Answered step by step

Verified Expert Solution

Question

1 Approved Answer

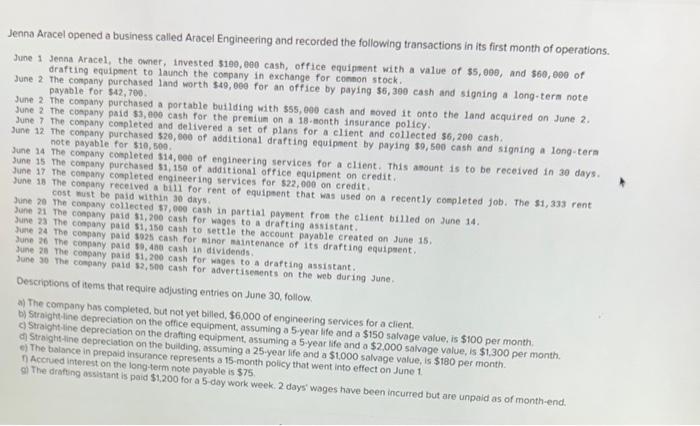

pls help Jenna Aracel opened a business called Aracel Engineering and recorded the following transactions in its first month of operations. June 1 Jeena Aracel,

pls help

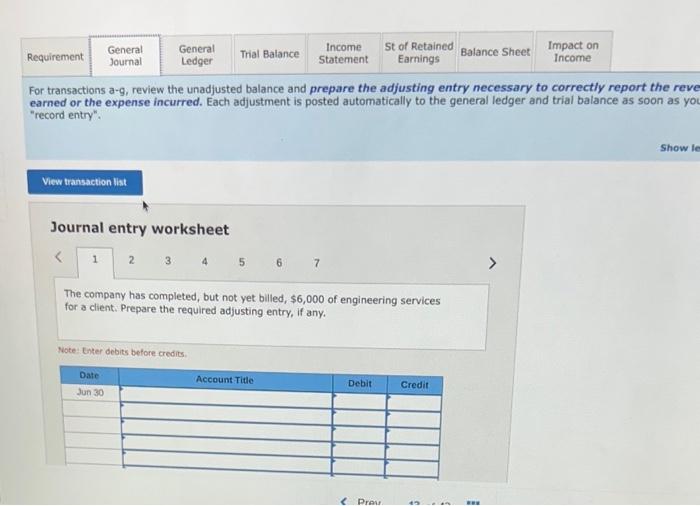

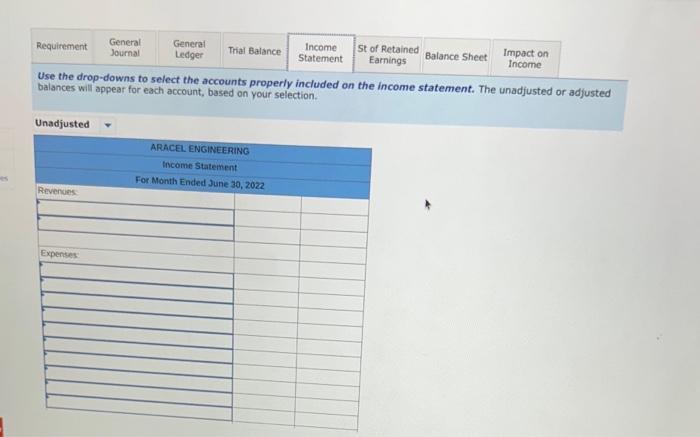

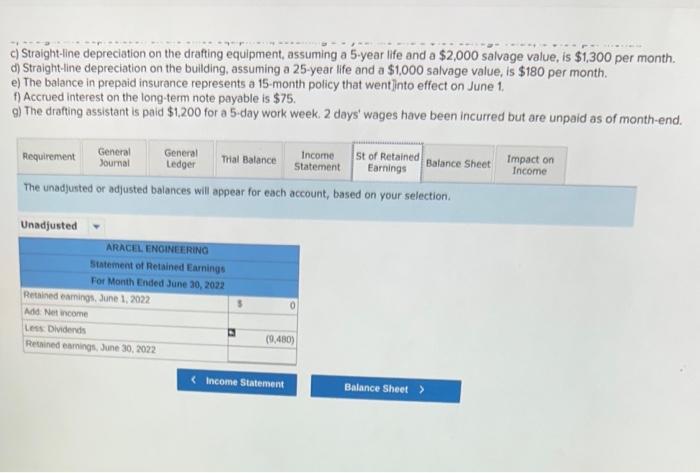

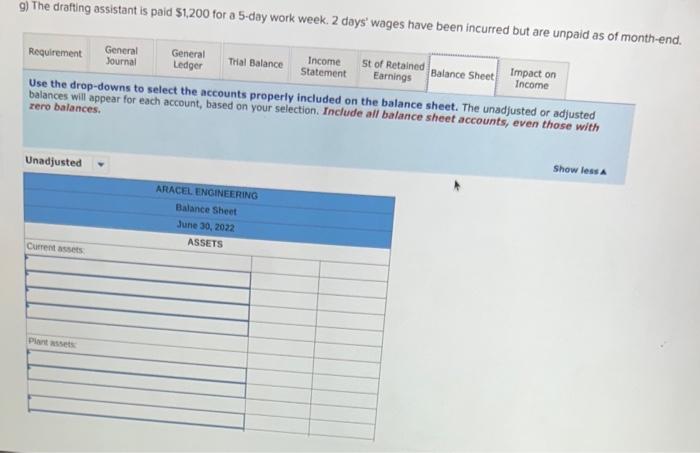

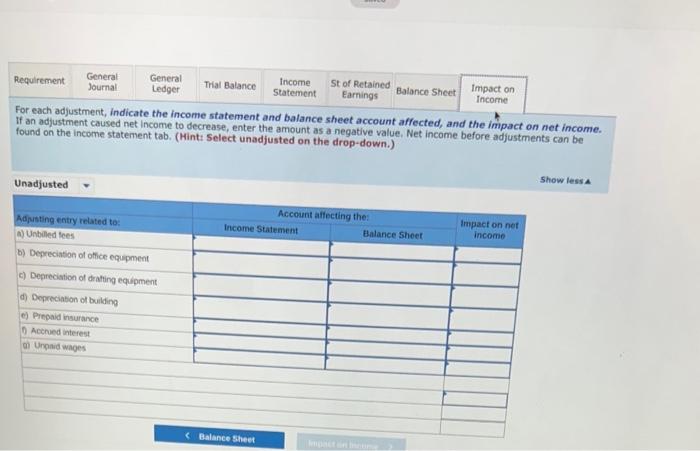

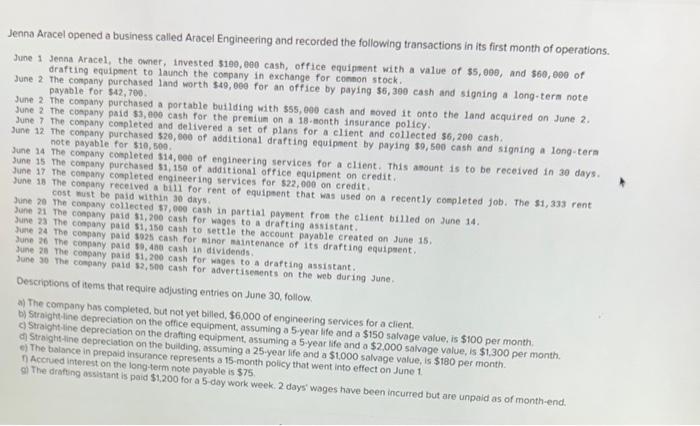

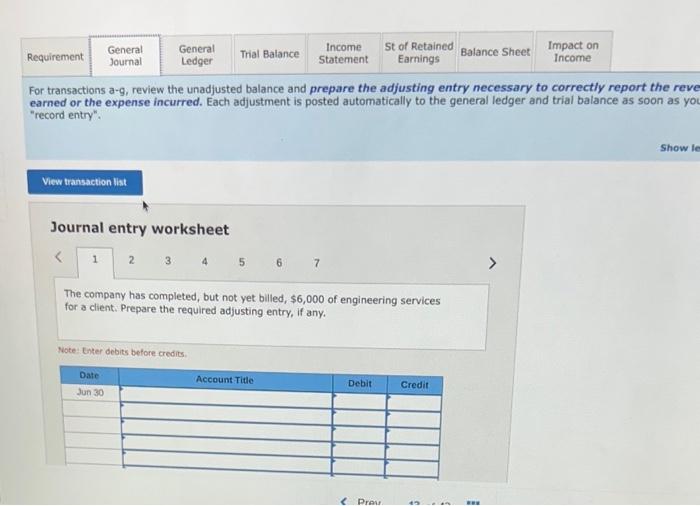

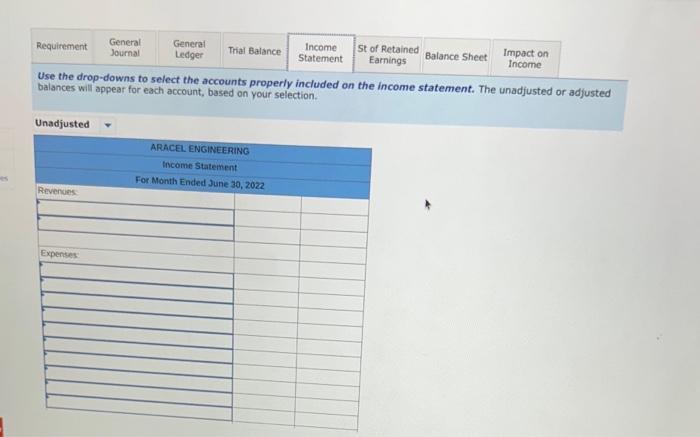

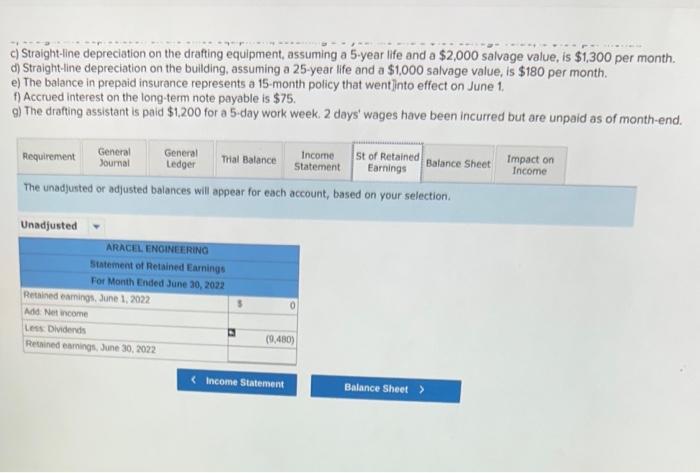

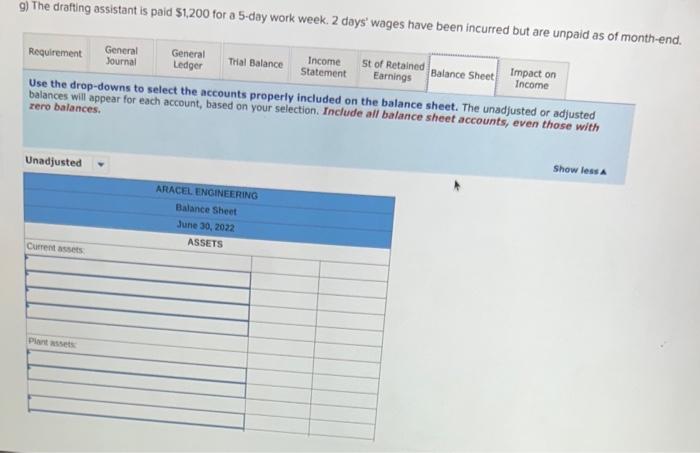

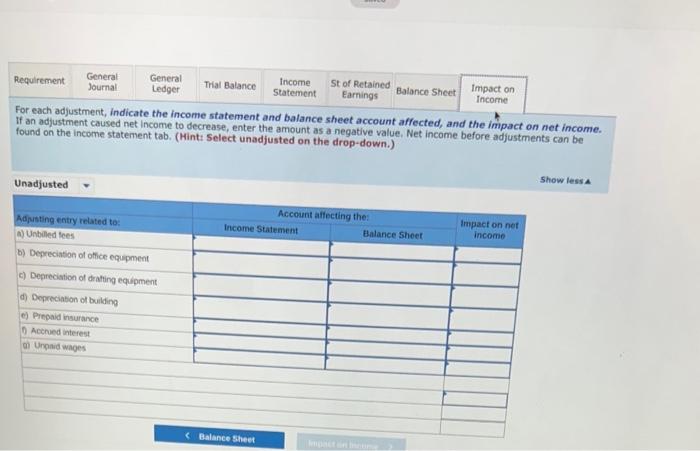

Jenna Aracel opened a business called Aracel Engineering and recorded the following transactions in its first month of operations. June 1 Jeena Aracel, the owner, invested $190,000cash, office equipeent with a value of $5,000, and $60,000 of drafting equipment to launch the conpany in exchange for conson stock. June 2 The conpany purchased land worth $49,900 for an office by paying $6,300 cash and signing a long-tera note payable for $42,700. June 2 The company purchased a portable building with $55,000 cash and noved it onto the land acquired on June 2. June 2. The coapany paid $3,000 cash for the presitie on a 18 -month insurance policy. June 7. The conpany conpleted and delivered a set of plans for a client and collected 56,20e cash. June 12 The conpany purchased $20,600 of additional drafting equipaent by paying $9,500 cash and signing a long-tera note payable for 510,500 . June 14 the coepany conpleted \$14, e0e of engineering services for a client. This asount is to be received in a0 days. sune 15 the company purchased s1, 150 of additional office equipnent on eredit. June 17 the conplany conpleted engineering services for 522,000 on credit. June 18 The conpary recelved a bili for rent of equipwent that was used on a recently completed job. The s1, 33s rent June 20 the conpany collected s7 as days: June 21 The conpany paid 31,200 cash fash in partial payment froe the client billed on June 14. June 23 the company patd $1,250 cash for wages to a drafting assistant. Jume 24 the coopany paid so2s cash for settle the account payable created on June 15. June 26 the coppany paid 59,40 ash far einer maintenance of its drafting equipsent, lune 20 the conpany pais 51,200 . eash in dividends. June 30 the company paid 52,500 cash for wages to a drafting assistant. for advertiscments on the web during June. the adjusting entries on June 30 , follow. b) Straight pany has completed, but not yet billed, $6,000 of engineering services for a client. c) Straight-line depreciation on the office equipment, assuming a 5 year life and a $150 salvage value, is $100 per month. di Straighteline depreciation on the builing equipment, assuming a 5 -year ife and a $2,000 salvage value, is $1,300 per month. e) The balance in prepoid insurance represents a 15 -month policy that went into salvage value, is $160 per month. 7) Accrued interest on the long-term note payable is $75 9) The drafting assistant is paid $1,200 for a 5 -day work week. 2 days' wages have been incurred but are unpald as of month.end. For transactions a-g, review the unadjusted balance and prepare the adjusting entry necessary to correctly report the rev earned or the expense incurred. Each adjustment is posted automatically to the general ledger and trial balance as soon as yo "record entry". Journal entry worksheet 234567 The company has completed, but not yet billed, $6,000 of engineering services for a client. Prepare the required adjusting entry, if any. Fote: Enter debits before credits. Use the drop-downs to select the accounts properly included on the income statement. The unadjusted or adjuste. balances will appear for each account, based on your selection. ) Straight-line depreciation on the drafting equipment, assuming a 5-year life and a $2,000 salvage value, is $1,300 per month. d) Straight-line depreciation on the bullding, assuming a 25 -year life and a $1,000 salvage value, is $180 per month. e) The balance in prepaid insurance represents a 15-month policy that went into effect on June 1 . f) Accrued interest on the long-term note payable is $75. 9) The drafting assistant is paid $1,200 for a 5 -day work week. 2 days' wages have been incurred but are unpaid as of month-end. The unadjusted or adjusted balances will appear for each account, based on your selection. 9) The drafting assistant is paid \$1,200 for a 5-day work week. 2 days' wages have been incurred but are unpaid as of month-end. Use the drop-downs to select the accounts properly included on the balance sheet. The unadjusted or adjusted balances will appear for each account, based on your selection. Include all balance sheet accounts, even those with For each adjustment, indicate the income statement and balance sheet account affected, and the impact on net income. If an adjustment caused net income to decrease, enter the amount as a negative value. Net income before adjustments can be found on the income statement tab. (Hint: Select unadjusted on the drop-down.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started