Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Pls help For this question, download and open the American Eagle Outfitters 201610Ks by clicking here. Along with the 10K, use the following data to

Pls help

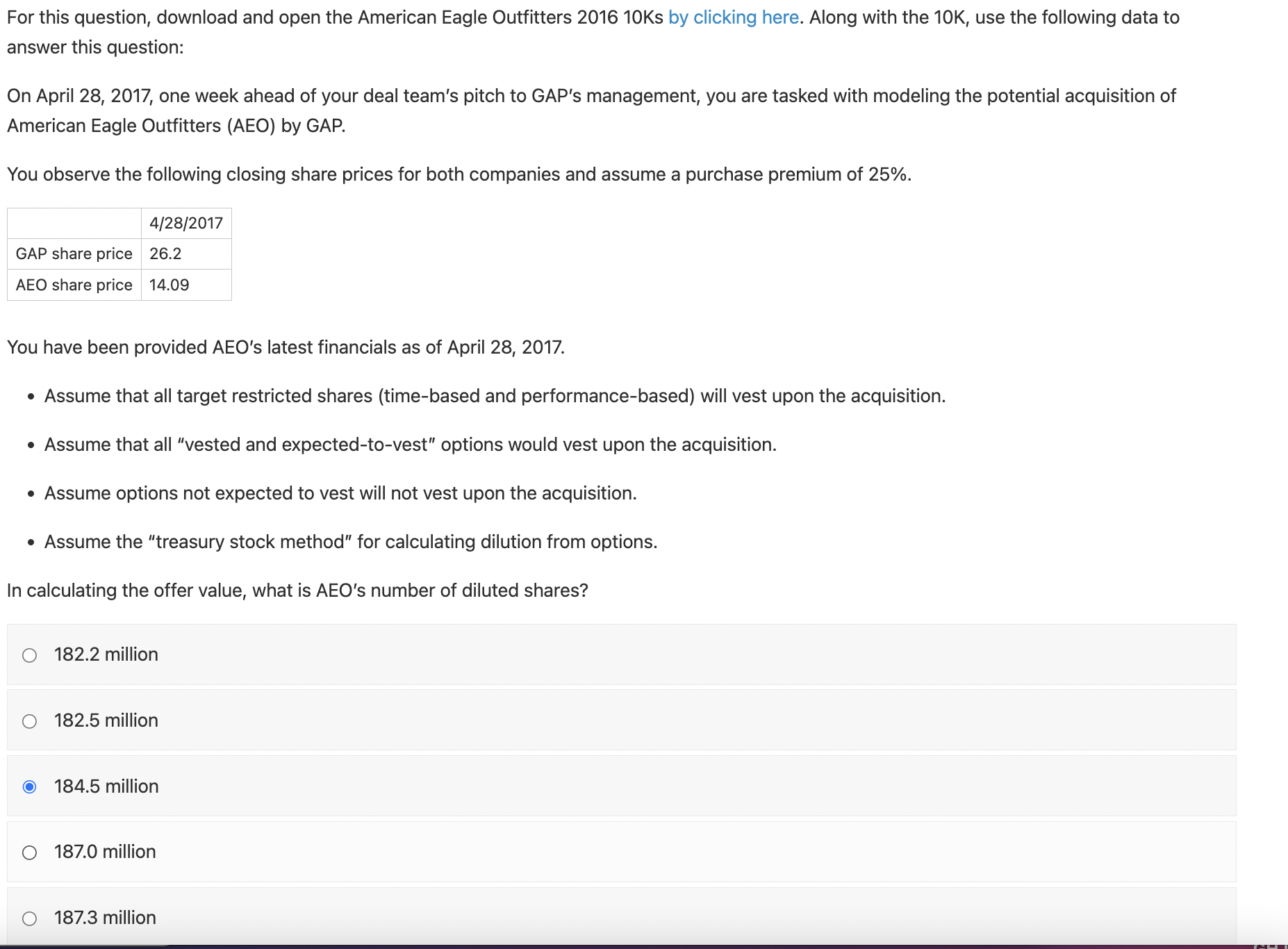

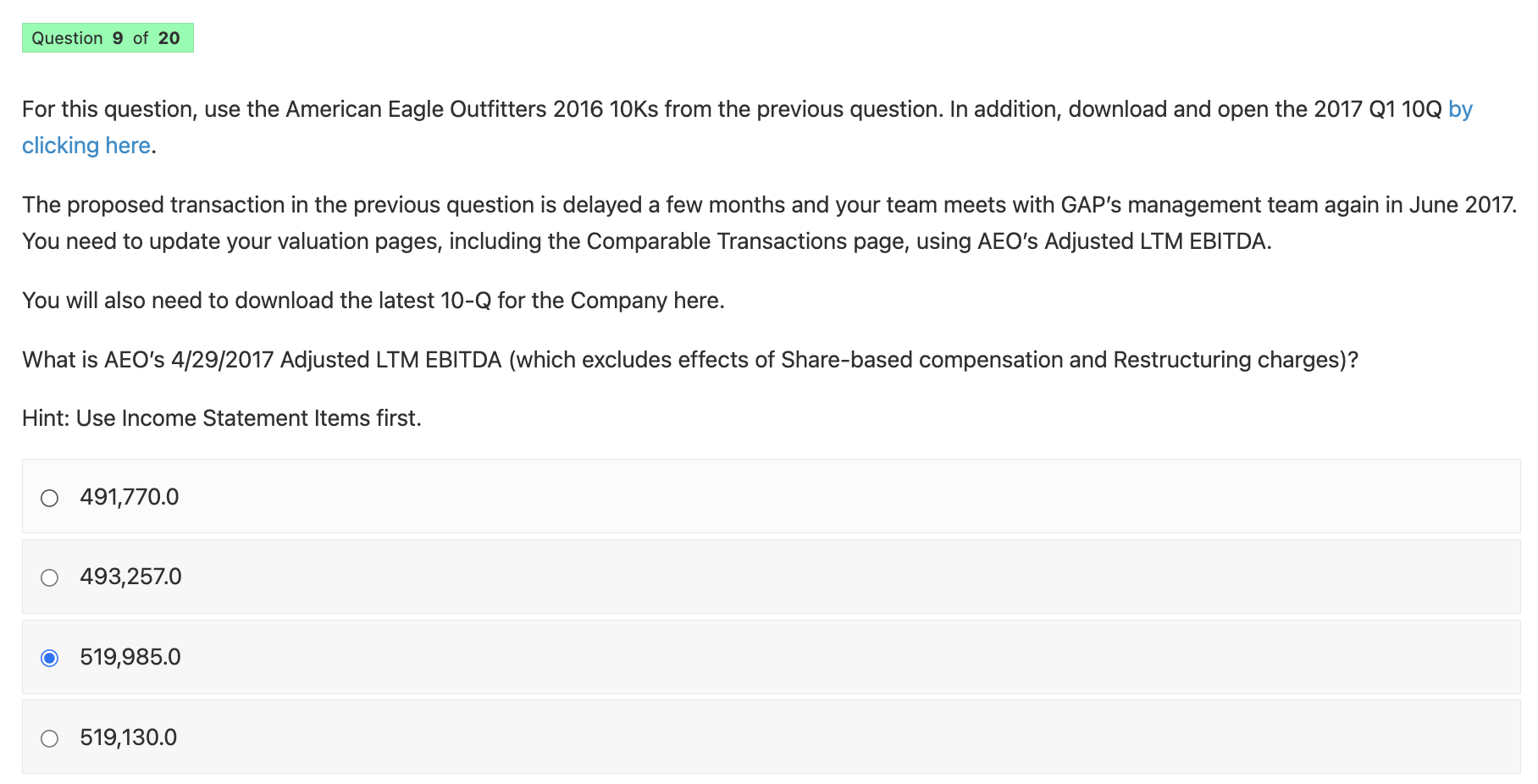

For this question, download and open the American Eagle Outfitters 201610Ks by clicking here. Along with the 10K, use the following data to answer this question: On April 28, 2017, one week ahead of your deal team's pitch to GAP's management, you are tasked with modeling the potential acquisition of American Eagle Outfitters (AEO) by GAP. You observe the following closing share prices for both companies and assume a purchase premium of 25%. You have been provided AEO's latest financials as of April 28, 2017. - Assume that all target restricted shares (time-based and performance-based) will vest upon the acquisition. - Assume that all "vested and expected-to-vest" options would vest upon the acquisition. - Assume options not expected to vest will not vest upon the acquisition. - Assume the "treasury stock method" for calculating dilution from options. In calculating the offer value, what is AEO's number of diluted shares? 182.2 million 182.5 million 184.5 million 187.0 million 187.3 million For this question, use the American Eagle Outfitters 2016 10Ks from the previous question. In addition, download and open the 2017 Q1 10Q by clicking here. The proposed transaction in the previous question is delayed a few months and your team meets with GAP's management team again in June 2017. You need to update your valuation pages, including the Comparable Transactions page, using AEO's Adjusted LTM EBITDA. You will also need to download the latest 10Q for the Company here. What is AEO's 4/29/2017 Adjusted LTM EBITDA (which excludes effects of Share-based compensation and Restructuring charges)? Hint: Use Income Statement Items first. 491,770.0 493,257.0 519,985.0 519,130.0

For this question, download and open the American Eagle Outfitters 201610Ks by clicking here. Along with the 10K, use the following data to answer this question: On April 28, 2017, one week ahead of your deal team's pitch to GAP's management, you are tasked with modeling the potential acquisition of American Eagle Outfitters (AEO) by GAP. You observe the following closing share prices for both companies and assume a purchase premium of 25%. You have been provided AEO's latest financials as of April 28, 2017. - Assume that all target restricted shares (time-based and performance-based) will vest upon the acquisition. - Assume that all "vested and expected-to-vest" options would vest upon the acquisition. - Assume options not expected to vest will not vest upon the acquisition. - Assume the "treasury stock method" for calculating dilution from options. In calculating the offer value, what is AEO's number of diluted shares? 182.2 million 182.5 million 184.5 million 187.0 million 187.3 million For this question, use the American Eagle Outfitters 2016 10Ks from the previous question. In addition, download and open the 2017 Q1 10Q by clicking here. The proposed transaction in the previous question is delayed a few months and your team meets with GAP's management team again in June 2017. You need to update your valuation pages, including the Comparable Transactions page, using AEO's Adjusted LTM EBITDA. You will also need to download the latest 10Q for the Company here. What is AEO's 4/29/2017 Adjusted LTM EBITDA (which excludes effects of Share-based compensation and Restructuring charges)? Hint: Use Income Statement Items first. 491,770.0 493,257.0 519,985.0 519,130.0 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started