Answered step by step

Verified Expert Solution

Question

1 Approved Answer

pls explain the steps the question is below work on a excel like this this excel is just a example Assume that Monsanto Corporation is

pls explain the steps the question is below

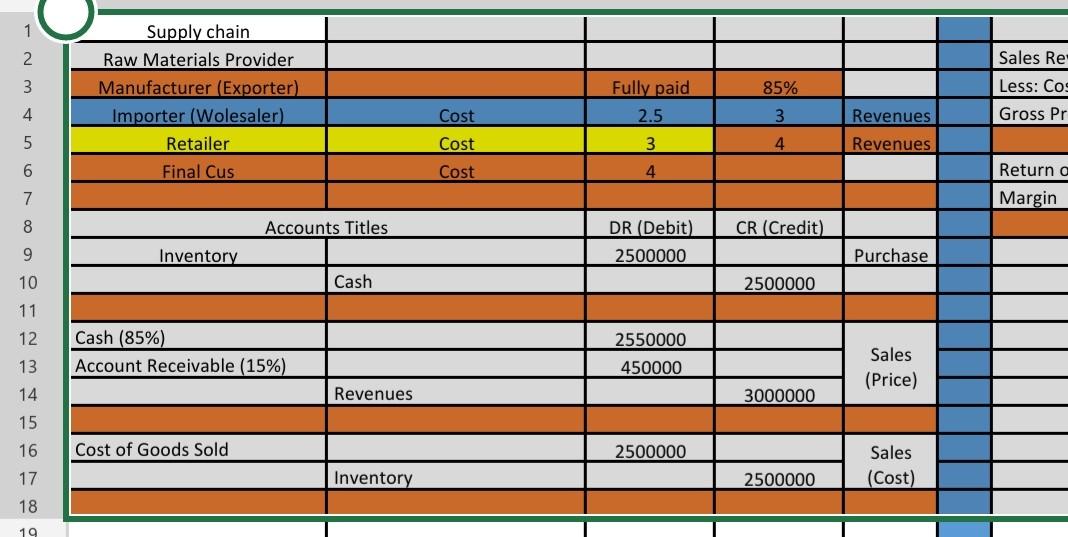

work on a excel like this this excel is just a example

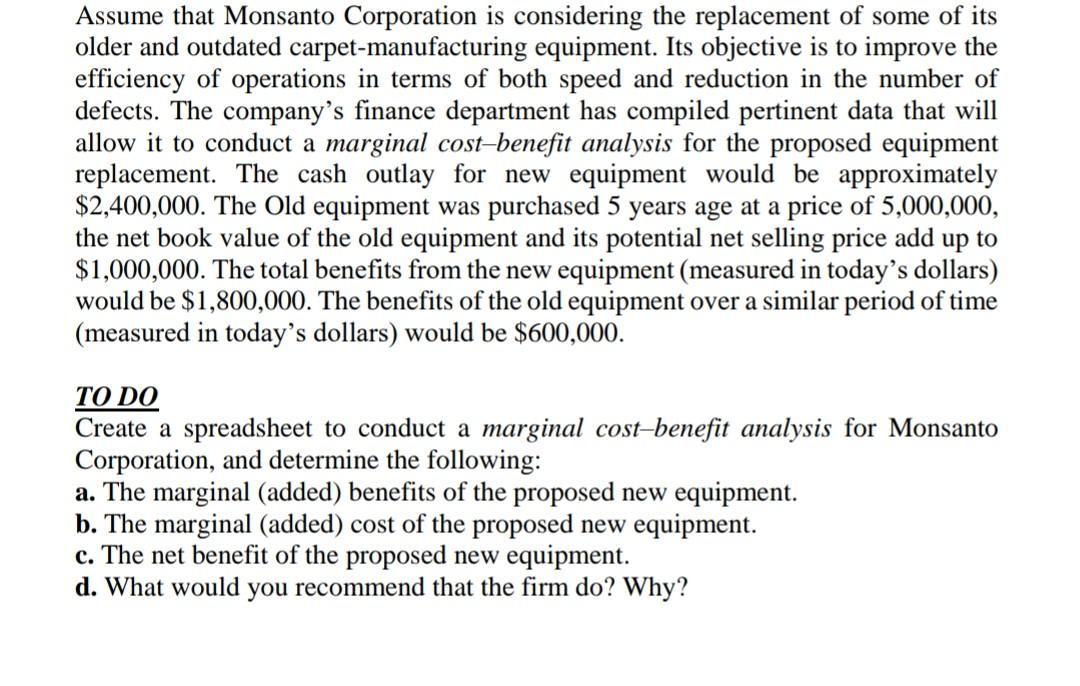

Assume that Monsanto Corporation is considering the replacement of some of its older and outdated carpet-manufacturing equipment. Its objective is to improve the efficiency of operations in terms of both speed and reduction in the number of defects. The company's finance department has compiled pertinent data that will allow it to conduct a marginal cost-benefit analysis for the proposed equipment replacement. The cash outlay for new equipment would be approximately $2,400,000. The Old equipment was purchased 5 years age at a price of 5,000,000, the net book value of the old equipment and its potential net selling price add up to $1,000,000. The total benefits from the new equipment (measured in today's dollars) would be $1,800,000. The benefits of the old equipment over a similar period of time (measured in today's dollars) would be $600,000. TO DO Create a spreadsheet to conduct a marginal cost-benefit analysis for Monsanto Corporation, and determine the following a. The marginal (added) benefits of the proposed new equipment. b. The marginal (added) cost of the proposed new equipment. c. The net benefit of the proposed new equipment. d. What would you recommend that the firm do? Why? 1 2 Sales Re 3 85% Less: Cog Supply chain Raw Materials Provider Manufacturer (Exporter) Importer (Wolesaler) Retailer Final Cus 4 Cost Fully paid 2.5 3 3 Gross Pr Revenues Revenues 5 Cost 4 6 Cost 4 Return a Margin 7 8 Accounts Titles CR Credit) DR (Debit) 2500000 9 Inventory Purchase 10 Cash 2500000 11 12 Cash (85%) Account Receivable (15%) 2550000 450000 13 Sales (Price) 14 Revenues 3000000 15 16 Cost of Goods Sold 2500000 Sales (Cost) 17 Inventory 2500000 18 19

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started