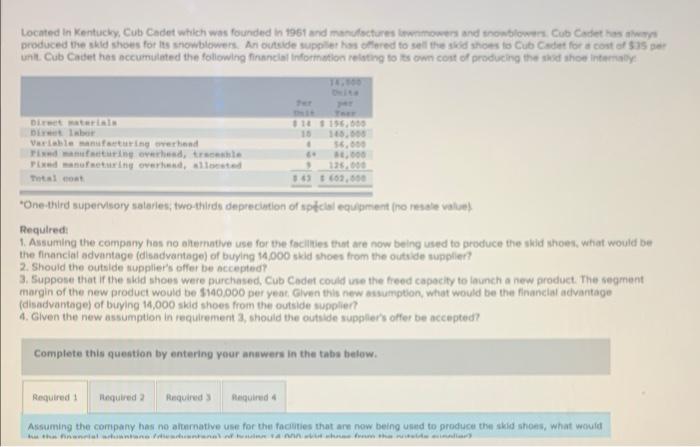

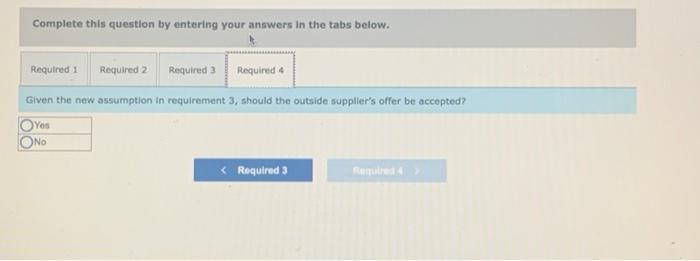

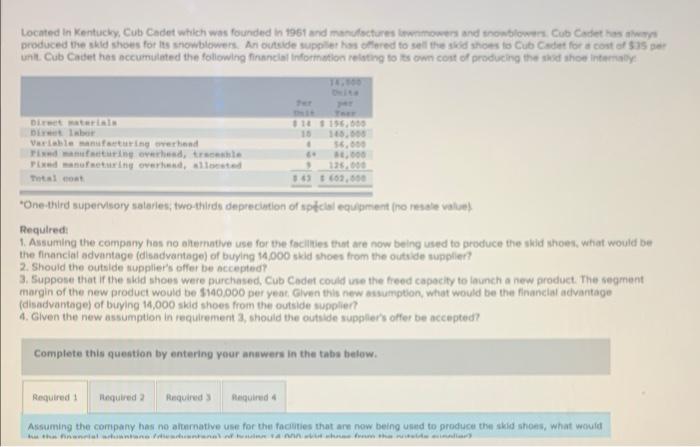

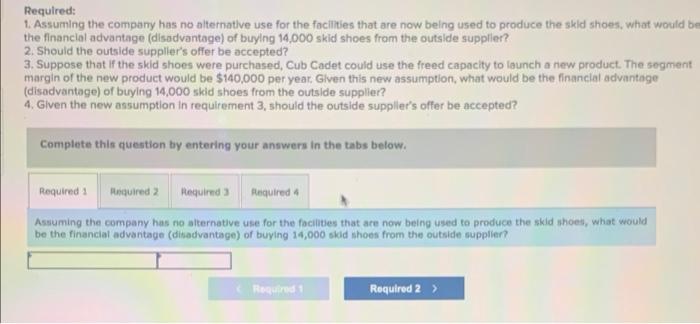

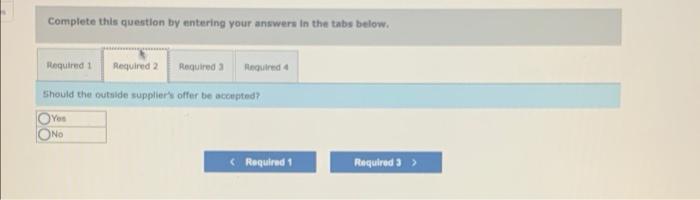

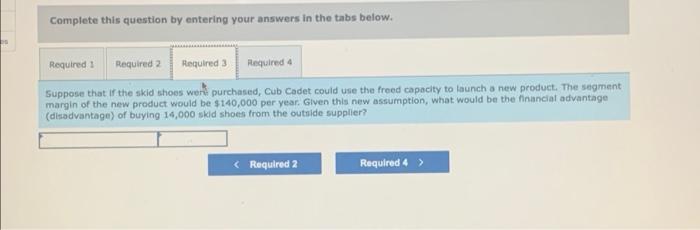

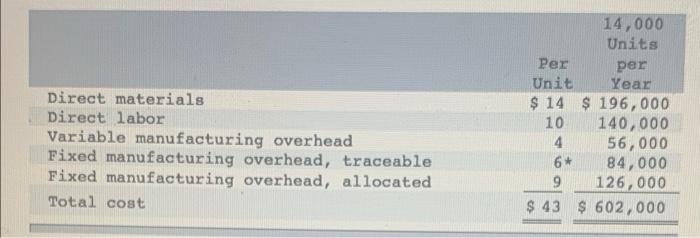

Located in Kentucky, Cub Cadet which was founded in 1961 and manufactures townmowers and trotowers Cute Cadet hos produced the skid shoes for its showblowers. An outside supplier has offered to sell these shoes to Cub Cadet for a cost of $35 unit. Cub Cadet has accumulated the following financial Information relating to own cost of producing the shoe Internal TE Diretta Dit Variable facturing overhead Peterhead, the xed manufacturing over, at Thatlat 145 156.15 15 165.000 . 56.600 108 125.000 63662.500 One-third supervisory stories, two-thode depreciation of special equipment (no resale value Required 1. Assuming the company res no aterrative use for the facilities that are now being used to produce the skid shoek. what would be the financial advantage disadvantage) of buying 14.000 skid shoes from the outside supplier? 2. Should the outside supplier's offer be accepted 3. Support that if the skid shows were purchased Cub Cadet could use the freed capacity to launch a new product. The segment margin of the new product would be $100.000 per year. Given this new assumption, what would be the financial advantage (disadvantage of buying 14,000 skid shoes from the outside supplier? 4. Given the new assumption in requirement should the outside supplier's offer be accepted? Complete this question by entering your answers in the tabs below. Required Required Required Required Assuming the company has no alternative use for the facilities that are now being used to produce the skid shoes, what would Required: 1. Assuming the company has no alternative use for the facilities that are now being used to produce the skid shoes, what would be the financial advantage (disadvantage) of buying 14,000 skid shoes from the outside supplier? 2. Should the outside supplier's offer be accepted? 3. Suppose that if the skid shoes were purchased, Cub Cadet could use the freed capacity to launch a new product. The segment margin of the new product would be $140,000 per year. Given this new assumption, what would be the financial advantage (disadvantage) of buying 14,000 skid shoes from the outside supplier? 4. Given the new assumption in requirement 3, should the outside suppler's offer be accepted? Complete this question by entering your answers in the tabs below. Required Aquired 2 Required 3 Aquired Assuming the company has no alternative use for the facilities that are now being used to produce the skid shoes, what would be the financial advantage (disadvantage) of buying 14,000 skid shoes from the outside supplier? Required Required 2 > Complete this question by entering your answers in the tabs below. Required Required 1 Required 2 Required Should the outside suppliers offer be compted? OY ONO (Required 1 Required 3 > Complete this question by entering your answers in the tabs below. Required: Required 2 Required 3 Required 4 Suppose that if the skid shoes went purchased, Cub Cadet could use the freed capacity to launch a new product. The segment margin of the new product would be $140,000 per year. Given this new assumption, what would be the financial advantage (disadvantage of buying 14,000 skid shoes from the outside supplier? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Given the new assumption in requirement 3, should the outside supplier's offer be accepted? Oros ONO