Answered step by step

Verified Expert Solution

Question

1 Approved Answer

pls do it in a hurry if you can? like in an a hour? and pls show working out thanks QUESTION 32 10 points Save

pls do it in a hurry if you can? like in an a hour? and pls show working out thanks

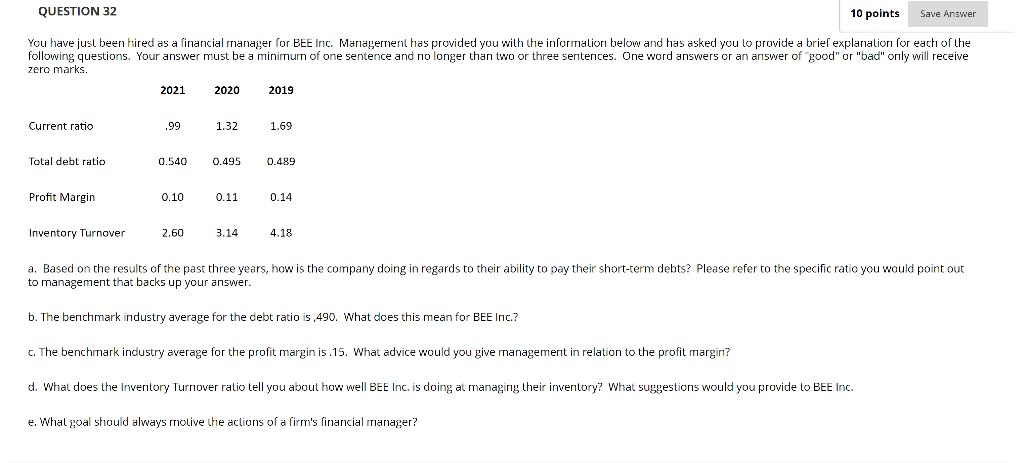

QUESTION 32 10 points Save Answer You have just been hired as a financial manager for BEE Inc. Management has provided you with the information below and has asked you to provide a brief explanation for each of the following questions. Your answer must be a minimum of one sentence and no longer than two or three sentences. One word answers or an answer of "good" or "bad" only will receive zero marks. 2021 2020 Current ratio .99 1.32 !!! Total debt ratio 0.540 0.495 Profit Margin 0.10 0.11 Inventory Turnover 2.60 3.14 2019 1.69 0.489 0.14 4.18 a. Based on the results of the past three years, how is the company doing in regards to their ability to pay their short-term debts? Please refer to the specific ratio you would point out to management that backs up your answer. b. The benchmark industry average for the debt ratio is ,490. What does this mean for BEE Inc.? c. The benchmark industry average for the profit margin is.15. What advice would you give management in relation to the profit margin? d. What does the Inventory Turnover ratio tell you about how well BEE Inc. is doing at managing their inventory? What suggestions would you provide to BEE Inc. e. What goal should always molive the actions of a firm's financial manager? c. The benchmark industry average for the profit margin is .15. What advice would you give management in relation to the profit margin? d. What does the Inventory Turnover ratio tell you about how well BEE Inc. is doing at managing their inventory? What suggestions would you provide to BEE Inc. e. What goal should always motive the actions of a firm's financial manager? For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). BIUS Paragraph P Open Sans,sa... 10pt Ev Tx G ... 0 WORDS POWERED BY TINYStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started