pls help me

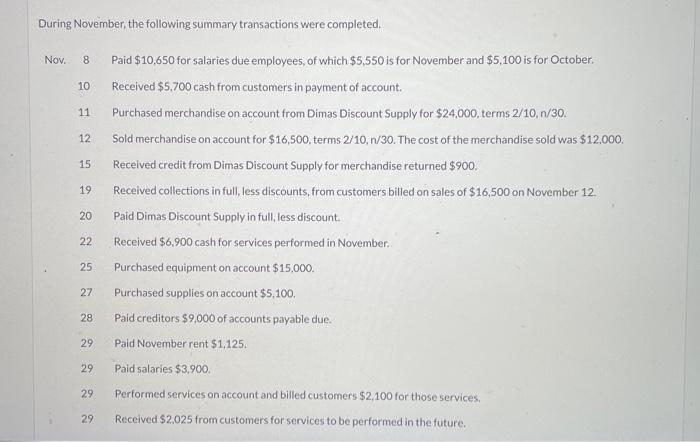

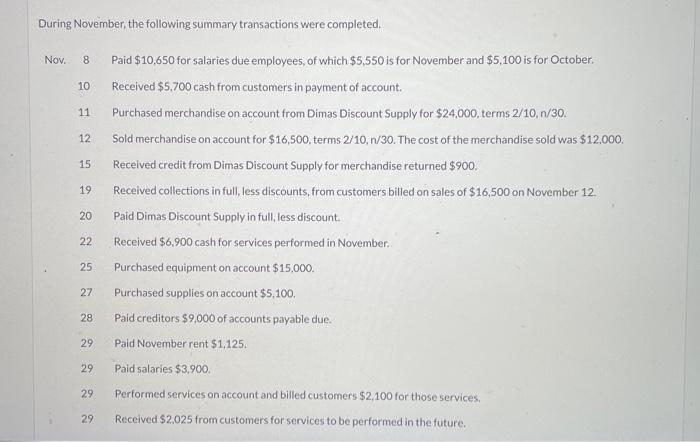

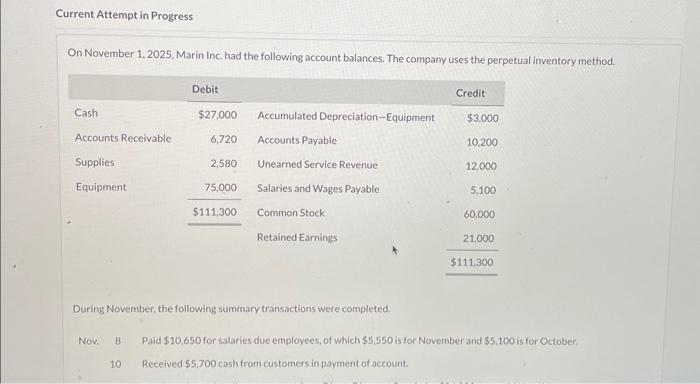

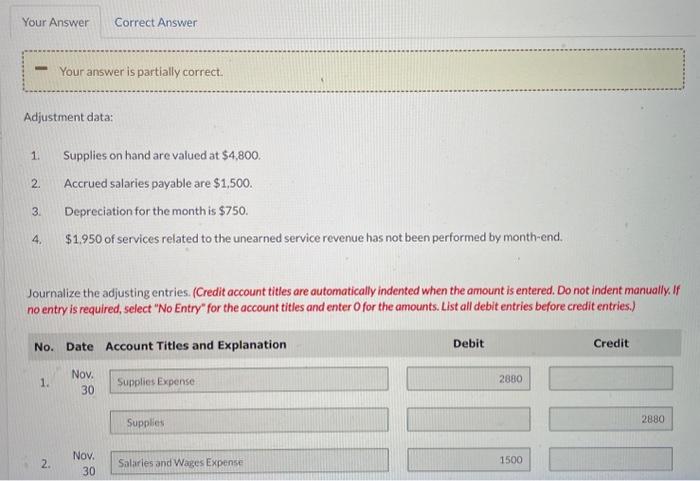

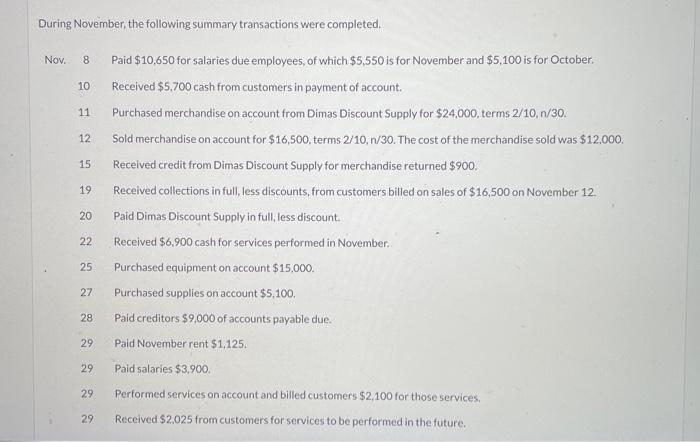

During November, the following summary transactions were completed. Nov, 8 Paid $10,650 for salaries due employees, of which $5,550 is for November and $5,100 is for October. 10 Received $5,700 cash from customers in payment of account. 11 Purchased merchandise on account from Dimas Discount Supply for $24,000, terms 2/10,n/30. 12. Sold merchandise on account for $16,500, terms 2/10,n/30. The cost of the merchandise sold was $12,000. 15 Received credit from Dimas Discount Supply for merchandise returned $900. 19 Received collections in full, less discounts, from customers billed on sales of $16,500 on November 12 20 Paid Dimas Discount Supply in full, less discount. 22. Received $6,900 cash for services performed in November. 25. Purchased equipment on account $15,000 27 Purchased supplies on account $5,100. 28 Paid creditors $9,000 of accounts payable due. 29 Paid November rent $1,125. 29 Paid salaries $3,900 29 Performed services on account and billed customers $2,100 for those services. 29 Received \$2.025 from customers for services to be performed in the future. Current Attempt in Progress On November 1, 2025. Marin Inc. had the following account balances. The company uses the perpetual inventory method. During November, the following summary transactions were completed. Nov. 8 Paid $10,650 for salaries due employees, of which $5,550 is tor November and $5,100 is for October. 10 Received $5.700 eash from customers in payment of account. Adjustment data: 1. Supplies on hand are valued at $4,800. 2. Accrued salaries payable are $1,500. 3. Depreciation for the month is $750. 4. $1,950 of services related to the unearned service revenue has not been performed by month-end. Journalize the adjusting entries. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) Adjustment data: 1. Supplies on hand are valued at $4,800. 2. Accrued salaries payable are $1,500. 3. Depreciation for the month is $750. 4. $1,950 of services related to the unearned service revenue has not been performed by month-end. Journalize the adjusting entries. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) MARIN Adjusted Trial Balance November 30,2025 Accounts Recelvable Imventory Supplies Equipment Accumulated Depreciation-Equipment Accounts Payable Unearned Service Revenue Salaries and Wages Payable Commen Stock Common Stock 60000 Retained Earnings 21000 Sales Revenue 16500 Service Revenue Sales Discounts Cost of Goods Sold \begin{tabular}{|} 12000 \\ \hline \end{tabular} Salaries and Wages Expense 10950 Rent Expense Depreciation Expense Supplies Expense Totals eTextbook and Media Retained Earnings 11/1Bal.21,000 Service Revenue \begin{tabular}{|l|ll|} \hline & 11/22 & 6,900 \\ \hline & & \\ \hline & 11/29 & 2,100 \\ \hline & 11/29 & 12075 \\ \hline & & \\ \hline \end{tabular} Depreciation Expense Supplies Expense Adj. 2880 Accounts Payable \begin{tabular}{lr|lr} \hline 11/15 & 900 & 11/1Bal & 10,200 \\ 11/20 & 23,100 & 11/11 & 24,000 \\ 11/28 & 9,000 & 11/25 & 15,000 \\ & & 11/27 & 5,100 \\ \hline & 11/30Bal. & 21,300 \end{tabular} Unearned Service Revenue \begin{tabular}{|l|lr|} \hline 12075 & 11/1Bal. & 12,000 \\ \hline & 11/29 & 2,025 \\ \hline & & 1950 \\ \hline & 11/30Bal: & \\ \hline & & \\ \hline \end{tabular} Salaries and Wages Payable 11/8 \begin{tabular}{|l|l|} \hline 5,100 & 11/1Bal \\ \hline 11/29 & 5,100 \\ \hline & 1500 \\ \hline 11/30Bal, & 1500 \\ \hline \end{tabular} Question 1 of 1 Salaries and Wages Expense \begin{tabular}{|l|l|} \hline 11/8 & 5,550 \\ 11/29 & 3,900 \\ \hline Adj & \\ \hline \end{tabular} Rent Expense 11/29 1,125 Sales Revenue 11/12 16,500 Cost of Goods Sold 11/12 12,000 Sales Discounts 11/19 330 PThparo a mulopie-step income statement ror November: ess 9: ross Profit Cost of Goods Sold loerating Expenses Salaries and Wages Expense Depreciatian Expente Supplies Expense Fent Expense fotal Operating Expenses it Incoine / (tois) eTextbook and Media Solution List of Accounts Prepare a retained earnings statement for November. eTextbook and Media List of Accounts Using multiple attempts will impact your score. 50% score reduction after attempt 1