Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLS HELP ME URGENT 4 UBFB3123 ISLAMIC BANKING Section A [Total: 40 marks] This section consists of ONE (1) COMPULSORY question. Q1. What the present-day

PLS HELP ME URGENT

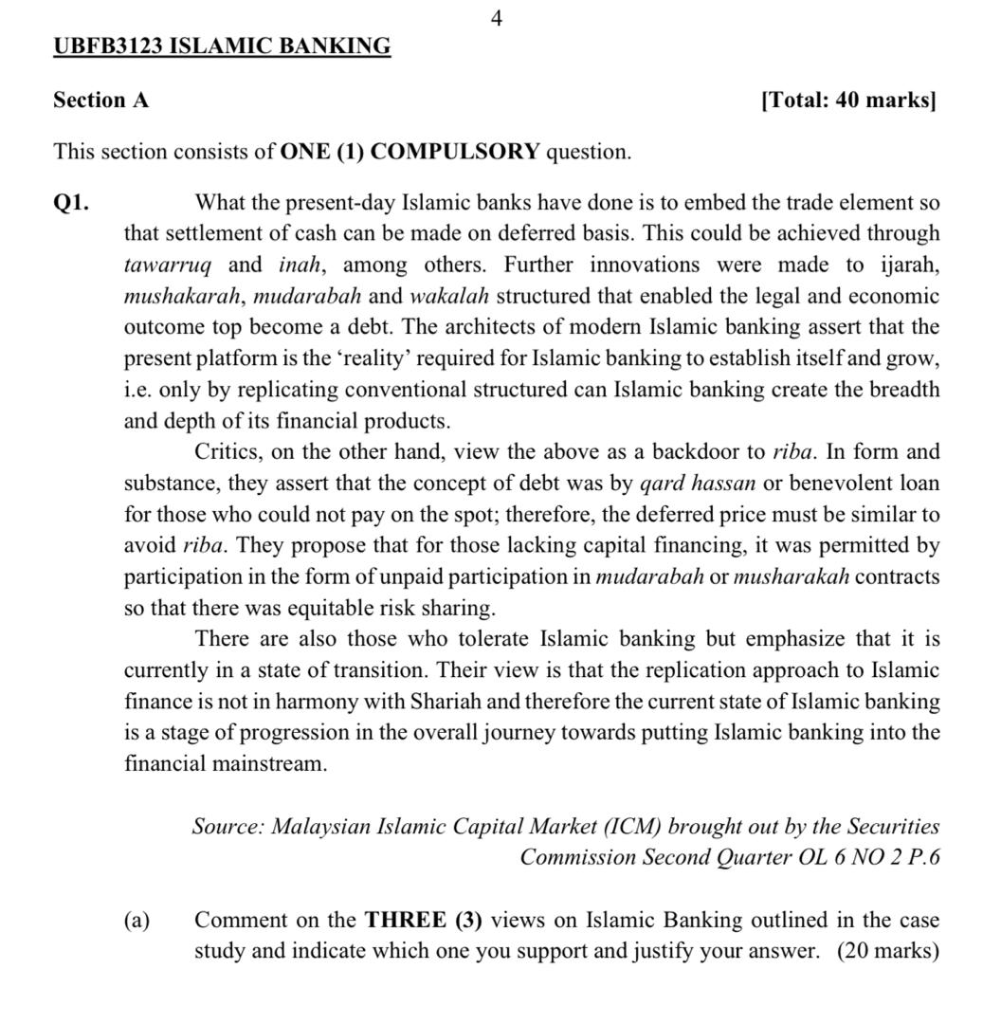

4 UBFB3123 ISLAMIC BANKING Section A [Total: 40 marks] This section consists of ONE (1) COMPULSORY question. Q1. What the present-day Islamic banks have done is to embed the trade element so that settlement of cash can be made on deferred basis. This could be achieved through tawarruq and inah, among others. Further innovations were made to ijarah, mushakarah, mudarabah and wakalah structured that enabled the legal and economic outcome top become a debt. The architects of modern Islamic banking assert that the present platform is the reality' required for Islamic banking to establish itself and grow, i.e. only by replicating conventional structured can Islamic banking create the breadth and depth of its financial products. Critics, on the other hand, view the above as a backdoor to riba. In form and substance, they assert that the concept of debt was by qard hassan or benevolent loan for those who could not pay on the spot; therefore, the deferred price must be similar to avoid riba. They propose that for those lacking capital financing, it was permitted by participation in the form of unpaid participation in mudarabah or musharakah contracts so that there was equitable risk sharing. There are also those who tolerate Islamic banking but emphasize that it is currently in a state of transition. Their view is that the replication approach to Islamic finance is not in harmony with Shariah and therefore the current state of Islamic banking is a stage of progression in the overall journey towards putting Islamic banking into the financial mainstream. Source: Malaysian Islamic Capital Market (ICM) brought out by the Securities Commission Second Quarter OL 6 NO 2 P.6 (a) Comment on the THREE (3) views on Islamic Banking outlined in the case study and indicate which one you support and justify your answer. (20 marks) 4 UBFB3123 ISLAMIC BANKING Section A [Total: 40 marks] This section consists of ONE (1) COMPULSORY question. Q1. What the present-day Islamic banks have done is to embed the trade element so that settlement of cash can be made on deferred basis. This could be achieved through tawarruq and inah, among others. Further innovations were made to ijarah, mushakarah, mudarabah and wakalah structured that enabled the legal and economic outcome top become a debt. The architects of modern Islamic banking assert that the present platform is the reality' required for Islamic banking to establish itself and grow, i.e. only by replicating conventional structured can Islamic banking create the breadth and depth of its financial products. Critics, on the other hand, view the above as a backdoor to riba. In form and substance, they assert that the concept of debt was by qard hassan or benevolent loan for those who could not pay on the spot; therefore, the deferred price must be similar to avoid riba. They propose that for those lacking capital financing, it was permitted by participation in the form of unpaid participation in mudarabah or musharakah contracts so that there was equitable risk sharing. There are also those who tolerate Islamic banking but emphasize that it is currently in a state of transition. Their view is that the replication approach to Islamic finance is not in harmony with Shariah and therefore the current state of Islamic banking is a stage of progression in the overall journey towards putting Islamic banking into the financial mainstream. Source: Malaysian Islamic Capital Market (ICM) brought out by the Securities Commission Second Quarter OL 6 NO 2 P.6 (a) Comment on the THREE (3) views on Islamic Banking outlined in the case study and indicate which one you support and justify your answer. (20 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started