pls help!

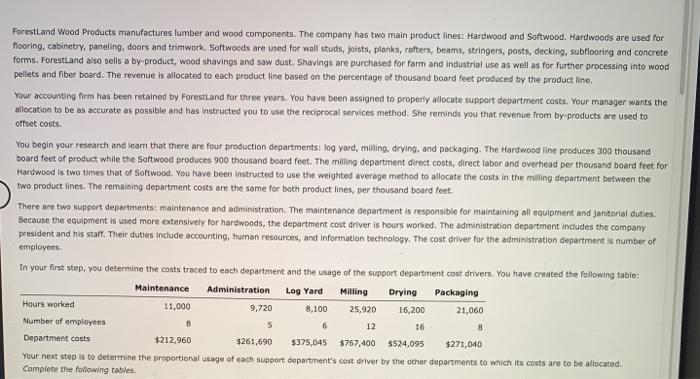

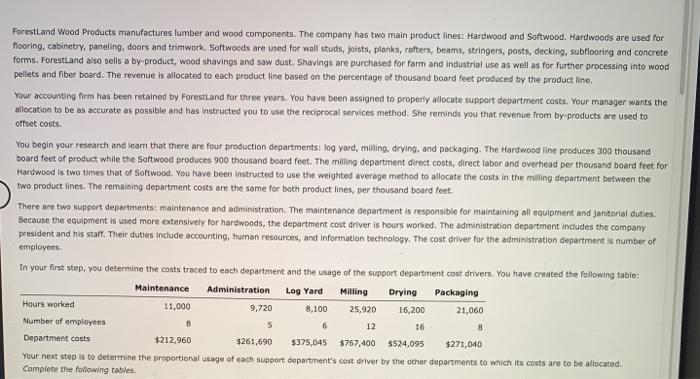

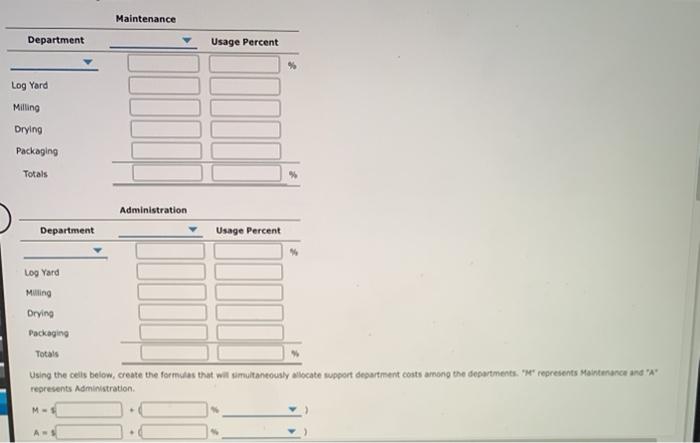

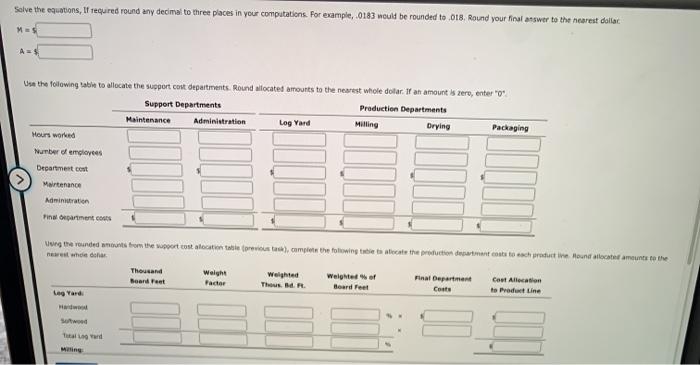

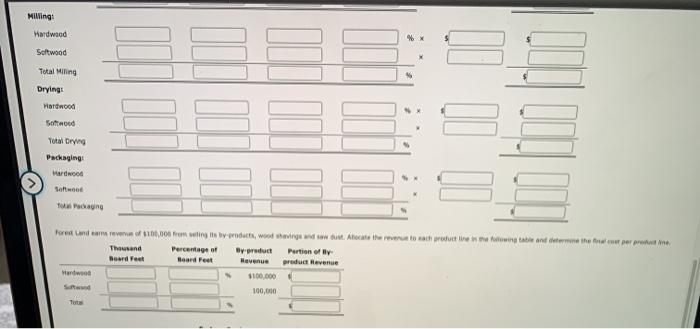

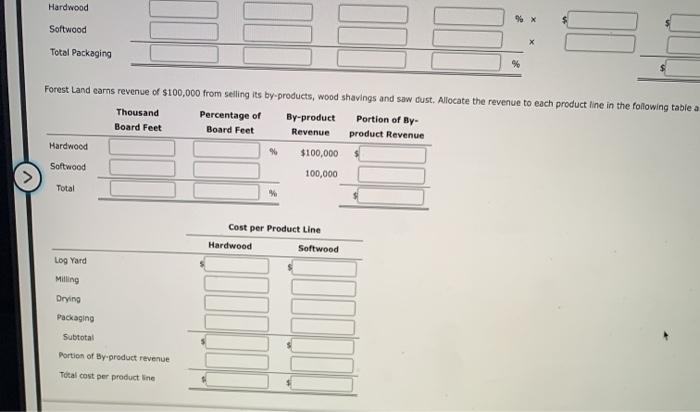

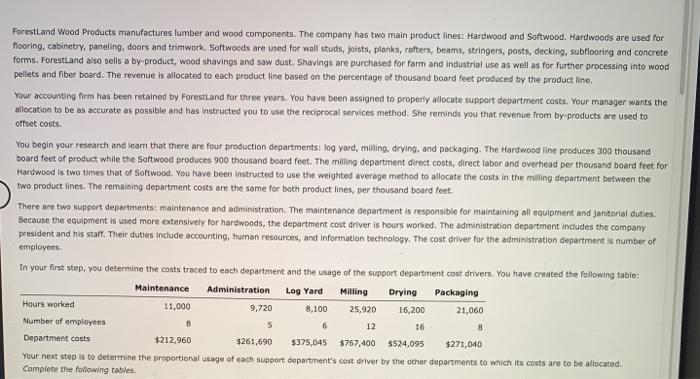

Forestland Wood Products manufactures lumber and wood components. The company has two main product lines: Hardwood and Softwood. Hardwoods are used for flooring, cabinetry, paneling, doors and trimwork. Softwoods are used for wall studs, joists, planks, rafters, beams, stringers, posts, decking, subflooring and concrete forms. Forestland also sells a by product, wood shavings and saw dust. Shavings are purchased for farm and industrial use as well as for further processing into wood pellets and fiber board. The revenue is allocated to each product line based on the percentage of thousand board feet produced by the product line. Your accounting firm has been retained by Forestland for three years. You have been assigned to properly allocate support department costs. Your manager wants the allocation to be as accurate as possible and has instructed you to use the reciprocal services method. She reminds you that revenue from by-products are used to offset costs. You begin your research and learn that there are four production departments: log yard, milling, drying, and packaging. The Hardwood line produces 300 thousand board feet of product while the Softwood produces 900 thousand board feet. The milling department direct costs, direct labor and overhead per thousand board feet for Hardwood is two times that of Softwood. You have been instructed to use the weighted average method to allocate the costs in the milling department between the two product lines. The remaining department costs are the same for both product lines, per thousand board feet. There are two support departments maintenance and administration. The maintenance department is responsible for maintaining all equipment and janitorial duties, Because the equipment is used more extensively for hardwoods, the department cost driver is hours worked. The administration department includes the company president and his staff. Their duties include accounting, human resources, and Information technology. The cost driver for the administration department is number of employees In your first step, you determine the costs traced to each department and the usage of the support department cost drivers. You have created the following table: Maintenance Administration Log Yard Milling Drying Packaging Hours worked 11,000 9,720 8,100 25,920 16,200 21,060 Number of employees 12 Department costs $212,960 $261,690 $375,045 $271,040 Your next step is to determine the proportional usage of each support department's cost driver by the other departments to which its costs are to be allocated Complete the following tables B 5 6 16 8 $757,400 $524,095 Maintenance Department Usage Percent Log Yard Milling Drying Packaging Totals Administration Department Usage Percent Log Yard Milling Drying Packaging Totals Using the cells below, create the formules that wil simultaneously locate wupport department costs among the departments. "He" represents Maintenance and "A" represents Administration M Selve the equations, If required round any decimal to three places in your computations. For example, 0183 would be rounded to 018. Round your final answer to the nearest dollar M Use the following table to allocate the support cost departments. Round located amounts to the nearest whole dollar. If an amount is zero, enter" Support Departments Production Departments Maintenance Administration Log Yard Milling Drying Packaging Hours world Number of employees Department cont Maintenance Administration Fineartment wwg the rounded wounts from the wpoort tot alocation table previous ), complete the following table to texto the production desartment costs to each production Hound allocated amounts to the who has Thousand Weight Weight of Final Department Cast Alication Board Feet Factor This BR Board Feet Costs to Product Line Lag Yard Milling: Mardwood Softwood Total Miling Drying: Hardwood Softwood IO Total Drying Packaging Marded Soft Padang forandriaen 100.000 from within 1 woducts, wood wing dowcu. Atecate the restoran promotion and determine in to evet per promotion, Thousand Percentage of By product Boardren Revenue product Revenue Mantwood Portion of Board Feet 1100.000 100,000 Hardwood Softwood Total Packaging Forest Land earns revenue of $100,000 from selling its by-products, wood shavings and saw dust. Allocate the revenue to each product line in the following table a Thousand Percentage of By-product Portion of By Board Feet Board Feet Revenue product Revenue Hardwood % $100,000 Softwood 100,000 Total Cost per Product Line Hardwood Softwood Log Yard Milling Drying Packaging Subtotal Portion of By.product revenue Total cost per product line