Answered step by step

Verified Expert Solution

Question

1 Approved Answer

pls assist to answer question 1 Competitive equilibrium with CARA Bernoulli utility function Consider an asset exchange economy with two agents & E (A, B),

pls assist to answer question 1

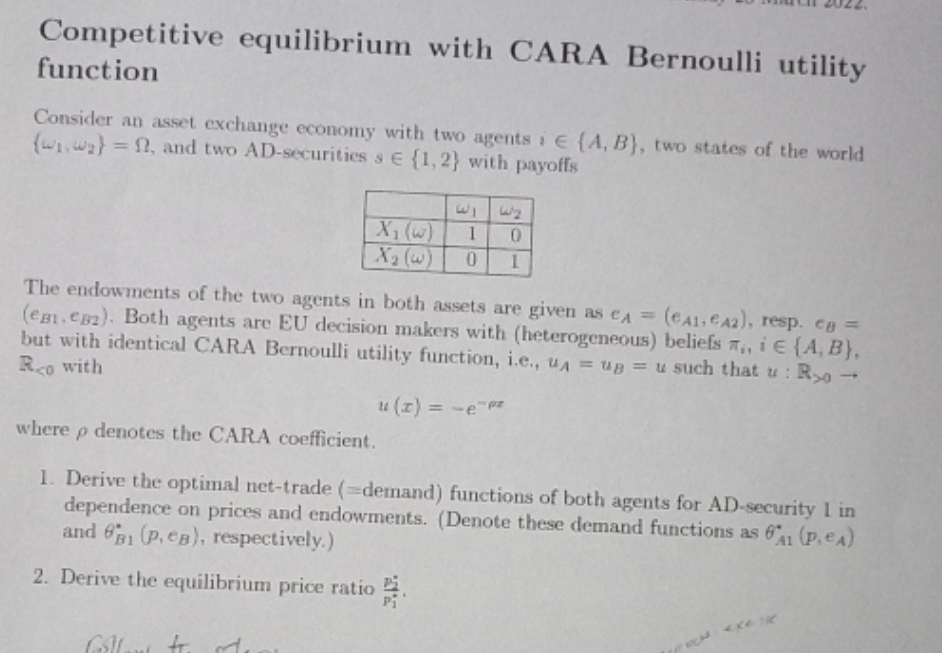

Competitive equilibrium with CARA Bernoulli utility function Consider an asset exchange economy with two agents & E (A, B), two states of the world = 22, and two AD-securities se {(1,2) with payoffs X (w) The endowments of the two agents in both assets are given as CA = (eg. eB2). Both agents are EU decision makers with (heterogeneous) beliefs ,, i {A, B), (eA1,A2), resp. CB = but with identical CARA Bernoulli utility function, i.e., u = UB = u such that u: Ro- Reo with u (x) = -e="z 2. Derive the equilibrium price ratio. Pi Gillar tt. tr where p denotes the CARA coefficient. 1. Derive the optimal net-trade (=demand) functions of both agents for AD-security 1 in dependence on prices and endowments. (Denote these demand functions as 61 (P, eA) and 6 (P, eB), respectively.) M 1 0 0 1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started