pls dont do the first one use this one with $31000 for the existing fleet

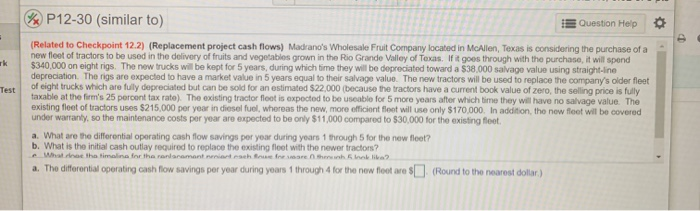

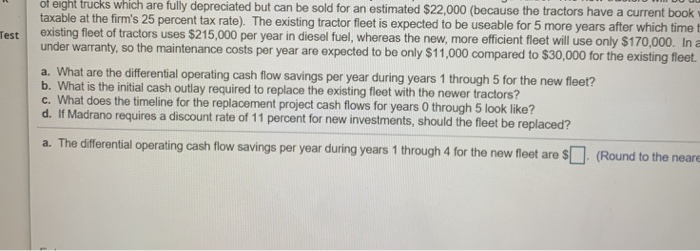

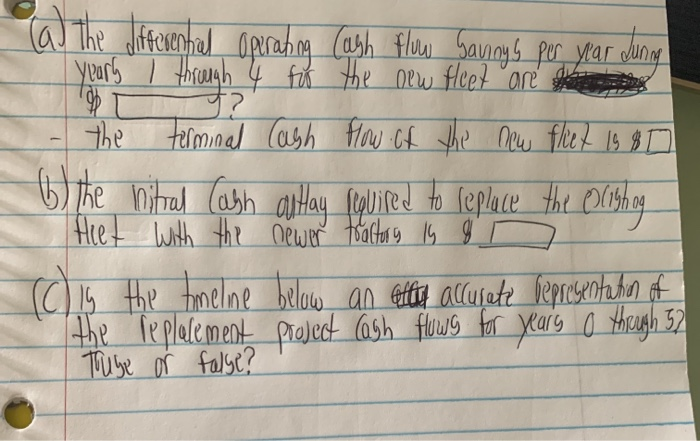

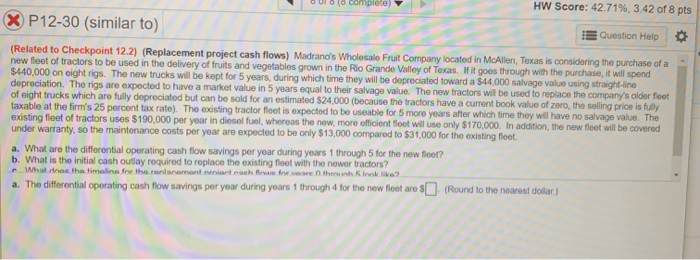

BP12-30 (similar to Question Help Test (Related to Checkpoint 12.2) (Replacement project cash flows) Madrano's Wholesale Fruit Company located in McAllen, Texas is considering the purchase of a new floor of tractors to be used in the delivery of fruits and vegetables grown in the Rio Grande Valley of Texas If it goes through with the purchase, it will spend $340,000 on eight rigs. The new trucks will be kept for 5 years, during which time they will be depreciated toward a $38,000 salvago value using straight-line depreciation. The rigs are expected to have a market value in 5 years equal to their salvage value. The new tractors will be used to replace the company's older fleet of eight trucks which are fully depreciated but can be sold for an estimated $22.000 (because the tractors have a current book value of zero, the selling price is fully taxable at the firm's 25 percent tax rate) The existing tractor floot is expected to be useable for 5 more years after which time they will have no salvage value. The existing floot of tractors usos $215.000 per year in diesel fuel, whereas the new, more efficient foot will use only $170.000. In addition, the new feet wil be covered under warranty, so the maintenance costs per year are expected to be only $11,000 compared to $30,000 for the existing fleet a. What are the differential operating cash flow savings per you during years through 5 for the new fleet? b. What is the initial cash outlay required to replace the existing floot with the newer tractors? What the main in the rarement t h e a. The differential operating cash flow savings per year during years through 4 for the new footare | (Round to the nearest dollar) oreight trucks which are fully depreciated but can be sold for an estimated $22,000 (because the tractors have a current book taxable at the firm's 25 percent tax rate). The existing tractor fleet is expected to be useable for 5 more years after which time! existing fleet of tractors uses $215,000 per year in diesel fuel, whereas the new, more efficient fleet will use only $170,000. In a under warranty, so the maintenance costs per year are expected to be only $11,000 compared to $30,000 for the existing fleet. Test a. What are the differential operating cash flow savings per year during years 1 through 5 for the new fleet? b. What is the initial cash outlay required to replace the existing fleet with the newer tractors? c. What does the timeline for the replacement project cash flows for years 0 through 5 look like? d. If Madrano requires a discount rate of 11 percent for new investments, should the fleet be replaced? a. The differential operating cash flow savings per year during years 1 through 4 for the new fleet are $ . (Round to the neare The differential Operating cash flow Savinys per year during years I through 4 for the new fleet are t he - the terminal Cash flow of the new fleet is 80 to the litral (ash antay required to replace the olish og Heet with the newer tractors Is & is the timeline below an other accurate representation of the replacement project cash flows for years o through 52 Truse or false? D ocomplete HW Score! 42.71%, 3.42 of 8 pts X P12-30 (similar to) Question Help (Related to Checkpoint 12.2) (Replacement project cash flows) Madrano's Wholesale Fruit Company located in McAllen, Texas is considering the purchase of a new feet of tractors to be used in the delivery of fruits and vegetables grown in the Rio Grande Valley of Texas. If it goes through with the purchase, it will spend $440,000 on eight rigs. The new trucks will be kept for 5 years, during which time they will be depreciated toward a $44,000 salvage value using straight-line depreciation. The rigs are expected to have a market value in 5 years equal to their salvage value. The new tractors will be used to replace the company's older foot of eight trucks which are fully depreciated but can be sold for an estimated $24,000 (because the tractors have a current book value of zero, the selling price is fully taxable at the firm's 25 percent tax rate). The existing tractor foot is expected to be useable for 5 more years after which time they will have no salvage value. The existing fleet of tractors uses $190,000 per year in diesel fuel, whereas the new, more officient floot will use only $170,000. In addition, the new fleet will be covered under warranty, so the maintenance costs per year are expected to be only $13,000 compared to $31,000 for the existing fleet. a. What are the differential operating cash flow savings per year during years 1 through 5 for the new feet? b. What is the initial cash outlay required to replace the existing floot with the newer tractors? Munce the timeline fr the rolamento achieve than a a. The differential operating cash flow savings per year during years through 4 for the new fleet are (Round to the nearest dollar) ulur warranty, so ine maintenance costs per year are expected to be only $13,000 compared to $31,000 for the a. What are the differential operating cash flow savings per year during years 1 through 5 for the new fleet? b. What is the initial cash outlay required to replace the existing fleet with the newer tractors? c. What does the timeline for the replacement project cash flows for years 0 through 5 look like? d. If Madrano requires a discount rate of 7 percent for new investments, should the fleet be replaced? a. The differential operating cash flow savings per year during years 1 through 4 for the new fleet are $ (Round Enter your answer in the newer hoy and then click Chan Anex