pls do it in excel form and ocf has to be calculated using depreciation tax shield.

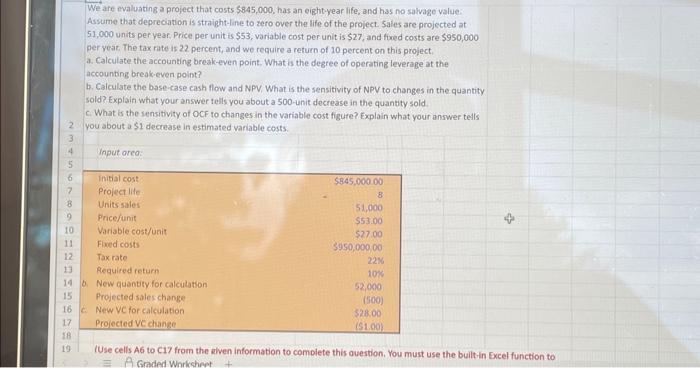

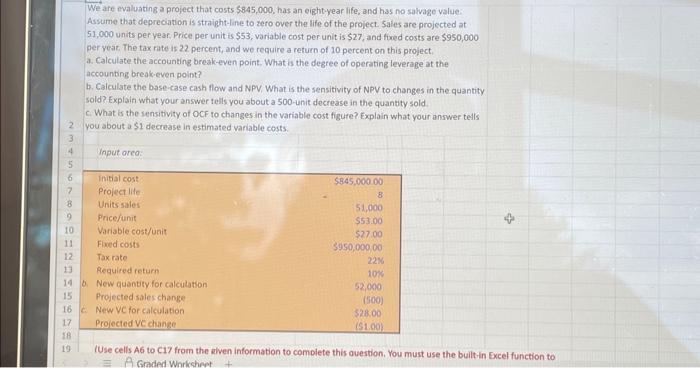

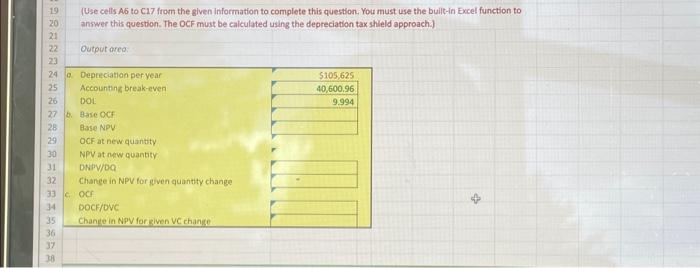

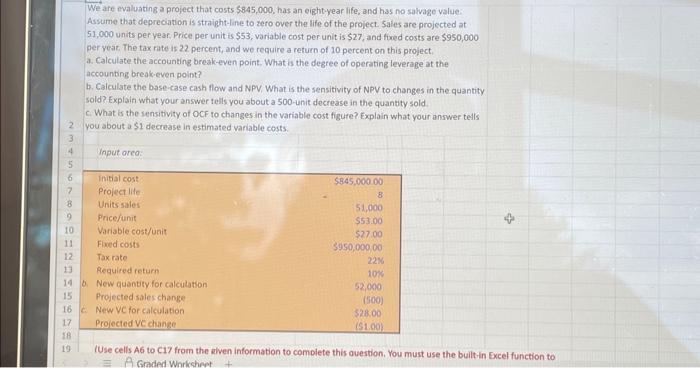

We are evaluating a project that costs 5845,000, has an eightyear life, and has no salvage value: Assume that depreciation is straight-line to zero over the life of the project. Sales are projected at 51,000 units per vear. Price per unit is $53, variable cost per unit is $27, and fued costs are $950,000 per veat. The tax rate is 22. percent, and we require a return of 10 percent on this project. a. Calculate the accounting break-even point. What is the degree of operating leverage at the accounting breakeven point? b. Calculate the base case cash flow and NPV, What is the sensitivity of NPV to changes in the quantity sold? Explain what your answer tells you about a 500 -unit decrease in the quantity sold. c. What is the sensitivity of OCF to changes in the variable cost figure? Explain what your answer tells you about a $1 decrease in estimated variable costs. IUse cells A6 to Cl7 from the alven information to comolete this ouestion. You must use the built-in Excel function to (Use cells A6 to C17 from the given information to complete this question. You must use the built-in Excel function to answer this question. The OCF must be calculated using the depreciation tax shleld approach.) We are evaluating a project that costs 5845,000, has an eightyear life, and has no salvage value: Assume that depreciation is straight-line to zero over the life of the project. Sales are projected at 51,000 units per vear. Price per unit is $53, variable cost per unit is $27, and fued costs are $950,000 per veat. The tax rate is 22. percent, and we require a return of 10 percent on this project. a. Calculate the accounting break-even point. What is the degree of operating leverage at the accounting breakeven point? b. Calculate the base case cash flow and NPV, What is the sensitivity of NPV to changes in the quantity sold? Explain what your answer tells you about a 500 -unit decrease in the quantity sold. c. What is the sensitivity of OCF to changes in the variable cost figure? Explain what your answer tells you about a $1 decrease in estimated variable costs. IUse cells A6 to Cl7 from the alven information to comolete this ouestion. You must use the built-in Excel function to (Use cells A6 to C17 from the given information to complete this question. You must use the built-in Excel function to answer this question. The OCF must be calculated using the depreciation tax shleld approach.)