Answered step by step

Verified Expert Solution

Question

1 Approved Answer

pls help asap before 11 In the Continuing Payroll Problem A, presented at the end of succeeding chapters, you will gain experience in computing wages

pls help asap before 11

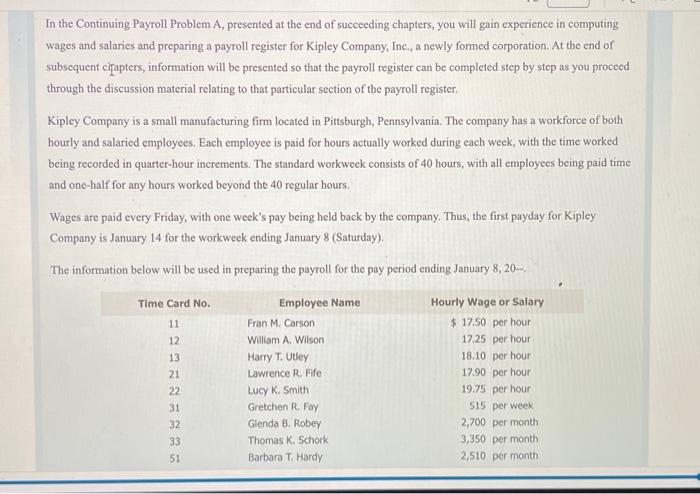

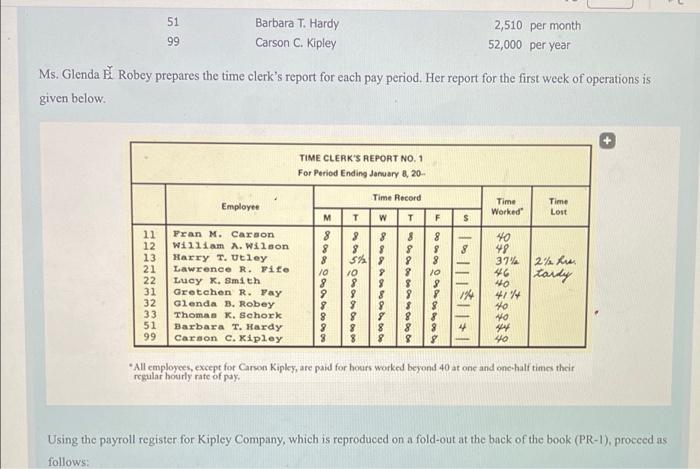

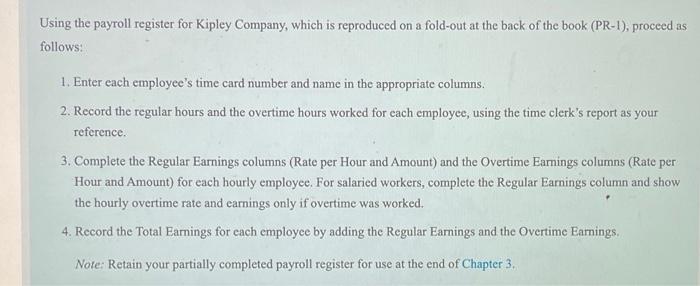

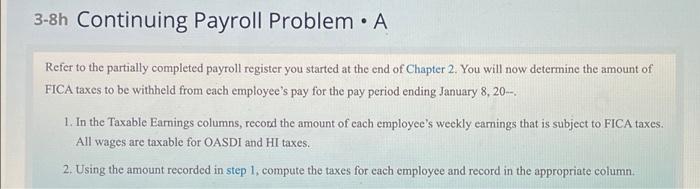

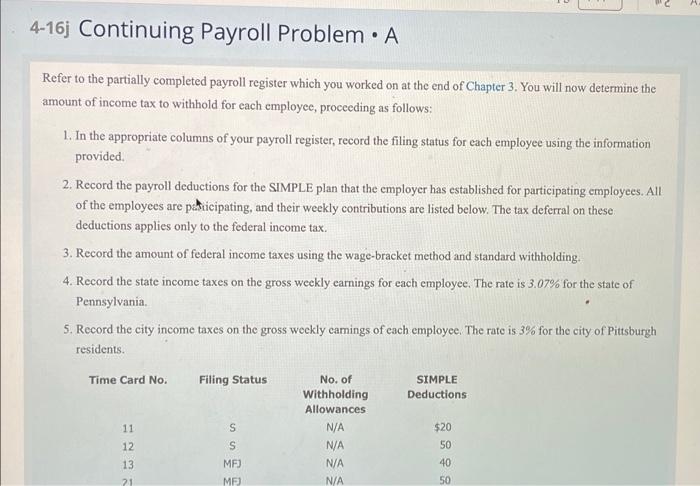

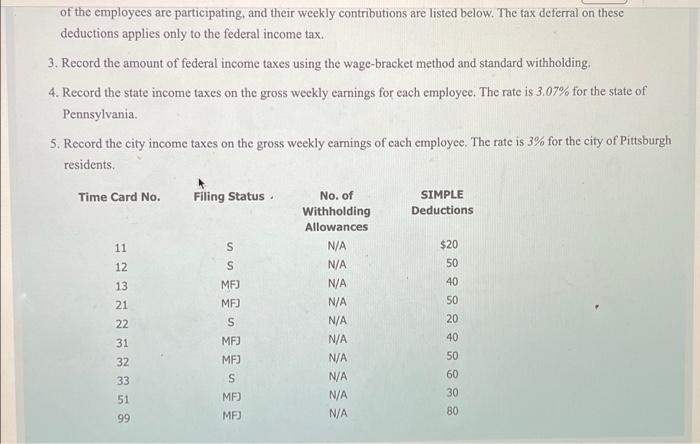

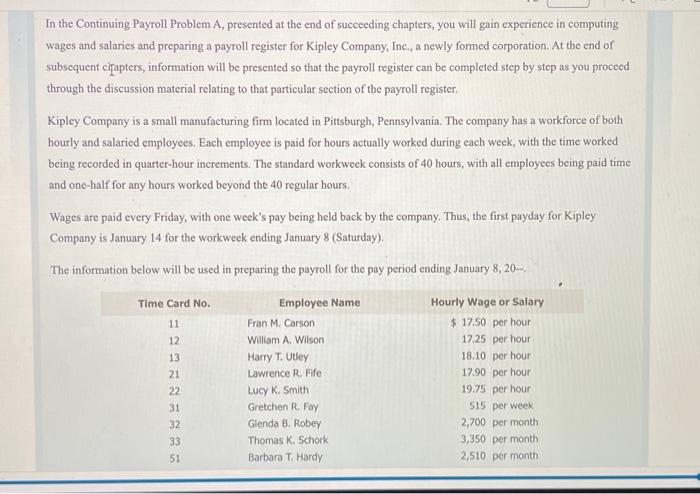

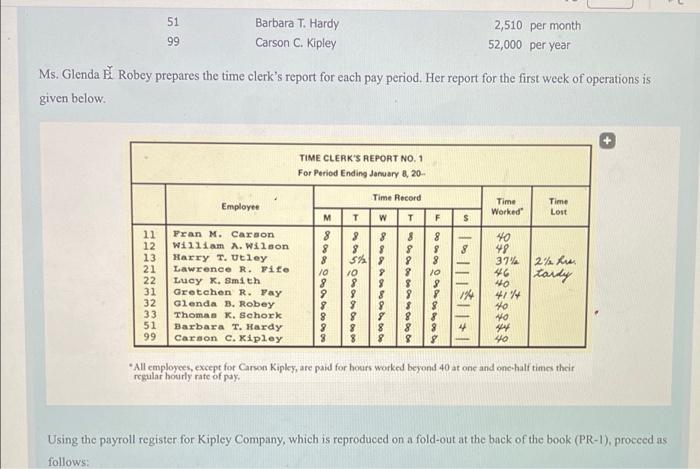

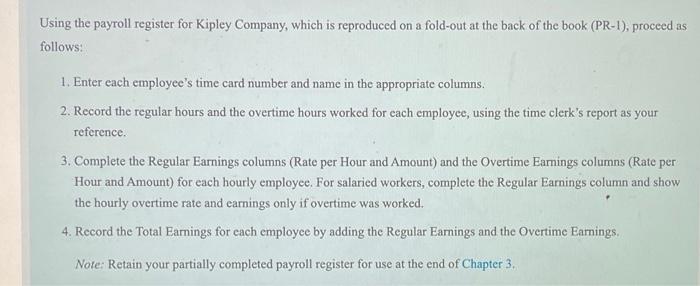

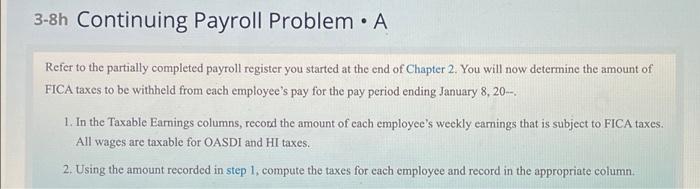

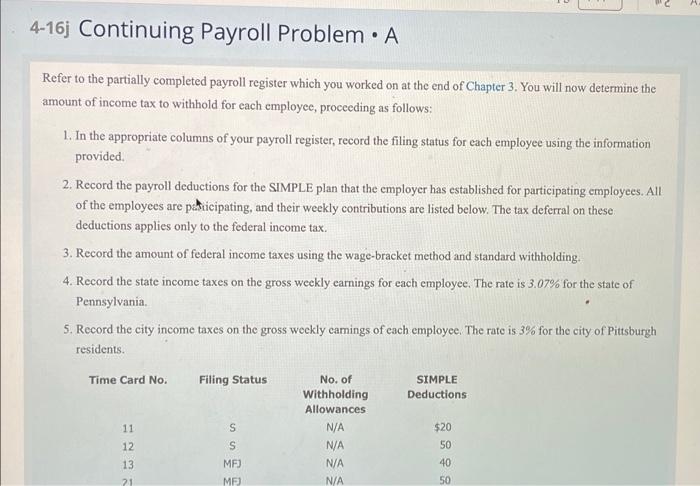

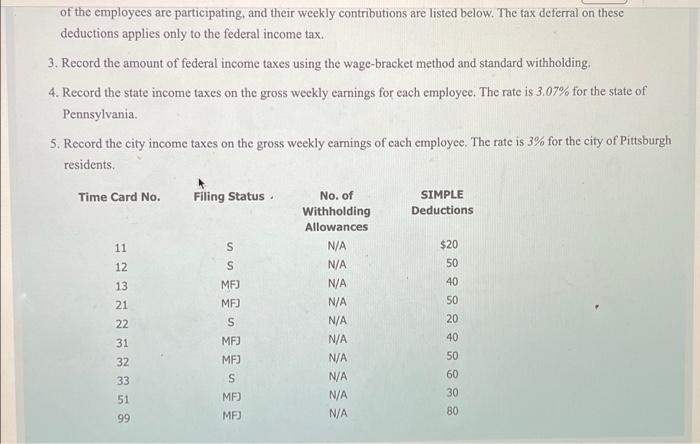

In the Continuing Payroll Problem A, presented at the end of succeeding chapters, you will gain experience in computing wages and salaries and preparing a payroll register for Kipley Company, Inc., a newly formed corporation. At the end of subsequent cirapters, information will be presented so that the payroll register can be completed step by step as you proceed through the discussion material relating to that particular section of the payroll register. Kipley Company is a small manufacturing firm located in Pittsburgh, Pennsylvania. The company has a workforce of both hourly and salaried employees. Each employee is paid for hours actually worked during each week, with the time worked being recorded in quarter-hour increments. The standard workweek consists of 40 hours, with all employees being paid time and one-half for any hours worked beyond the 40 regular hours. Wages are paid every Friday, with one week's pay being held back by the company. Thus, the first payday for Kipley Company is January 14 for the workweek ending January 8 (Saturday). The information below will be used in preparing the payroll for the pay period ending January 8, 20-. Time Card No. Employee Name Hourly Wage or Salary Fran M. Carson $17.50 per hour William A. Wilson 17.25 per hour Harry T. Utley 18.10 per hour Lawrence R. Fife 17.90 per hour Lucy K. Smith 19.75 per hour 515 per week Glenda B. Robey 2,700 per month Thomas K. Schork 3,350 per month Barbara T. Hardy 2,510 per month 11 12 13 21 22 31 32 33 51 Gretchen R. Foy 51 Barbara T. Hardy 2,510 per month 99 Carson C. Kipley 52,000 per year Ms. Glenda i Robey prepares the time clerk's report for each pay period. Her report for the first week of operations is given below. TIME CLERK'S REPORT NO. 1 For Period Ending January 8, 20 Employee Time Worked Time Lost S & Os - 11 12 13 21 22 31 32 Time Record M T W T 8 8 8 8 8 8 563 8 10 10 10 8 NNM GINN PWN |2% hrs tardy Oo oo Fran M. Carson William A. Wilson Harry T. Utley Lawrence R. Fico Lucy K. Smith Gretchen R. Pay Glenda B. Robey Thomas K. Schork Barbara T. Hardy Carson C. Kipley 0 0 0 0 0 0 Yo 42 37% 46 40 4144 Ho wo 44 40 14 33 8 8 51 99 3 *All employees, except for Carson Kipley, are paid for hours worked beyond 40 at one and one-half times their regular hourly rate of pay. Using the payroll register for Kipley Company, which is reproduced on a fold-out at the back of the book (PR-1), proceed as follows: Using the payroll register for Kipley Company, which is reproduced on a fold-out at the back of the book (PR-1), proceed as follows: 1. Enter each employee's time card number and name in the appropriate columns 2. Record the regular hours and the overtime hours worked for each employee, using the time clerk's report as your reference 3. Complete the Regular Earnings columns (Rate per Hour and Amount) and the Overtime Earnings columns (Rate per Hour and Amount) for each hourly employee. For salaried workers, complete the Regular Earnings column and show the hourly overtime rate and earnings only if overtime was worked. Record the Total Earnings for each employee by adding the Regular Earnings and the Overtime Earnings Note: Retain your partially completed payroll register for use at the end of Chapter 3 3-8h Continuing Payroll Problem. A Refer to the partially completed payroll register you started at the end of Chapter 2. You will now determine the amount of FICA taxes to be withheld from cach employee's pay for the pay period ending January 8, 20.--. 1. In the Taxable Earnings columns, record the amount of cach employec's weekly earnings that is subject to FICA taxes. All wages are taxable for OASDI and HI taxes. 2. Using the amount recorded in step 1. compute the taxes for each employee and record in the appropriate column. 2 4-16] Continuing Payroll Problem. A . Refer to the partially completed payroll register which you worked on at the end of Chapter 3. You will now determine the amount of income tax to withhold for each employee, proceeding as follows: 1. In the appropriate columns of your payroll register, record the filing status for each employee using the information provided 2. Record the payroll deductions for the SIMPLE plan that the employer has established for participating employees. All of the employees are pesticipating, and their weekly contributions are listed below. The tax deferral on these deductions applies only to the federal income tax. 3. Record the amount of federal income taxes using the wage-bracket method and standard withholding 4. Record the state income taxes on the gross weekly earnings for each employee. The rate is 3.07% for the state of Pennsylvania. 5. Record the city income taxes on the gross weekly camnings of each employee. The rate is 3% for the city of Pittsburgh residents. Time Card No. Filing Status SIMPLE Deductions S 11 12 13 21 No. of Withholding Allowances N/A N/A N/A N/A S MF) $20 50 40 MF) 50 of the employees are participating, and their weekly contributions are listed below. The tax deferral on these deductions applies only to the federal income tax. 3. Record the amount of federal income taxes using the wage-bracket method and standard withholding. 4. Record the state income taxes on the gross weekly earnings for each employee. The rate is 3.07% for the state of Pennsylvania 5. Record the city income taxes on the gross weekly earnings of each employee. The rate is 3% for the city of Pittsburgh residents Time Card No. Filing Status SIMPLE Deductions 11 un $20 50 12 S MF) 40 13 21 MF) No. of Withholding Allowances N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A SO 20 22 S 40 31 MF) MF) 32 33 50 60 30 80 S MF) MP3 51 99

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started