pls help

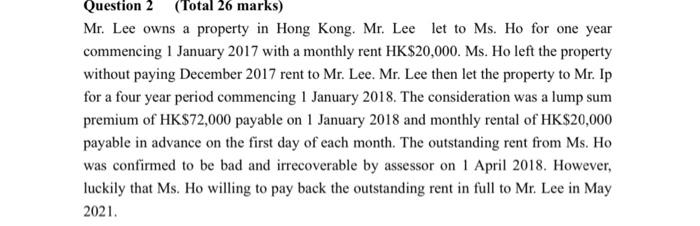

Required Compute the assessable value of the above property from the year of assessment 2017/18 to 2021/22 (Show your detailed calculations). (26 marks) Question 3 (Total 14 marks) Mr. Ng owns a flat in Hong Kong. He let on a two-year lease commencing on 1 June 2021 for a premium of HK$240,000, monthly rental of HK$20,000 and a monthly service fee of HK$1,500. Mr. Ng paid yearly rates of HK$5,500, government rent 3,500 and incurred HK$25,000 on essential repairs during March 2022 . The tenant has paid repairing fee HK$3,000 for Mr. Ng to repair the kitchen and Mr. Ng paid back HK$2,000 to the tenant. Required Compute the property tax payable for Mr. Ng for the year of assessment 2021/22. (Ignore rates concession and provisional tax) (14 marks) Mr. Lee owns a property in Hong Kong. Mr. Lee let to Ms. Ho for one year commencing 1 January 2017 with a monthly rent HK$20,000. Ms. Ho left the property without paying December 2017 rent to Mr. Lee. Mr. Lee then let the property to Mr. Ip for a four year period commencing 1 January 2018. The consideration was a lump sum premium of HK\$72,000 payable on 1 January 2018 and monthly rental of HK\$20,000 payable in advance on the first day of each month. The outstanding rent from Ms. Ho was confirmed to be bad and irrecoverable by assessor on 1 April 2018. However, luckily that Ms. Ho willing to pay back the outstanding rent in full to Mr. Lee in May 2021. Required Compute the assessable value of the above property from the year of assessment 2017/18 to 2021/22 (Show your detailed calculations). (26 marks) Question 3 (Total 14 marks) Mr. Ng owns a flat in Hong Kong. He let on a two-year lease commencing on 1 June 2021 for a premium of HK$240,000, monthly rental of HK$20,000 and a monthly service fee of HK$1,500. Mr. Ng paid yearly rates of HK$5,500, government rent 3,500 and incurred HK$25,000 on essential repairs during March 2022 . The tenant has paid repairing fee HK$3,000 for Mr. Ng to repair the kitchen and Mr. Ng paid back HK$2,000 to the tenant. Required Compute the property tax payable for Mr. Ng for the year of assessment 2021/22. (Ignore rates concession and provisional tax) (14 marks) Mr. Lee owns a property in Hong Kong. Mr. Lee let to Ms. Ho for one year commencing 1 January 2017 with a monthly rent HK$20,000. Ms. Ho left the property without paying December 2017 rent to Mr. Lee. Mr. Lee then let the property to Mr. Ip for a four year period commencing 1 January 2018. The consideration was a lump sum premium of HK\$72,000 payable on 1 January 2018 and monthly rental of HK\$20,000 payable in advance on the first day of each month. The outstanding rent from Ms. Ho was confirmed to be bad and irrecoverable by assessor on 1 April 2018. However, luckily that Ms. Ho willing to pay back the outstanding rent in full to Mr. Lee in May 2021