Answered step by step

Verified Expert Solution

Question

1 Approved Answer

pls help and show steps, will give good thumbs up Brock Florist Company buys a new delivery truck for 540,000. It is classified as a

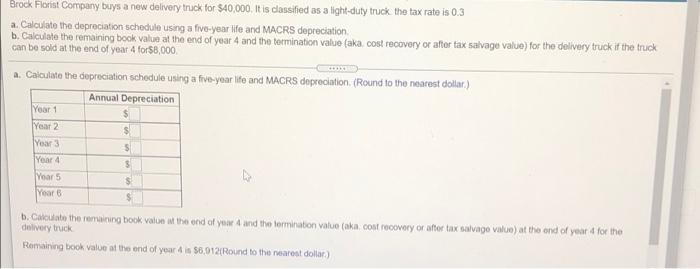

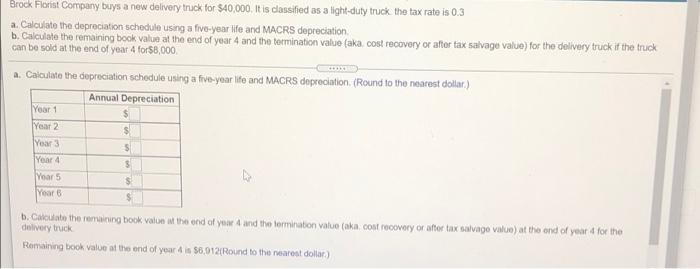

pls help and show steps, will give good thumbs up  Brock Florist Company buys a new delivery truck for 540,000. It is classified as a light-duty truck the tax rate is 0.3 a. Calculate the depreciation schedule using a five-year life and MACRS depreciation b. Calculate the remaining book value at the end of year 4 and the termination value (aka cost recovery or after tax salvage value) for the delivery truck if the truck can be sold at the end of year 4 for58,000. a. Calculate the depreciation schedule using a five-year life and MACRS depreciation (Round to the nearest dollar) Annual Depreciation Year 1 Year 2 $ Year 5 Year 4 $ Year 5 Year 6 b. Calculate the remaining book value at the end of year 4 and the termination value (aka.cost recovery or after tax salvingo value) at the end of years for the delivery truck Romaining book value at the end of year is 56,012(Round to the nearest dollar)

Brock Florist Company buys a new delivery truck for 540,000. It is classified as a light-duty truck the tax rate is 0.3 a. Calculate the depreciation schedule using a five-year life and MACRS depreciation b. Calculate the remaining book value at the end of year 4 and the termination value (aka cost recovery or after tax salvage value) for the delivery truck if the truck can be sold at the end of year 4 for58,000. a. Calculate the depreciation schedule using a five-year life and MACRS depreciation (Round to the nearest dollar) Annual Depreciation Year 1 Year 2 $ Year 5 Year 4 $ Year 5 Year 6 b. Calculate the remaining book value at the end of year 4 and the termination value (aka.cost recovery or after tax salvingo value) at the end of years for the delivery truck Romaining book value at the end of year is 56,012(Round to the nearest dollar)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started