Answered step by step

Verified Expert Solution

Question

1 Approved Answer

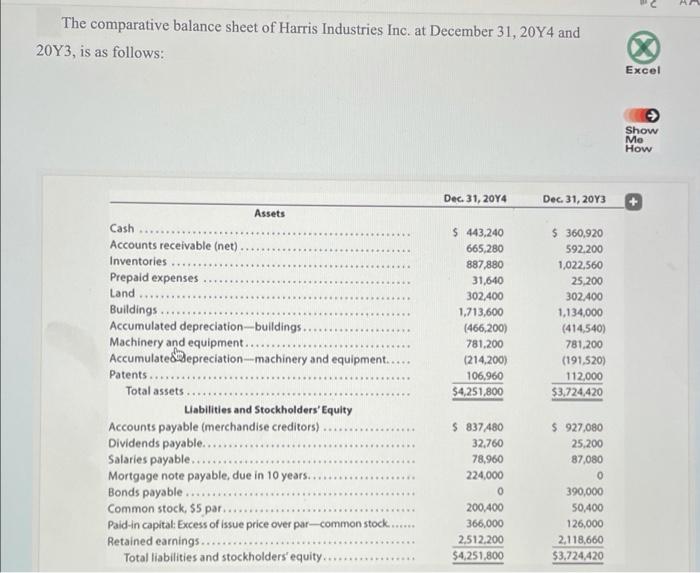

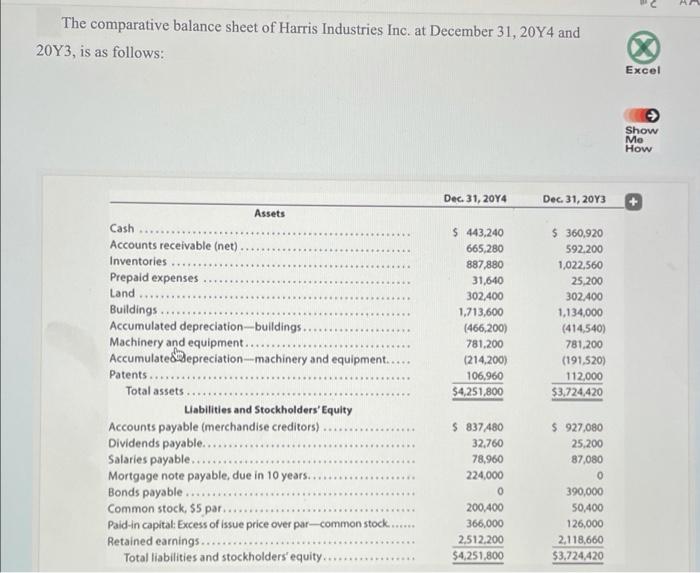

pls help ): The comparative balance sheet of Harris Industries Inc. at December 31, 20Y4 and 20Y3, is as follows: Dec. 31, 2014 Dec. 31,

pls help ):

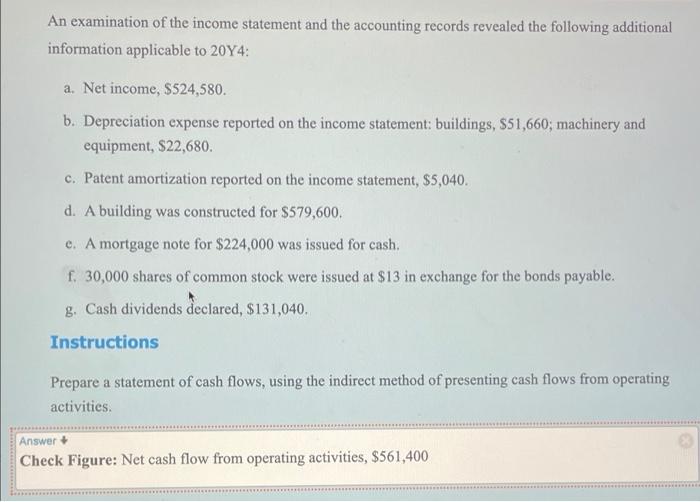

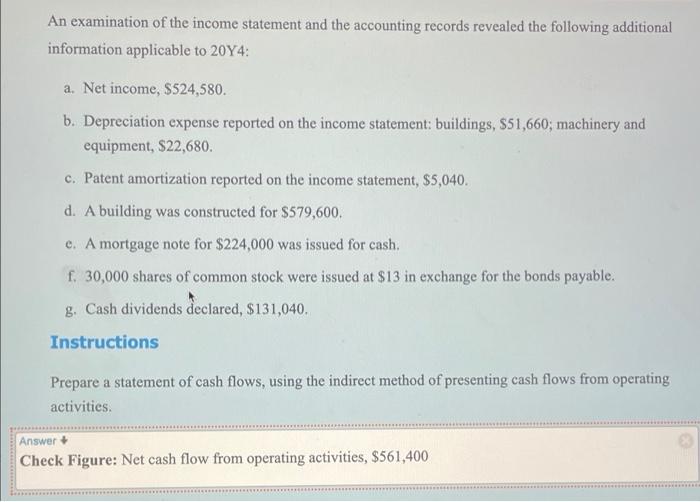

The comparative balance sheet of Harris Industries Inc. at December 31, 20Y4 and 20Y3, is as follows: Dec. 31, 2014 Dec. 31, 2013 Assets Cash ******** $ 443,240 $360,920 Accounts receivable (net) 665,280 592.200 Inventories 887,880 1,022,560 Prepaid expenses.... 31,640 25,200 Land **************** 302,400 302,400 Buildings 1,713,600 1,134,000 Accumulated depreciation-buildings. (466,200) (414,540) Machinery and equipment.. 781,200 781,200 Accumulated depreciation-machinery and equipment..... (214,200) (191,520) Patents. 106,960 112,000 Total assets. $4,251,800 $3,724,420 Liabilities and Stockholders' Equity Accounts payable (merchandise creditors) $ 837,480 $ 927,080 Dividends payable...... 32,760 25,200 Salaries payable.. 78,960 87,080 Mortgage note payable, due in 10 years. 224,000 0 0 Bonds payable. 390,000 Common stock, $5 par... 200,400 50,400 366,000 Paid-in capital: Excess of issue price over par-common stock. 126,000 Retained earnings....... 2,512,200 2,118,660 Total liabilities and stockholders' equity.. $4,251,800 $3,724,420 Excel Show Me How 2 An examination of the income statement and the accounting records revealed the following additional information applicable to 20Y4: a. Net income, $524,580. b. Depreciation expense reported on the income statement: buildings, $51,660; machinery and equipment, $22,680. c. Patent amortization reported on the income statement, $5,040. d. A building was constructed for $579,600. e. A mortgage note for $224,000 was issued for cash. f. 30,000 shares of common stock were issued at $13 in exchange for the bonds payable. g. Cash dividends declared, $131,040. Instructions Prepare a statement of cash flows, using the indirect method of presenting cash flows from operating activities. Answer + Check Figure: Net cash flow from operating activities, $561,400

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started