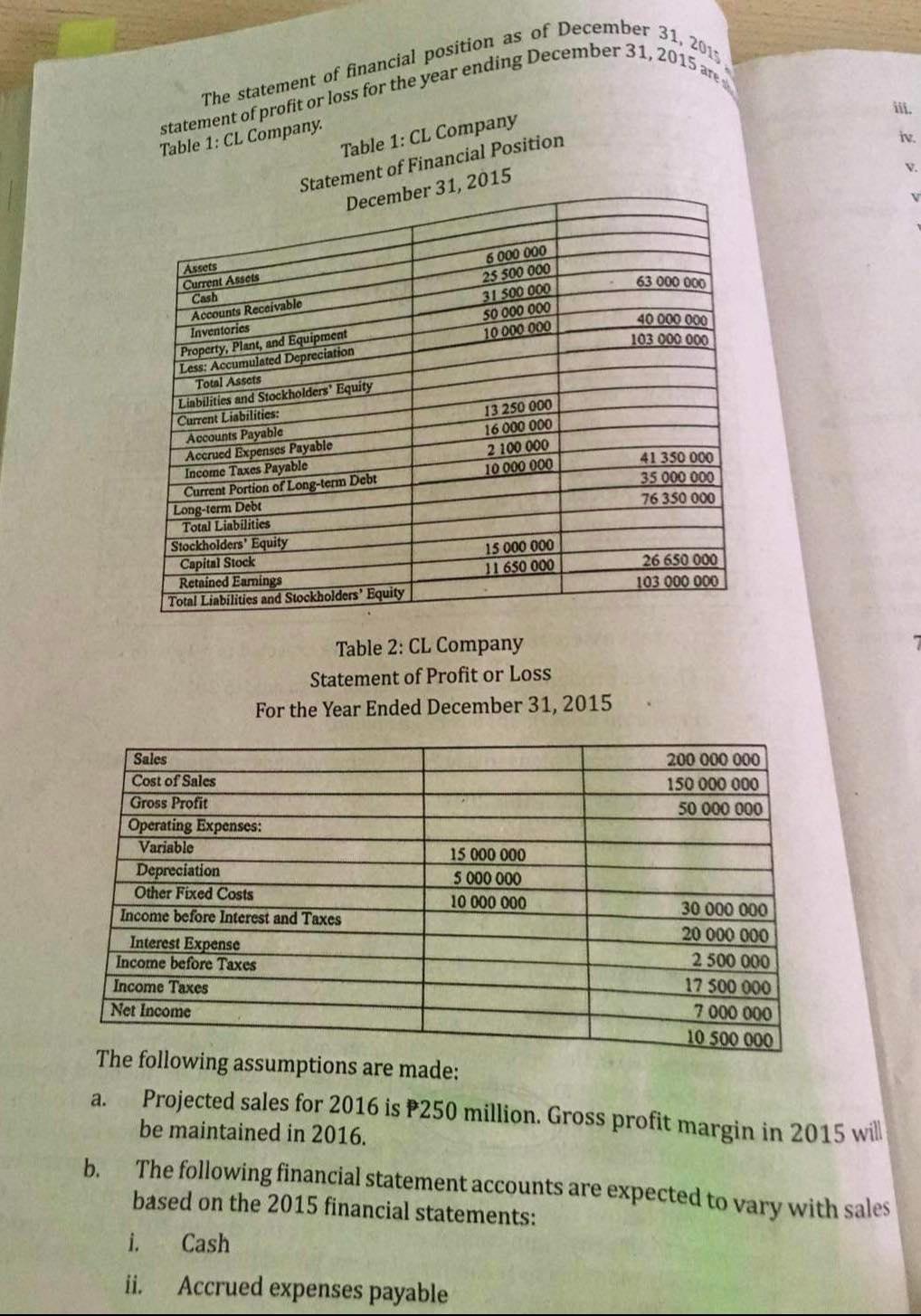

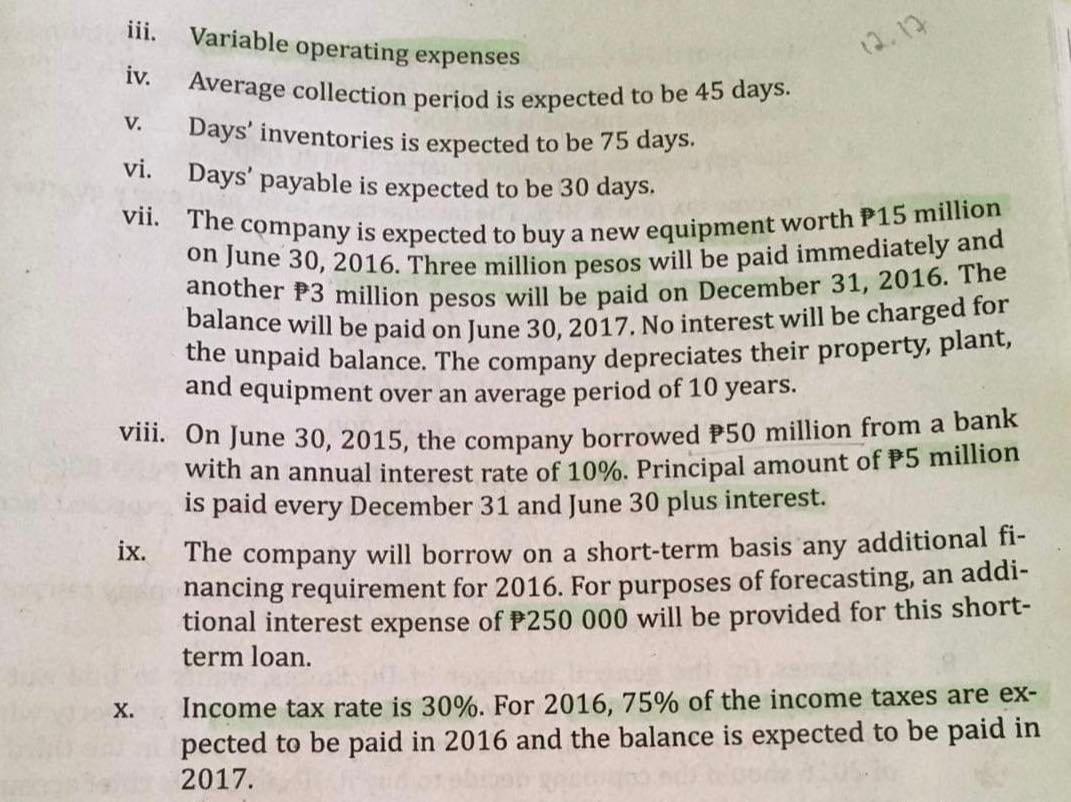

6. In January 2016, the president of CL Company, a merchandise trading company, asked her accountant to prepare a projected statement of financial position and statement of profit or loss for 2016. The president wants to find out how much cash dividends can be declared given the good performance in 2015. The company's loan covenant, however, states that the company's current ratio cannot fall below 1.20. While the total debt-equity ratio was high in 2015, this ratio has to improve and cannot exceed 2.5 by the end of 2016. The president was initially planning to recommend to the board the declaration of 60% of net income in 2015 as cash dividends in 2016. The statement of financial position as of December 31, 2015 statement of profit or loss for the year ending December 31, 2015 are ail. i Table 1: CL Company. Table 1: CL Company Statement of Financial Position December 31, 2015 V 63 000 000 6 000 000 25 500 000 31 500 000 50 000 000 10 000.000 40 000 000 103 000 000 Assets Current Assets Cash Accounts Receivablo Inventories Property, Plant, and Equipment Less: Accumulated Depreciation Total Assets Liabilities and Stockholders' Equity Current Liabilities: Accounts Payable Accrued Expenses Payable Income Taxes Payable Current Portion of Long-term Debt Long-term Debt Total Liabilities Stockholders' Equity Capital Stock Retained Eamings Total Liabilities and Stockholders' Equity 13 250 000 16 000 000 2 100 000 10 000 000 41 350 000 35 000 000 76 350 000 15 000 000 11 650 000 26 650 000 103 000 000 Table 2: CL Company Statement of Profit or Loss For the Year Ended December 31, 2015 200 000 000 150 000 000 50 000 000 Sales Cost of Sales Gross Profit Operating Expenses: Variable Depreciation Other Fixed Costs Income before Interest and Taxes Interest Expense Income before Taxes Income Taxes Net Income 15 000 000 5 000 000 10 000 000 30 000 000 20 000 000 2 500 000 17 500 000 7 000 000 10 500 000 a. The following assumptions are made: Projected sales for 2016 is P250 million. Gross profit margin in 2015 will be maintained in 2016. b. The following financial statement accounts are expected to vary with sales based on the 2015 financial statements: i. Cash ii. Accrued expenses payable iii. Variable operating expenses 12.13 iv. V. vii. Average collection period is expected to be 45 days. Days' inventories is expected to be 75 days. vi. Days' payable is expected to be 30 days. The on June 30, 2016. Three million pesos will be paid immediately and company is expected to buy a new equipment worth P15 million balance will be paid on June 30, 2017. No interest will be charged for the unpaid balance. The company depreciates their property, plant, and equipment over an average period of 10 years. viii. On June 30, 2015, the company borrowed P50 million from a bank with an annual interest rate of 10%. Principal amount of P5 million is paid every December 31 and June 30 plus interest. ix. The company will borrow on a short-term basis any additional fi- nancing requirement for 2016. For purposes of forecasting, an addi- tional interest expense of P250 000 will be provided for this short- term loan. Income tax rate is 30%. For 2016, 75% of the income taxes are ex- pected to be paid in 2016 and the balance is expected to be paid in 2017. X