PLS HELP ASAP

PLS HELP ASAP

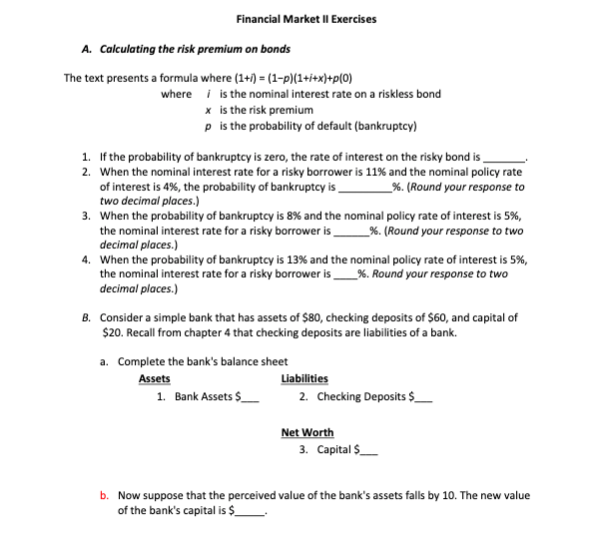

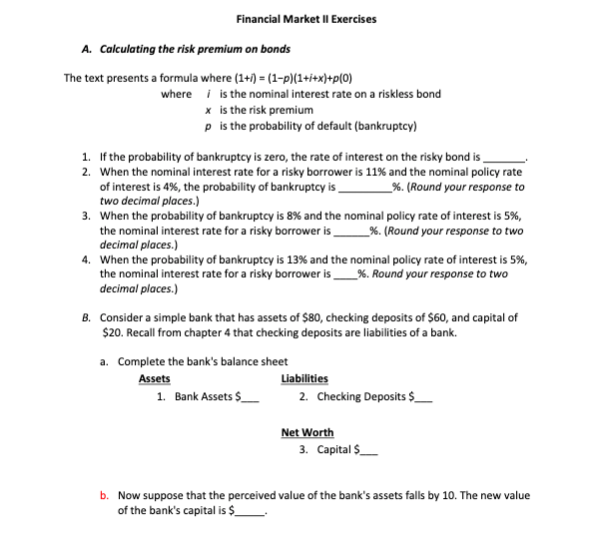

Financial Market II Exercises A. Calculating the risk premium on bonds The text presents a formula where (1+i)= (1-P)(1+i+x)+p(0) where i is the nominal interest rate on a riskless bond x is the risk premium p is the probability of default (bankruptcy) 1. If the probability of bankruptcy is zero, the rate of interest on the risky bond is 2. When the nominal interest rate for a risky borrower is 11% and the nominal policy rate %. (Round your response to of interest is 4%, the probability of bankruptcy is__ two decimal places.) 3. When the probability of bankruptcy is 8% and the nominal policy rate of interest is 5%, the nominal interest rate for a risky borrower is %. (Round your response to two decimal places.) 4. When the probability of bankruptcy is 13% and the nominal policy rate of interest is 5%, the nominal interest rate for a risky borrower is%. Round your response to two decimal places.) B. Consider a simple bank that has assets of $80, checking deposits of $60, and capital of $20. Recall from chapter 4 that checking deposits are liabilities of a bank. a. Complete the bank's balance sheet Assets Liabilities 1. Bank Assets $____ 2. Checking Deposits $____ 3. Capital $ b. Now suppose that the perceived value of the bank's assets falls by 10. The new value of the bank's capital is $ Net Worth Financial Market II Exercises A. Calculating the risk premium on bonds The text presents a formula where (1+i)= (1-P)(1+i+x)+p(0) where i is the nominal interest rate on a riskless bond x is the risk premium p is the probability of default (bankruptcy) 1. If the probability of bankruptcy is zero, the rate of interest on the risky bond is 2. When the nominal interest rate for a risky borrower is 11% and the nominal policy rate %. (Round your response to of interest is 4%, the probability of bankruptcy is__ two decimal places.) 3. When the probability of bankruptcy is 8% and the nominal policy rate of interest is 5%, the nominal interest rate for a risky borrower is %. (Round your response to two decimal places.) 4. When the probability of bankruptcy is 13% and the nominal policy rate of interest is 5%, the nominal interest rate for a risky borrower is%. Round your response to two decimal places.) B. Consider a simple bank that has assets of $80, checking deposits of $60, and capital of $20. Recall from chapter 4 that checking deposits are liabilities of a bank. a. Complete the bank's balance sheet Assets Liabilities 1. Bank Assets $____ 2. Checking Deposits $____ 3. Capital $ b. Now suppose that the perceived value of the bank's assets falls by 10. The new value of the bank's capital is $ Net Worth

PLS HELP ASAP

PLS HELP ASAP