Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Pls answer this fast.. incorrect= unhelpful Answer probs: #6: #7: #8: #9: #10: #11: fayag Corp., which began operations in 2013, accounts for revenues using

Pls answer this fast.. incorrect= unhelpful

Answer probs:

#6:

#7:

#8:

#9:

#10:

#11:

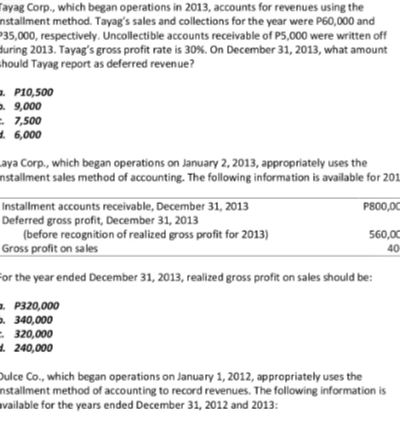

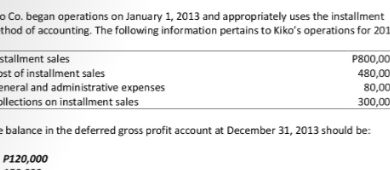

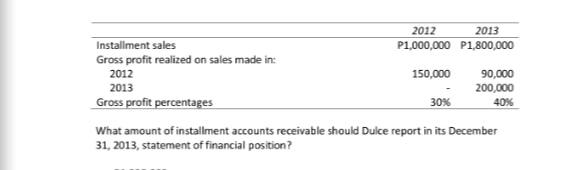

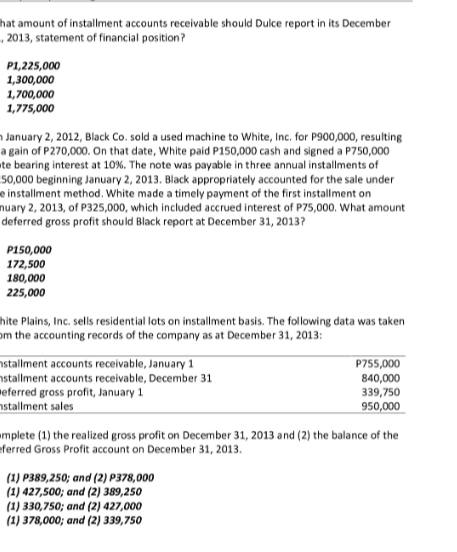

fayag Corp., which began operations in 2013, accounts for revenues using the nstallment method. Tayag's sales and collections for the year were P60,000 and 35,000 , respectively. Uncollectible accounts receivable of P5, 000 were written off during 2013. Tayag's gross profit rate is 30\%. On December 31, 2013, what amount hould Tayag report as deferred revenue? aya Corp., which began operations on January 2,2013, appropriately uses the nstallment sales method of accounting. The following information is available for 20 For the year ended December 31, 2013, realized gross profit on sales should be: P320,000 340,000 320,000 1. 240,000 Dulce Co., which began operations on January 1, 2012, appropriately uses the nstallment method of accounting to record revenues. The following information is vailable for the years ended December 31, 2012 and 2013: Co. began operations on January 1,2013 and appropriately uses the installment thod of accounting. The following information pertains to Kiko's operations for 20 ? balance in the deferred gross profit account at December 31, 2013 should be: P120,000 What amount of installment accounts receivable should Dulce report in its December 31,2013 , statement of financial position? hat amount of installment accounts receivable should Dulce report in its December 2013, statement of financial position? January 2, 2012, Black Co. sold a used machine to White, Inc. for P900,000, resulting a gain of P270,000. On that date, White paid P150,000 cash and signed a P750,000 te bearing interest at 10%. The note was payable in three annual installments of 50,000 beginning January 2, 2013. Black appropriately accounted for the sale under e installment method. White made a timely payment of the first installment on nuary 2, 2013, of P325,000, which included accrued interest of P75,000. What amount deferred gross profit should Black report at December 31, 2013? hite Plains, Inc. sells residential lots on installment basis. The following data was taken om the accounting records of the company as at December 31, 2013: Implete (1) the realized gross profit on December 31, 2013 and (2) the balance of the ferred Gross Profit account on December 31, 2013. (1) P389,250; and (2) P378,000 (1) 427,500; and (2) 389,250 (1) 330,750 ; and (2) 427,000 (1) 378,000 ; and (2) 339,750 fayag Corp., which began operations in 2013, accounts for revenues using the nstallment method. Tayag's sales and collections for the year were P60,000 and 35,000 , respectively. Uncollectible accounts receivable of P5, 000 were written off during 2013. Tayag's gross profit rate is 30\%. On December 31, 2013, what amount hould Tayag report as deferred revenue? aya Corp., which began operations on January 2,2013, appropriately uses the nstallment sales method of accounting. The following information is available for 20 For the year ended December 31, 2013, realized gross profit on sales should be: P320,000 340,000 320,000 1. 240,000 Dulce Co., which began operations on January 1, 2012, appropriately uses the nstallment method of accounting to record revenues. The following information is vailable for the years ended December 31, 2012 and 2013: Co. began operations on January 1,2013 and appropriately uses the installment thod of accounting. The following information pertains to Kiko's operations for 20 ? balance in the deferred gross profit account at December 31, 2013 should be: P120,000 What amount of installment accounts receivable should Dulce report in its December 31,2013 , statement of financial position? hat amount of installment accounts receivable should Dulce report in its December 2013, statement of financial position? January 2, 2012, Black Co. sold a used machine to White, Inc. for P900,000, resulting a gain of P270,000. On that date, White paid P150,000 cash and signed a P750,000 te bearing interest at 10%. The note was payable in three annual installments of 50,000 beginning January 2, 2013. Black appropriately accounted for the sale under e installment method. White made a timely payment of the first installment on nuary 2, 2013, of P325,000, which included accrued interest of P75,000. What amount deferred gross profit should Black report at December 31, 2013? hite Plains, Inc. sells residential lots on installment basis. The following data was taken om the accounting records of the company as at December 31, 2013: Implete (1) the realized gross profit on December 31, 2013 and (2) the balance of the ferred Gross Profit account on December 31, 2013. (1) P389,250; and (2) P378,000 (1) 427,500; and (2) 389,250 (1) 330,750 ; and (2) 427,000 (1) 378,000 ; and (2) 339,750

fayag Corp., which began operations in 2013, accounts for revenues using the nstallment method. Tayag's sales and collections for the year were P60,000 and 35,000 , respectively. Uncollectible accounts receivable of P5, 000 were written off during 2013. Tayag's gross profit rate is 30\%. On December 31, 2013, what amount hould Tayag report as deferred revenue? aya Corp., which began operations on January 2,2013, appropriately uses the nstallment sales method of accounting. The following information is available for 20 For the year ended December 31, 2013, realized gross profit on sales should be: P320,000 340,000 320,000 1. 240,000 Dulce Co., which began operations on January 1, 2012, appropriately uses the nstallment method of accounting to record revenues. The following information is vailable for the years ended December 31, 2012 and 2013: Co. began operations on January 1,2013 and appropriately uses the installment thod of accounting. The following information pertains to Kiko's operations for 20 ? balance in the deferred gross profit account at December 31, 2013 should be: P120,000 What amount of installment accounts receivable should Dulce report in its December 31,2013 , statement of financial position? hat amount of installment accounts receivable should Dulce report in its December 2013, statement of financial position? January 2, 2012, Black Co. sold a used machine to White, Inc. for P900,000, resulting a gain of P270,000. On that date, White paid P150,000 cash and signed a P750,000 te bearing interest at 10%. The note was payable in three annual installments of 50,000 beginning January 2, 2013. Black appropriately accounted for the sale under e installment method. White made a timely payment of the first installment on nuary 2, 2013, of P325,000, which included accrued interest of P75,000. What amount deferred gross profit should Black report at December 31, 2013? hite Plains, Inc. sells residential lots on installment basis. The following data was taken om the accounting records of the company as at December 31, 2013: Implete (1) the realized gross profit on December 31, 2013 and (2) the balance of the ferred Gross Profit account on December 31, 2013. (1) P389,250; and (2) P378,000 (1) 427,500; and (2) 389,250 (1) 330,750 ; and (2) 427,000 (1) 378,000 ; and (2) 339,750 fayag Corp., which began operations in 2013, accounts for revenues using the nstallment method. Tayag's sales and collections for the year were P60,000 and 35,000 , respectively. Uncollectible accounts receivable of P5, 000 were written off during 2013. Tayag's gross profit rate is 30\%. On December 31, 2013, what amount hould Tayag report as deferred revenue? aya Corp., which began operations on January 2,2013, appropriately uses the nstallment sales method of accounting. The following information is available for 20 For the year ended December 31, 2013, realized gross profit on sales should be: P320,000 340,000 320,000 1. 240,000 Dulce Co., which began operations on January 1, 2012, appropriately uses the nstallment method of accounting to record revenues. The following information is vailable for the years ended December 31, 2012 and 2013: Co. began operations on January 1,2013 and appropriately uses the installment thod of accounting. The following information pertains to Kiko's operations for 20 ? balance in the deferred gross profit account at December 31, 2013 should be: P120,000 What amount of installment accounts receivable should Dulce report in its December 31,2013 , statement of financial position? hat amount of installment accounts receivable should Dulce report in its December 2013, statement of financial position? January 2, 2012, Black Co. sold a used machine to White, Inc. for P900,000, resulting a gain of P270,000. On that date, White paid P150,000 cash and signed a P750,000 te bearing interest at 10%. The note was payable in three annual installments of 50,000 beginning January 2, 2013. Black appropriately accounted for the sale under e installment method. White made a timely payment of the first installment on nuary 2, 2013, of P325,000, which included accrued interest of P75,000. What amount deferred gross profit should Black report at December 31, 2013? hite Plains, Inc. sells residential lots on installment basis. The following data was taken om the accounting records of the company as at December 31, 2013: Implete (1) the realized gross profit on December 31, 2013 and (2) the balance of the ferred Gross Profit account on December 31, 2013. (1) P389,250; and (2) P378,000 (1) 427,500; and (2) 389,250 (1) 330,750 ; and (2) 427,000 (1) 378,000 ; and (2) 339,750 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started