Pls explain the process of solving as well

Pls explain the process of solving as well

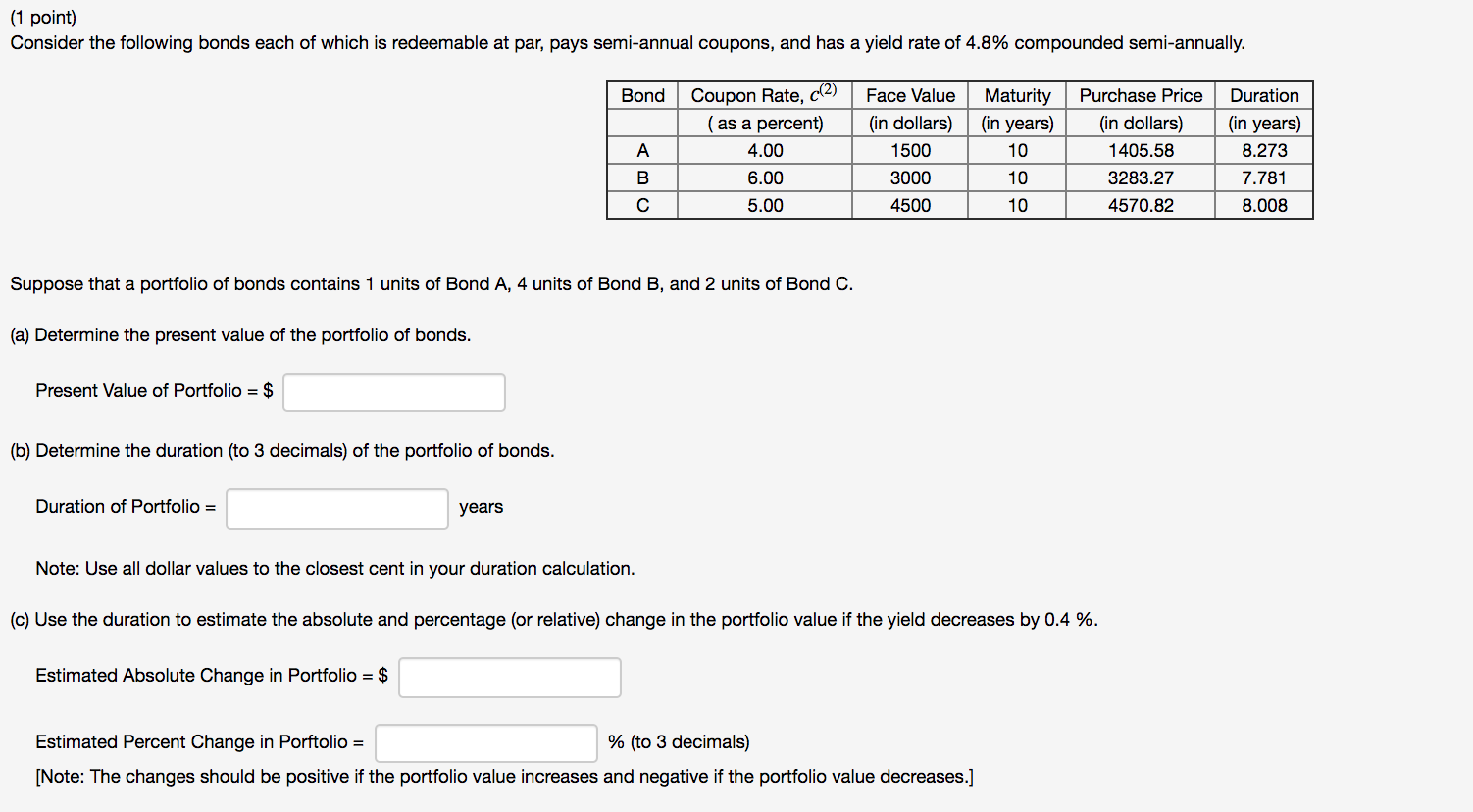

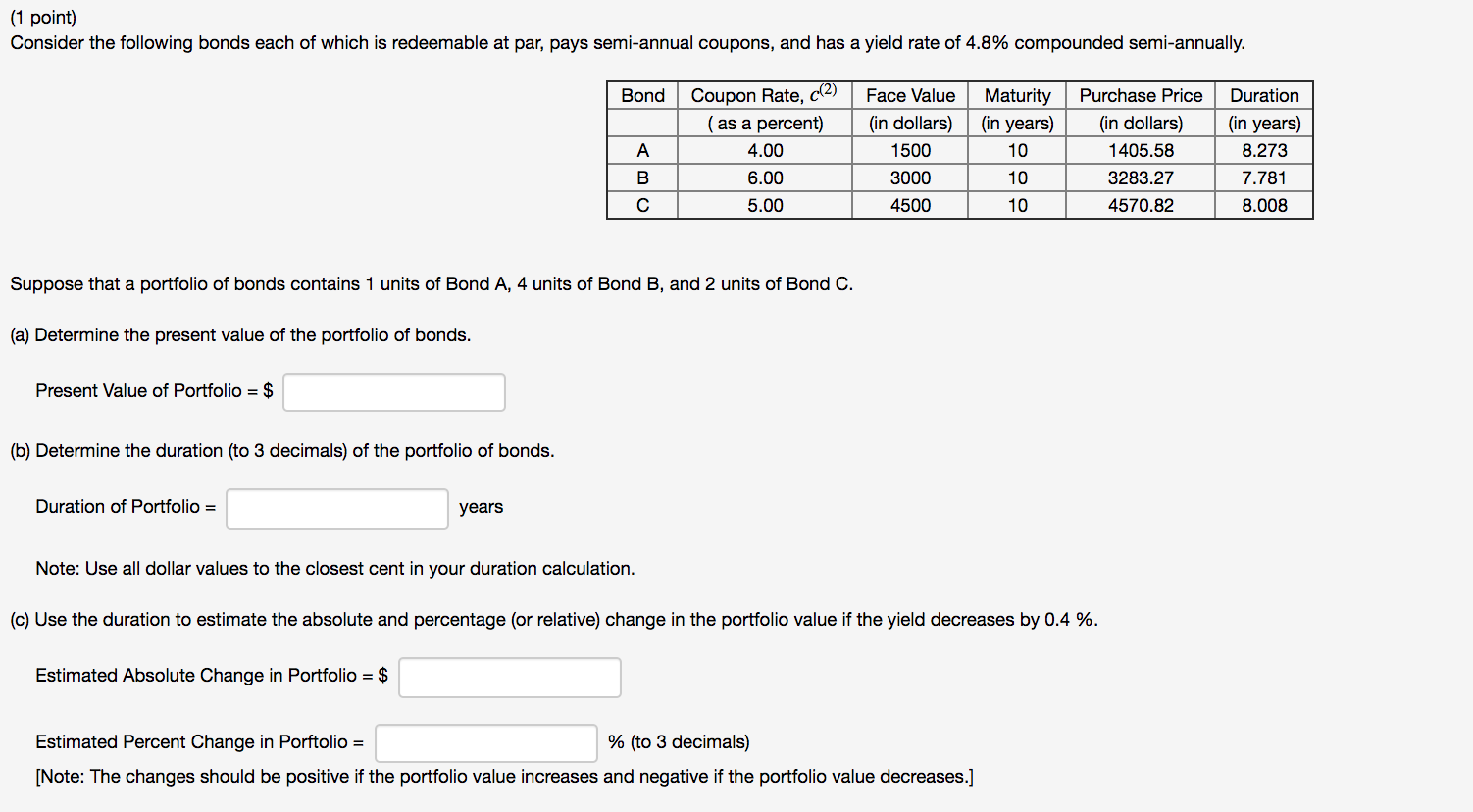

(1 point) Consider the following bonds each of which is redeemable at par, pays semi-annual coupons, and has a yield rate of 4.8% compounded semi-annually. Bond Coupon Rate, (2) (as a percent) 4.00 6.00 5.00 . Face Value (in dollars) 1500 3000 4500 Maturity (in years) 10 Purchase Price (in dollars) 1405.58 3283.27 4570.82 Duration (in years) 8.273 7.781 8.008 B 10 10 Suppose that a portfolio of bonds contains 1 units of Bond A, 4 units of Bond B, and 2 units of Bond C. (a) Determine the present value of the portfolio of bonds. Present Value of Portfolio = $ (b) Determine the duration (to 3 decimals) of the portfolio of bonds. Duration of Portfolio = years Note: Use all dollar values to the closest cent in your duration calculation. (c) Use the duration to estimate the absolute and percentage (or relative) change in the portfolio value if the yield decreases by 0.4 %. Estimated Absolute Change in Portfolio = $ Estimated Percent Change in Porftolio = % (to 3 decimals) [Note: The changes should be positive if the portfolio value increases and negative if the portfolio value decreases.] (1 point) Consider the following bonds each of which is redeemable at par, pays semi-annual coupons, and has a yield rate of 4.8% compounded semi-annually. Bond Coupon Rate, (2) (as a percent) 4.00 6.00 5.00 . Face Value (in dollars) 1500 3000 4500 Maturity (in years) 10 Purchase Price (in dollars) 1405.58 3283.27 4570.82 Duration (in years) 8.273 7.781 8.008 B 10 10 Suppose that a portfolio of bonds contains 1 units of Bond A, 4 units of Bond B, and 2 units of Bond C. (a) Determine the present value of the portfolio of bonds. Present Value of Portfolio = $ (b) Determine the duration (to 3 decimals) of the portfolio of bonds. Duration of Portfolio = years Note: Use all dollar values to the closest cent in your duration calculation. (c) Use the duration to estimate the absolute and percentage (or relative) change in the portfolio value if the yield decreases by 0.4 %. Estimated Absolute Change in Portfolio = $ Estimated Percent Change in Porftolio = % (to 3 decimals) [Note: The changes should be positive if the portfolio value increases and negative if the portfolio value decreases.]

Pls explain the process of solving as well

Pls explain the process of solving as well