Answered step by step

Verified Expert Solution

Question

1 Approved Answer

pls give the exact answer ill rate Assume the current Treasury yield curve shows that the spot rates for six months, one year, and one

pls give the exact answer ill rate

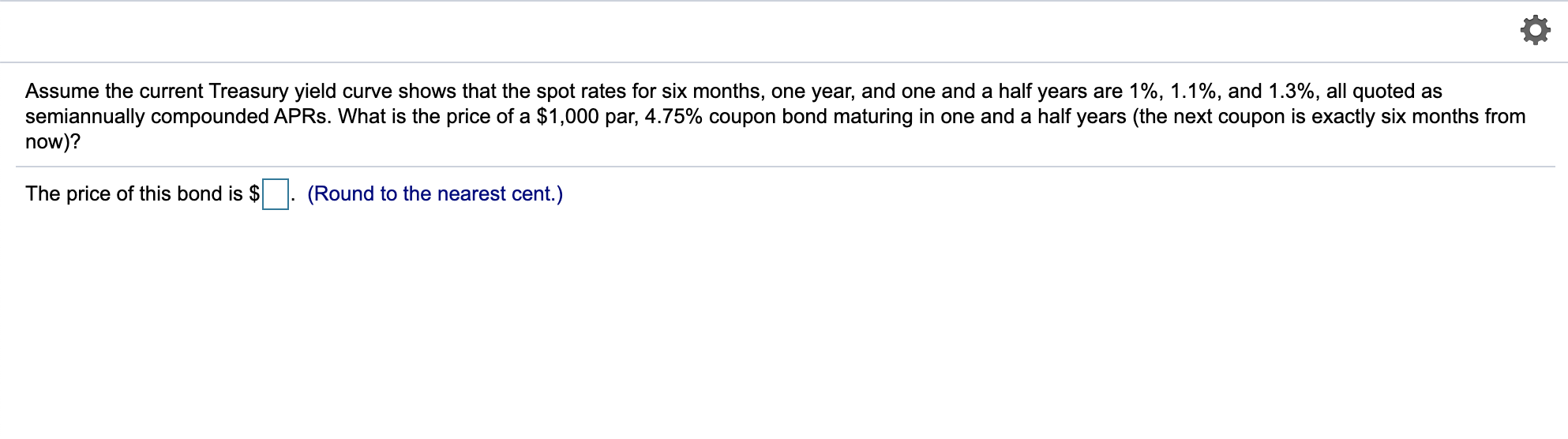

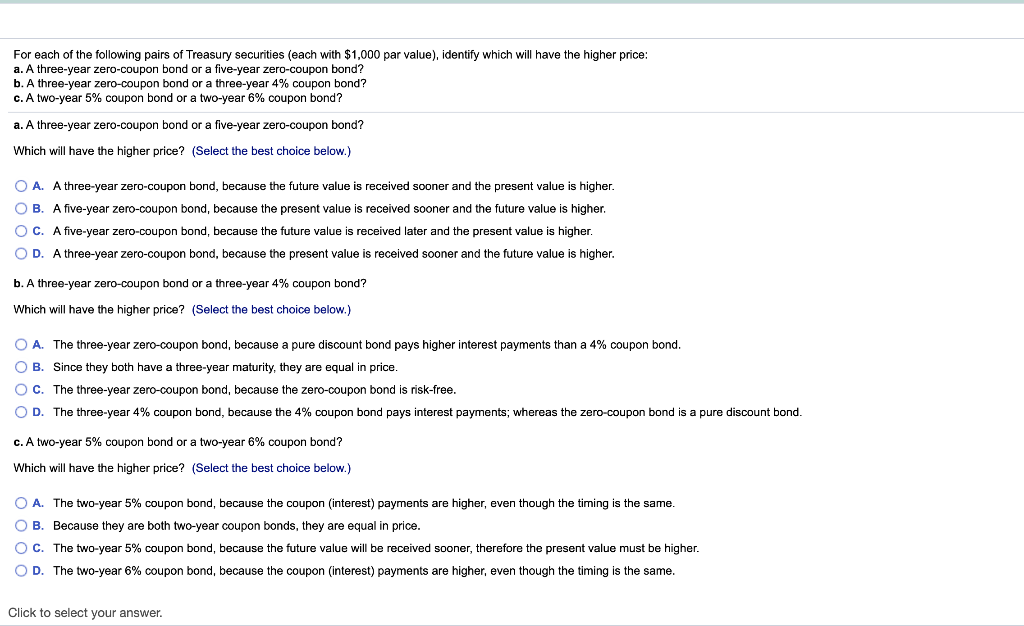

Assume the current Treasury yield curve shows that the spot rates for six months, one year, and one and a half years are 1%, 1.1%, and 1.3%, all quoted as semiannually compounded APRs. What is the price of a $1,000 par, 4.75% coupon bond maturing in one and a half years (the next coupon is exactly six months from now)? The price of this bond is $ (Round to the nearest cent.) For each of the following pairs of Treasury securities (each with $1,000 par value), identify which will have the higher price: a. A three-year zero-coupon bond or a five-year zero-coupon bond? b. A three-year zero-coupon bond or a three-year 4% coupon bond? c. A two-year 5% coupon bond or a two-year 6% coupon bond? a. A three-year zero-coupon bond or a five-year zero-coupon bond? Which will have the higher price? (Select the best choice below.) O A. A three-year zero-coupon bond, because the future value is received sooner and the present value is higher. OB. A five-year zero-coupon bond, because the present value is received sooner and the future value is higher. OC. A five-year zero-coupon bond, because the future value is received later and the present value is higher. OD. A three-year zero-coupon bond, because the present value is received sooner and the future value higher. b. A three-year zero-coupon bond or a three-year 4% coupon bond? Which will have the higher price? (Select the best choice below.) O A. The three-year zero-coupon bond, because a pure discount bond pays higher interest payments than a 4% coupon bond. O B. Since they both have a three-year maturity, they are equal in price. O c. The three-year zero-coupon bond, because the zero-coupon bond is risk-free. OD. The three-year 4% coupon bond, because the 4% coupon bond pays interest payments; whereas the zero-coupon bond is a pure discount bond. c. A two-year 5% coupon bond or a two-year 6% coupon bond? Which will have the higher price? (Select the best choice below.) O A. The two-year 5% coupon bond, because the coupon (interest) payments are higher, even though the timing is the same. OB. Because they are both two-year coupon bonds, they are equal in price. OC. The two-year 5% coupon bond, because the future value will be received sooner, therefore the present value must be higher. OD. The two-year 6% coupon bond, because the coupon (interest) payments are higher, even though the timing is the same. Click to select yourStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started