pls hlp me in question c

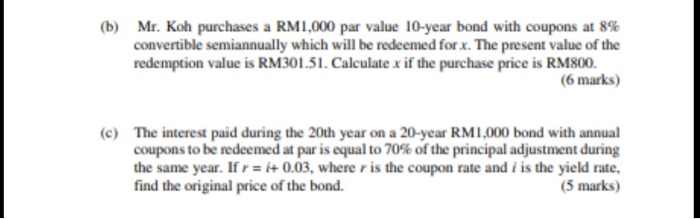

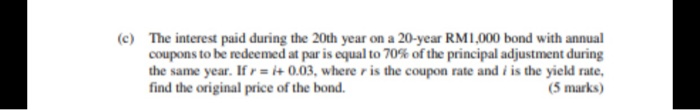

(b) Mr. Koh purchases a RM1,000 par value 10-year bond with coupons at 8% convertible semiannually which will be redeemed for x. The present value of the redemption value is RM301.51. Calculate x if the purchase price is RM800. (6 marks) (c) The interest paid during the 20th year on a 20-year RM1,000 bond with annual coupons to be redeemed at par is equal to 70% of the principal adjustment during the same year. If r = i+ 0.03, where r is the coupon rate and is the yield rate, find the original price of the bond. (5 marks) (c) The interest paid during the 20th year on a 20-year RM1,000 bond with annual coupons to be redeemed at par is equal to 70% of the principal adjustment during the same year. If r = i+ 0.03, wherer is the coupon rate and is the yield rate, find the original price of the bond. (5 marks) (c) The interest paid during the 20th year on a 20-year RM1,000 bond with annual coupons to be redeemed at par is equal to 70% of the principal adjustment during the same year. If r = i+ 0.03, wherer is the coupon rate and is the yield rate, find the original price of the bond. (5 marks) (b) Mr. Koh purchases a RM1,000 par value 10-year bond with coupons at 8% convertible semiannually which will be redeemed for x. The present value of the redemption value is RM301.51. Calculate x if the purchase price is RM800. (6 marks) (c) The interest paid during the 20th year on a 20-year RM1,000 bond with annual coupons to be redeemed at par is equal to 70% of the principal adjustment during the same year. If r = i+ 0.03, where r is the coupon rate and is the yield rate, find the original price of the bond. (5 marks) (c) The interest paid during the 20th year on a 20-year RM1,000 bond with annual coupons to be redeemed at par is equal to 70% of the principal adjustment during the same year. If r = i+ 0.03, wherer is the coupon rate and is the yield rate, find the original price of the bond. (5 marks) (c) The interest paid during the 20th year on a 20-year RM1,000 bond with annual coupons to be redeemed at par is equal to 70% of the principal adjustment during the same year. If r = i+ 0.03, wherer is the coupon rate and is the yield rate, find the original price of the bond