Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Pls explain how to get answer without excel Your firm is upgrading its production facilities. Currently the company sells 58,500 units per year and the

Pls explain how to get answer without excel

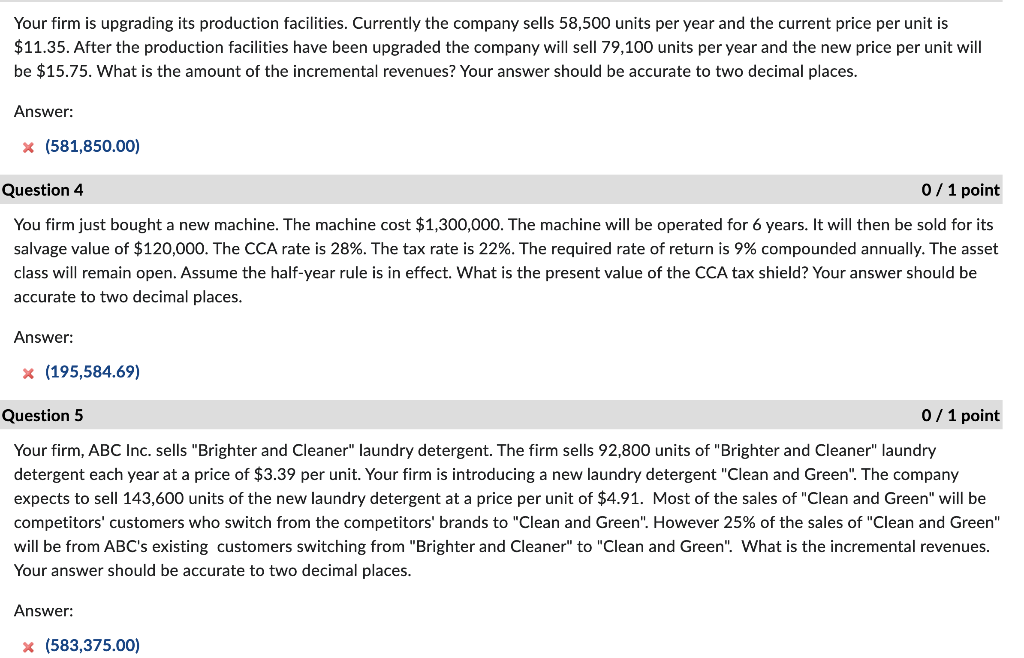

Your firm is upgrading its production facilities. Currently the company sells 58,500 units per year and the current price per unit is $11.35. After the production facilities have been upgraded the company will sell 79,100 units per year and the new price per unit will be $15.75. What is the amount of the incremental revenues? Your answer should be accurate to two decimal places. Answer: x (581,850.00) Question 4 0 / 1 point You firm just bought a new machine. The machine cost $1,300,000. The machine will be operated for 6 years. It will then be sold for its salvage value of $120,000. The CCA rate is 28%. The tax rate is 22%. The required rate of return is 9% compounded annually. The asset class will remain open. Assume the half-year rule is in effect. What is the present value of the CCA tax shield? Your answer should be accurate to two decimal places. Answer: x (195,584.69) Question 5 0 / 1 point Your firm, ABC Inc. sells "Brighter and Cleaner" laundry detergent. The firm sells 92,800 units of "Brighter and Cleaner" laundry detergent each year at a price of $3.39 per unit. Your firm is introducing a new laundry detergent "Clean and Green". The company expects to sell 143,600 units of the new laundry detergent at a price per unit of $4.91. Most of the sales of "Clean and Green" will be competitors' customers who switch from the competitors' brands to "Clean and Green". However 25% of the sales of "Clean and Green" will be from ABC's existing customers switching from "Brighter and Cleaner" to "Clean and Green". What is the incremental revenues. Your answer should be accurate to two decimal places. Answer: x (583,375.00)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started