Answered step by step

Verified Expert Solution

Question

1 Approved Answer

pls help its okay u can forget about the first question SRI an outstanding of perpetual preferred to with vidend of $8.50 per share the

pls help

its okay u can forget about the first question

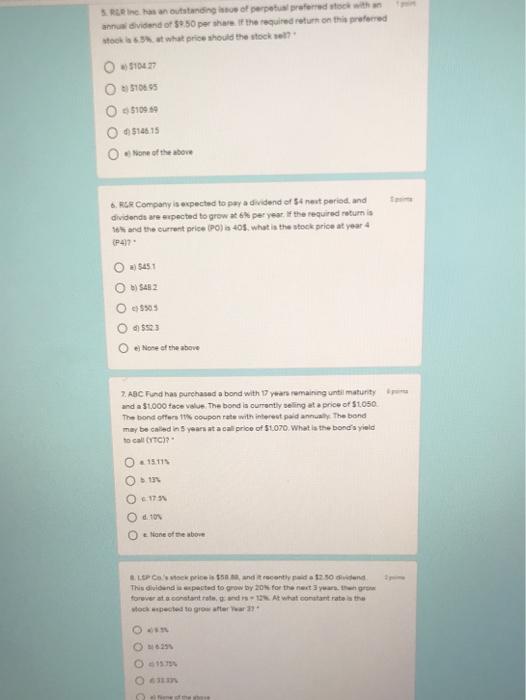

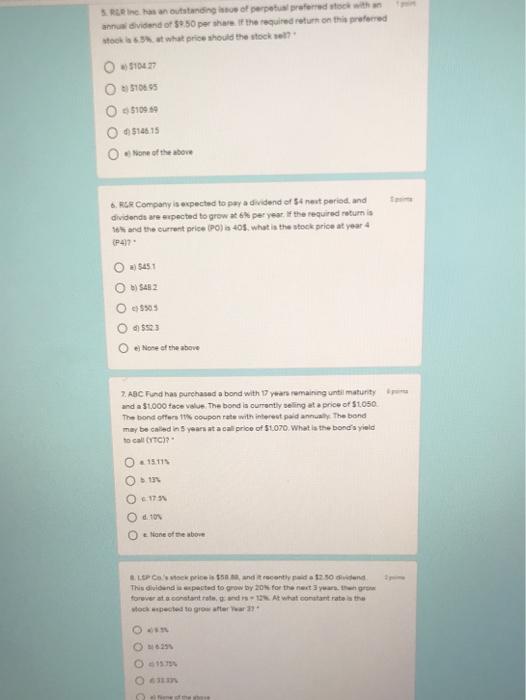

SRI an outstanding of perpetual preferred to with vidend of $8.50 per share the required return on this preferred wot what price should the stock el? 1042 510 5109 514515 None of the S. RR Company is expected to pay dividend of 4 nest period and dividende are expected to grow at per year the required return is to and the current price (PO) is 405, what is the stock price at your 4 (P42 15451 5505 O None of the above 7. ABC Fundas purchased a bond with 17 years remaining until maturity and a $1.000 face value. The bond is currently being at a price of $1050 The bond offers coupon rate with interest paid annually. The band may be called in 3 years at a cal price of $1070 What is the bond's yield to call 15111 175 None of the above La vock prices and recently pada 1250 This dividund a spected to grow by 200 for the next year. Then forverat constanta, At What constant to the ockspected to grow after war Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started