pls help one this question

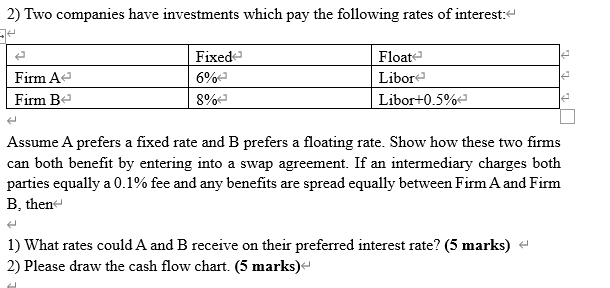

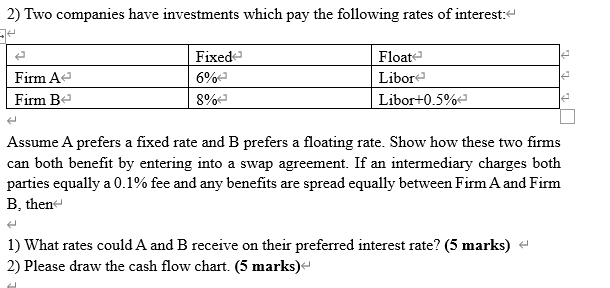

1) Background: Metallgesellschaft AG was formerly one of Germany's largest industrial conglomerates based in Frankfurt. It had over 20,000 employees and revenues in excess of 10 billion US dollars. It had over 250 subsidiaries specializing in mining specialty chemicals (Chemetall), commodity trading, financial services, and engineering (Lurgi). In 1993, the company lost 1.3 billion dollars suffering from flawed long hedge strategy in near term futures contracts that was meant to protect against forward sales commitments. A fall in spot prices forced margin calls for the company and the contracts were closed at a loss. Subsequently, the spot price increased and the company suffered even greater losses covering its customer commitments. It is debated whether the company was speculating after unwinding the long futures hedge since they became essentially exposed or naked against their forward customer Commitments. from Wikipedia [https://en.wikipedia.org/wiki/Metallgesellschaft] The following illustrates how important it is to consider tailing factor in taking a correct hedge strategy. Suppose the current spot price is $3. With 50 percent of the probability, the spot price will increase or decrease by 1 dollar for first year and then remain the same as shown in the graph below. Pu=0.5 SC 50=4 SO-3 SC S0=2 Pd=0.5 Please answer the following questions (a) If the annual discrete compounding risk-free rate is 10%, and the cost of carry offsets the convenience yield exactly, then the future price is equal to the spot price. Please explain. (2 marks) 2) Two companies have investments which pay the following rates of interest:- Firm A Firm Be Fixed 6% 8% Float Libor Libor+0.5% Assume A prefers a fixed rate and B prefers a floating rate. Show how these two firms can both benefit by entering into a swap agreement. If an intermediary charges both parties equally a 0.1% fee and any benefits are spread equally between Firm A and Firm B, then 1) What rates could A and B receive on their preferred interest rate? (5 marks) 2) Please draw the cash flow chart. (5 marks) 1) Background: Metallgesellschaft AG was formerly one of Germany's largest industrial conglomerates based in Frankfurt. It had over 20,000 employees and revenues in excess of 10 billion US dollars. It had over 250 subsidiaries specializing in mining specialty chemicals (Chemetall), commodity trading, financial services, and engineering (Lurgi). In 1993, the company lost 1.3 billion dollars suffering from flawed long hedge strategy in near term futures contracts that was meant to protect against forward sales commitments. A fall in spot prices forced margin calls for the company and the contracts were closed at a loss. Subsequently, the spot price increased and the company suffered even greater losses covering its customer commitments. It is debated whether the company was speculating after unwinding the long futures hedge since they became essentially exposed or naked against their forward customer Commitments. from Wikipedia [https://en.wikipedia.org/wiki/Metallgesellschaft] The following illustrates how important it is to consider tailing factor in taking a correct hedge strategy. Suppose the current spot price is $3. With 50 percent of the probability, the spot price will increase or decrease by 1 dollar for first year and then remain the same as shown in the graph below. Pu=0.5 SC 50=4 SO-3 SC S0=2 Pd=0.5 Please answer the following questions (a) If the annual discrete compounding risk-free rate is 10%, and the cost of carry offsets the convenience yield exactly, then the future price is equal to the spot price. Please explain. (2 marks) 2) Two companies have investments which pay the following rates of interest:- Firm A Firm Be Fixed 6% 8% Float Libor Libor+0.5% Assume A prefers a fixed rate and B prefers a floating rate. Show how these two firms can both benefit by entering into a swap agreement. If an intermediary charges both parties equally a 0.1% fee and any benefits are spread equally between Firm A and Firm B, then 1) What rates could A and B receive on their preferred interest rate? (5 marks) 2) Please draw the cash flow chart