Answered step by step

Verified Expert Solution

Question

1 Approved Answer

pls awnser c and d Problem 2 (10 points). Attached are several situations involving property transactions. REQUIRED: For each of the situations provided, answer the

pls awnser c and d

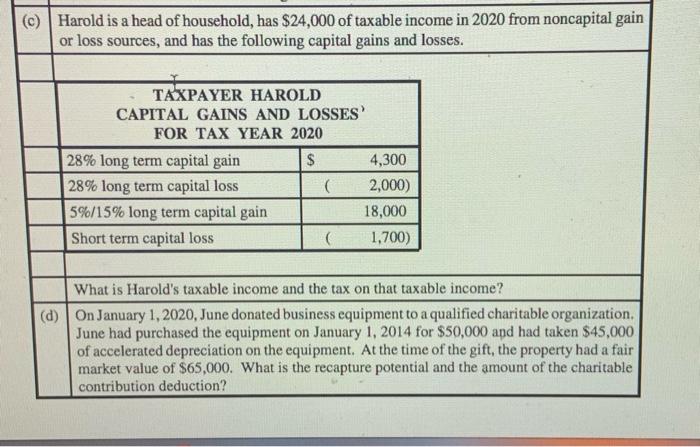

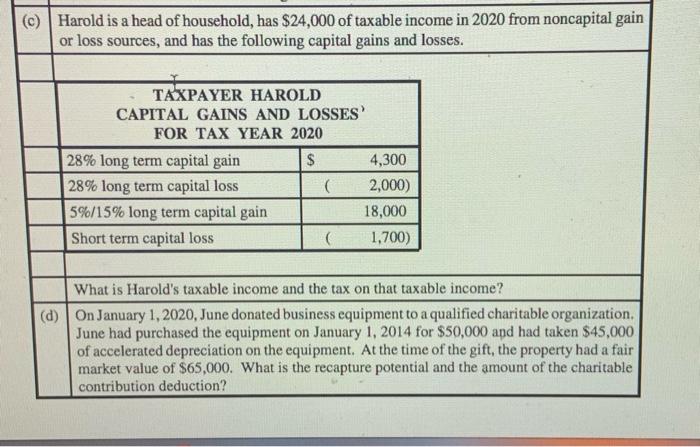

Problem 2 (10 points). Attached are several situations involving property transactions. REQUIRED: For each of the situations provided, answer the question asked about the property transaction. pa (c) Harold is a head of household, has $24,000 of taxable income in 2020 from noncapital gain or loss sources, and has the following capital gains and losses. TAXPAYER HAROLD CAPITAL GAINS AND LOSSES FOR TAX YEAR 2020 28% long term capital gain $ 4,300 | 28% long term capital loss 2,000) 5%/15% long term capital gain 18,000 Short term capital loss 1,700) What is Harold's taxable income and the tax on that taxable income? (d) On January 1, 2020, June donated business equipment to a qualified charitable organization. June had purchased the equipment on January 1, 2014 for $50,000 and had taken $45,000 of accelerated depreciation on the equipment. At the time of the gift, the property had a fair market value of $65,000. What is the recapture potential and the amount of the charitable contribution deduction

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started