Answered step by step

Verified Expert Solution

Question

1 Approved Answer

pls choose the correct answers regardles of the ones chosen Suppose company A is 100% equity and goes through a leverage recapitalisation operation, i.e., it

pls choose the correct answers regardles of the ones chosen

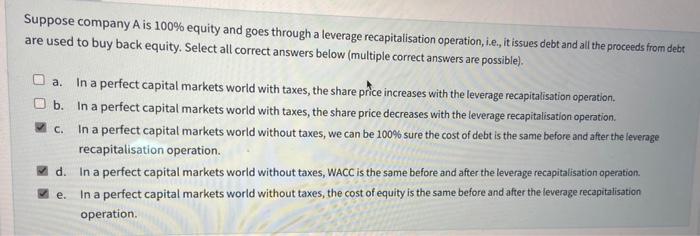

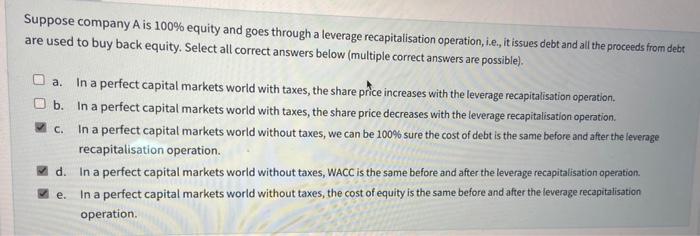

Suppose company A is 100% equity and goes through a leverage recapitalisation operation, i.e., it issues debt and all the proceeds from debt are used to buy back equity. Select all correct answers below (multiple correct answers are possible). a. In a perfect capital markets world with taxes, the share price increases with the leverage recapitalisation operation. b. In a perfect capital markets world with taxes, the share price decreases with the leverage recapitalisation operation. c. In a perfect capital markets world without taxes, we can be 100% sure the cost of debt is the same before and after the leverage recapitalisation operation. d. In a perfect capital markets world without taxes, WACC is the same before and after the leverage recapitalisation operation. e. In a perfect capital markets world without taxes, the cost of equity is the same before and after the leverage recapitalisation operation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started