Pls help me with a script for my reporting. (Taglish/ Tagalog with English script)

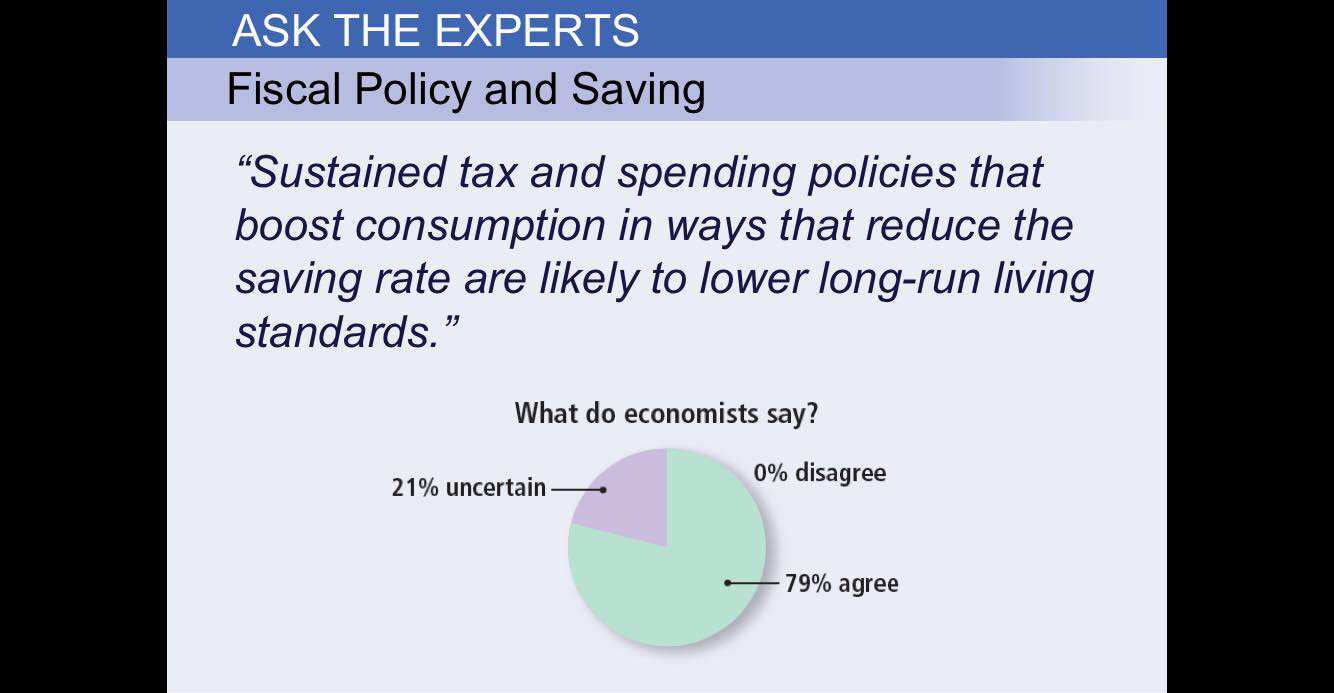

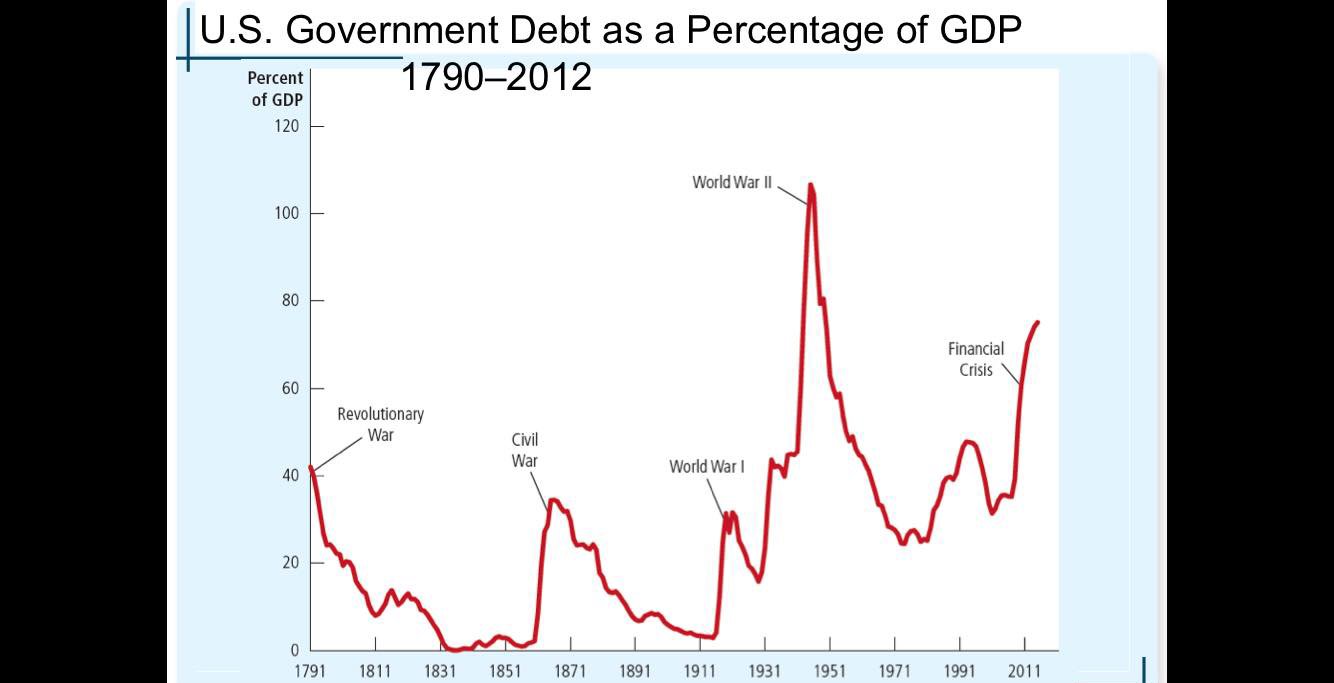

Budget Deficits, Crowding Out, _ _ ._ and Lon Run Growth - Our analysis: _ Increase in budget deficit causes fall in investment _ The government borrows to finance its deficit, leaving less funds available for investment: crowding out . Investment is important for long-run economic growth . Hence, budget deficits reduce the economy's growth rate and future standard of living. ASK THE EXPERTS \"Sustained tax and spending policies that boost consumption in ways that reduce the saving rate are likely to lower long-run living standards. \" What do economists say? 0% disagree )1 79% agree 21% uncertain __, The US. Government Debt __ . The government finances deficits by borrowing (selling government bonds). _ Persistent deficits lead to a rising government debt - The ratio of government debt to GDP Useful measure of the govemment's indebtedness relative to its ability to raise tax revenue. _ Historically, the debt-GDP ratio usually rises during wartime and falls during peacetimeuntil the early 1980s. U.S. Government Debt as a Percentage of GDP Percent 1790-2012 of GDP 120 World War II 100 80 Financial Crisis 60 Revolutionary War Civil War World War I 40 20 0 1791 1811 1831 1851 1871 1891 1911 1931 1951 1971 1991 2011Conclusion Markets are usually a good way to organize economic activity . Financial markets: governed by the forces of supply and demand _ Help allocate the economy's scarce resources to their most efficient uses. _ Link the present to the future - Savers: convert current income into future purchasing power - Borrowers: acquire capital to produce goods and services in the future Summary . The U.S. financial system is made up of many types of financial institutions, like the stock and bond markets, banks, and mutual funds. . National saving equals private saving plus public saving. . In a closed economy, national saving equals investment. The financial system makes this happen.Summary . The supply of loanable funds comes from saving. The demand for funds comes from investment. The interest rate adjusts to balance supply and demand in the loanable funds market. . A government budget deficit is negative public saving, so it reduces national saving, the supply of funds available to finance investment. . When a budget decit crowds out investment, it reduces the growth of productivity and GDP