Answered step by step

Verified Expert Solution

Question

1 Approved Answer

pls calculate: Return on Equity (ROE): Return on Assets (ROA): Current Ratio: Price-to-Earnings Ratio (P/E ratio): Debt to Equity Ratio: Then critically evaluate and suggest

pls calculate:

Return on Equity (ROE):

Return on Assets (ROA):

Current Ratio:

Price-to-Earnings Ratio (P/E ratio):

Debt to Equity Ratio:

Then critically evaluate and suggest to the board which company should be invested in.

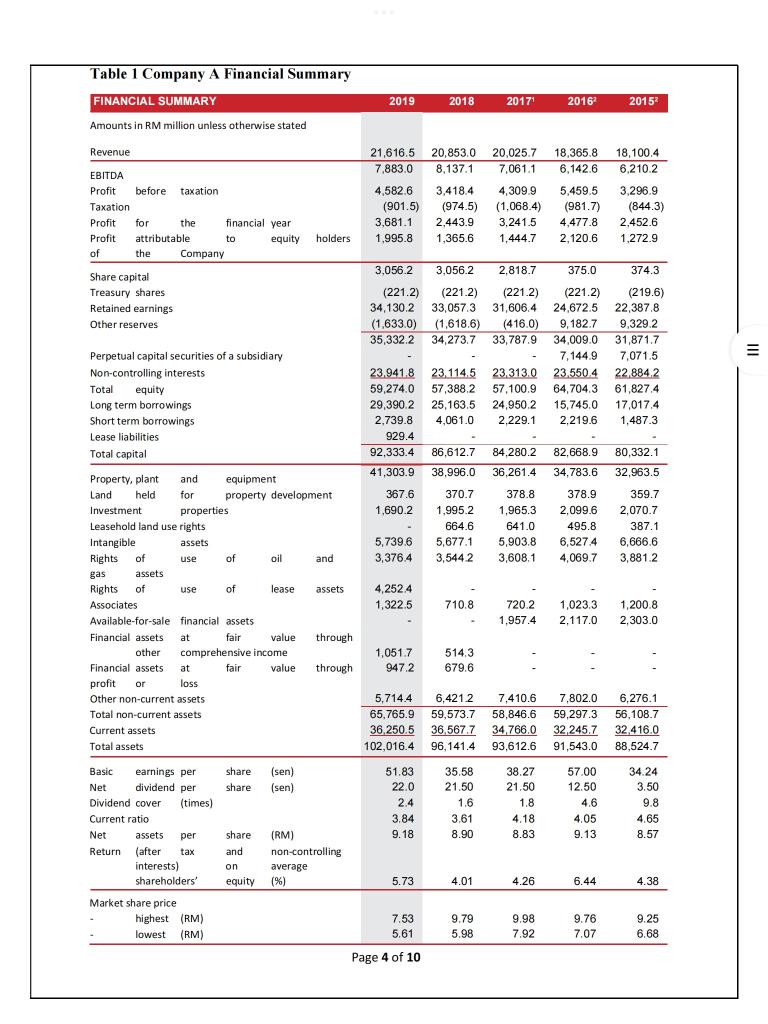

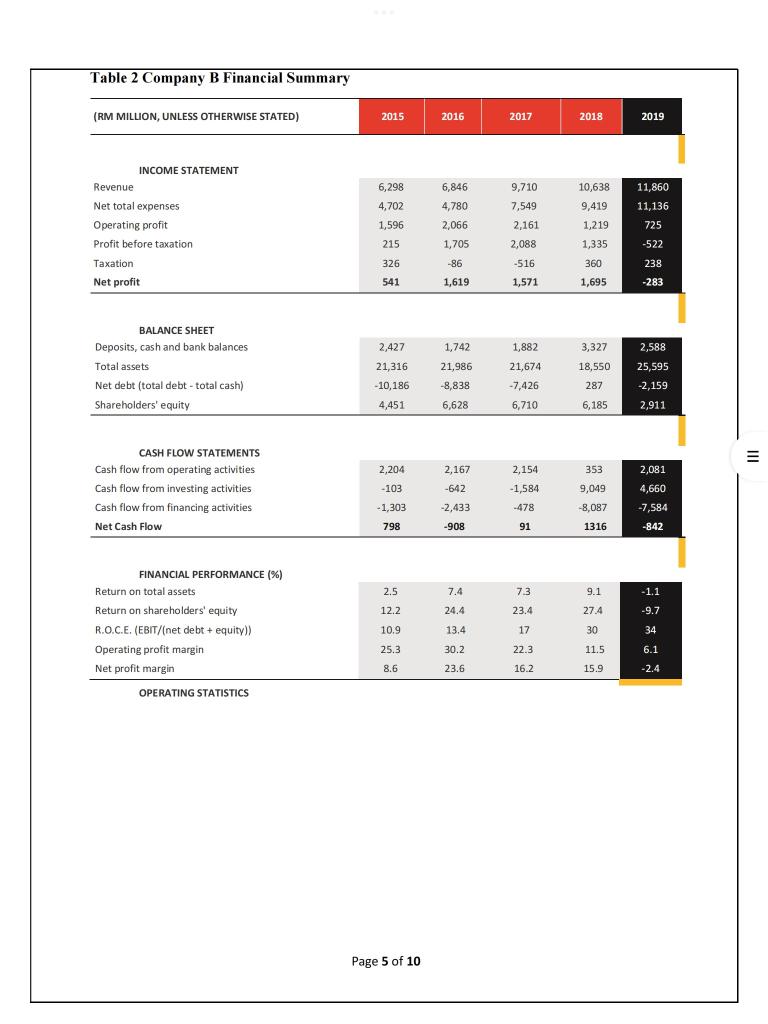

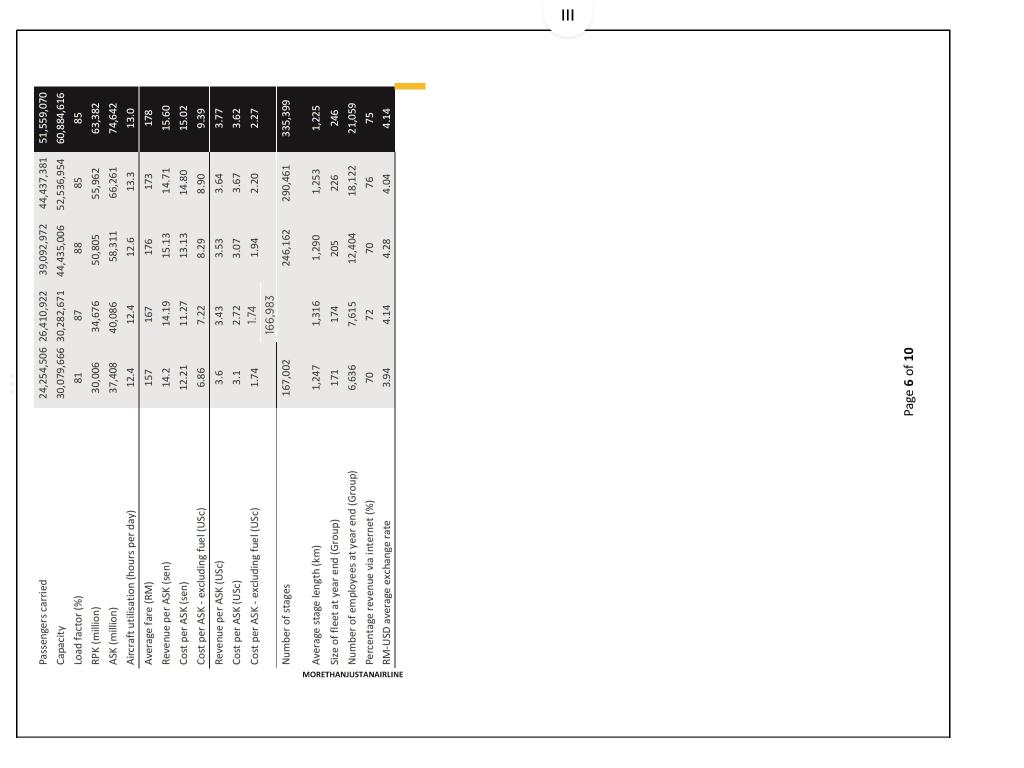

Table 1 Company A Financial Summary FINANCIAL SUMMARY \begin{tabular}{lllll} 2019 & 2018 & 20174 & 20162 & 20152 \\ \hline \end{tabular} Amounts in RM million unless otherwise stated Table 2 Company B Financial Summary \begin{tabular}{l|l|l|l|l|l} \hline (RM MILUON, UNLESS OTHERWISE STATED) & 2015 & 2016 & 2017 & 2018 & 2019 \\ \hline \end{tabular} \begin{tabular}{l|cccccc} \multicolumn{1}{l}{ INCOME STATEMENT } & 6,298 & 6,846 & 9,710 & 10,638 & 11,860 \\ Revenue & 4,702 & 4,780 & 7,549 & 9,419 & 11,136 \\ Net total expenses & 1,596 & 2,066 & 2,161 & 1,219 & 725 \\ Operating profit & 215 & 1,705 & 2,088 & 1,335 & 522 \\ Profit before taxation & 326 & 86 & 516 & 360 & 238 \\ Taxation & 541 & 1,619 & 1,571 & 1,695 & 283 \\ Net profit & & & & & \end{tabular} BALANCE SHEET Deposits, cash and bank balances Total assets Net debt (total debt - total cash) Shareholders' equity \begin{tabular}{cccc|c|c|} 2,427 & 1,742 & 1,882 & 3,327 & 2,588 & \\ 21,316 & 21,986 & 21,674 & 18,550 & 25,595 & \\ 10,186 & 8,838 & 7,426 & 287 & 2,159 & \\ 4,451 & 6,628 & 6,710 & 6,185 & 2,911 & \\ \hline \end{tabular} CASH FLOW STATEMENTS Cash flow from operating activities Cash flow from investing activities Cash flow from financing activities Net Cash Flow \begin{tabular}{llll|l|l} 2,204 & 2,167 & 2,154 & 353 & 2,081 & \end{tabular} FINANCIAL PERFORMANCE (\%) Return on total assets Return on shareholders' equity R.O.C.E. (EBIT/(net debt + equity)) Operating profit margin Net profit margin \begin{tabular}{cccc|c|} 2.5 & 7.4 & 7.3 & 9.1 & 1.1 \\ 12.2 & 24.4 & 23.4 & 27.4 & 9.7 \\ 10.9 & 13.4 & 17 & 30 & 34 \\ 25.3 & 30.2 & 22.3 & 11.5 & 6.1 \\ 8.6 & 23.6 & 16.2 & 15.9 & 2.4 \\ \hline \end{tabular} OPERATING STATISTICS Page 5 of 10 Page 6 of 10 Table 1 Company A Financial Summary FINANCIAL SUMMARY \begin{tabular}{lllll} 2019 & 2018 & 20174 & 20162 & 20152 \\ \hline \end{tabular} Amounts in RM million unless otherwise stated Table 2 Company B Financial Summary \begin{tabular}{l|l|l|l|l|l} \hline (RM MILUON, UNLESS OTHERWISE STATED) & 2015 & 2016 & 2017 & 2018 & 2019 \\ \hline \end{tabular} \begin{tabular}{l|cccccc} \multicolumn{1}{l}{ INCOME STATEMENT } & 6,298 & 6,846 & 9,710 & 10,638 & 11,860 \\ Revenue & 4,702 & 4,780 & 7,549 & 9,419 & 11,136 \\ Net total expenses & 1,596 & 2,066 & 2,161 & 1,219 & 725 \\ Operating profit & 215 & 1,705 & 2,088 & 1,335 & 522 \\ Profit before taxation & 326 & 86 & 516 & 360 & 238 \\ Taxation & 541 & 1,619 & 1,571 & 1,695 & 283 \\ Net profit & & & & & \end{tabular} BALANCE SHEET Deposits, cash and bank balances Total assets Net debt (total debt - total cash) Shareholders' equity \begin{tabular}{cccc|c|c|} 2,427 & 1,742 & 1,882 & 3,327 & 2,588 & \\ 21,316 & 21,986 & 21,674 & 18,550 & 25,595 & \\ 10,186 & 8,838 & 7,426 & 287 & 2,159 & \\ 4,451 & 6,628 & 6,710 & 6,185 & 2,911 & \\ \hline \end{tabular} CASH FLOW STATEMENTS Cash flow from operating activities Cash flow from investing activities Cash flow from financing activities Net Cash Flow \begin{tabular}{llll|l|l} 2,204 & 2,167 & 2,154 & 353 & 2,081 & \end{tabular} FINANCIAL PERFORMANCE (\%) Return on total assets Return on shareholders' equity R.O.C.E. (EBIT/(net debt + equity)) Operating profit margin Net profit margin \begin{tabular}{cccc|c|} 2.5 & 7.4 & 7.3 & 9.1 & 1.1 \\ 12.2 & 24.4 & 23.4 & 27.4 & 9.7 \\ 10.9 & 13.4 & 17 & 30 & 34 \\ 25.3 & 30.2 & 22.3 & 11.5 & 6.1 \\ 8.6 & 23.6 & 16.2 & 15.9 & 2.4 \\ \hline \end{tabular} OPERATING STATISTICS Page 5 of 10 Page 6 of 10Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started