Answered step by step

Verified Expert Solution

Question

1 Approved Answer

pls i need answers within 15 min thankyou 1 pts Question 9 Company A broke construction on a 5-storey building in the beginning of July,

pls i need answers within 15 min thankyou

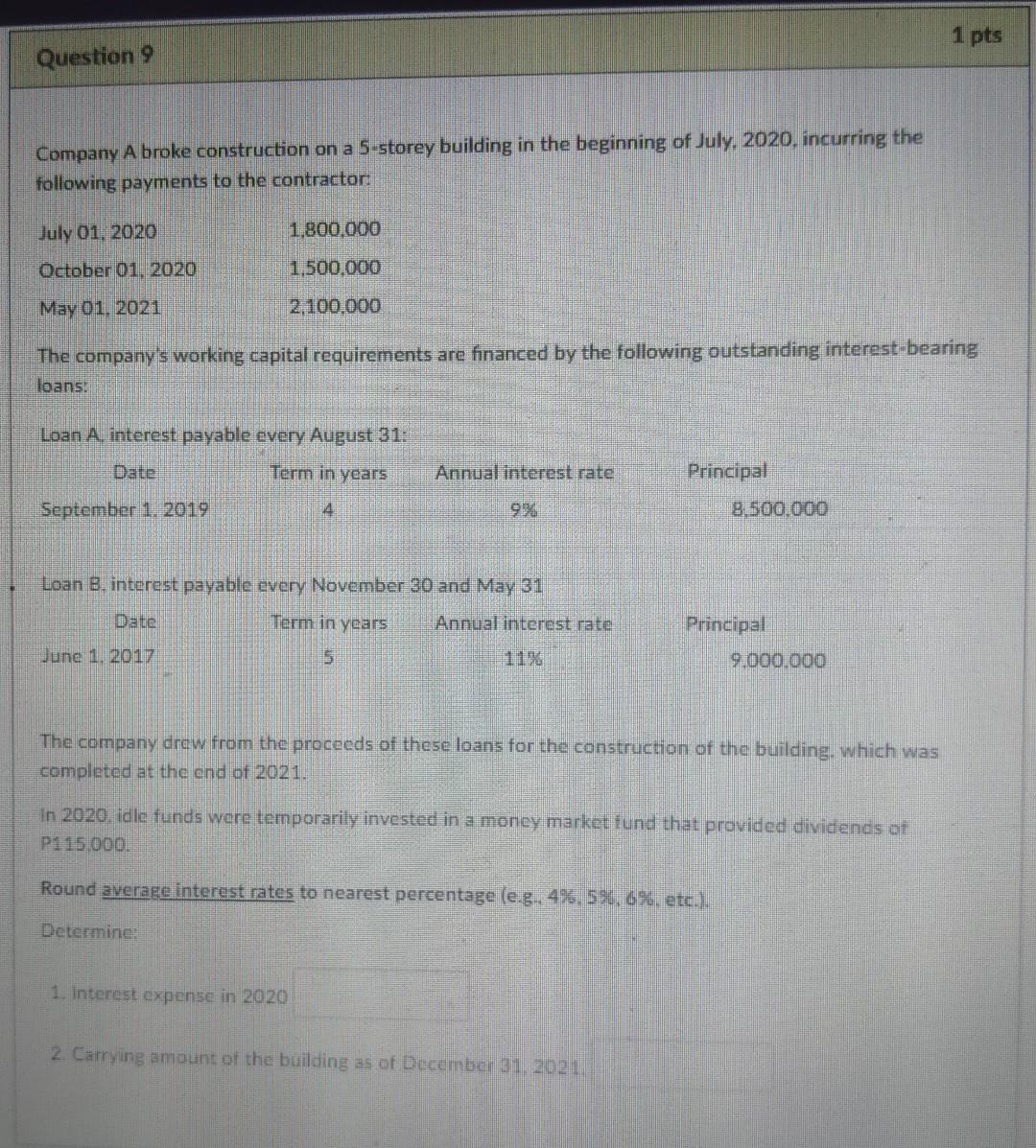

1 pts Question 9 Company A broke construction on a 5-storey building in the beginning of July, 2020, incurring the following payments to the contractor July 01, 2020 1.800.000 October 01, 2020 1.500.000 May 01, 2021 2,100,000 The company's working capital requirements are financed by the following outstanding interest-bearing loans. Loan A, interest payable every August 31: Date Term in years Annual interest rate Principal September 1, 2019 4 9.500.000 Loan B. interest payable every November 30 and May 31 Date Term in years Annual interest rate Principal June 1, 2017 5 9.000.000 The company drew from the proceeds of these loans for the construction of the building, which was completed at the end of 2021. In 2020. idle funds were temporarily invested in a money market tund that provided dividends at Pir 15.000 Round average interest rates to nearest percentage (e.g., 4% 5%, 6%, etc.). Determine: 1. Interest expense in 2020 2. Carrying amount of the building as of December 31, 2021Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started