Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Pls I need to answer to all the questions 1. Your bank offers a savings account that pays 3.5% interest, compounded annually. How much will

Pls I need to answer to all the questions

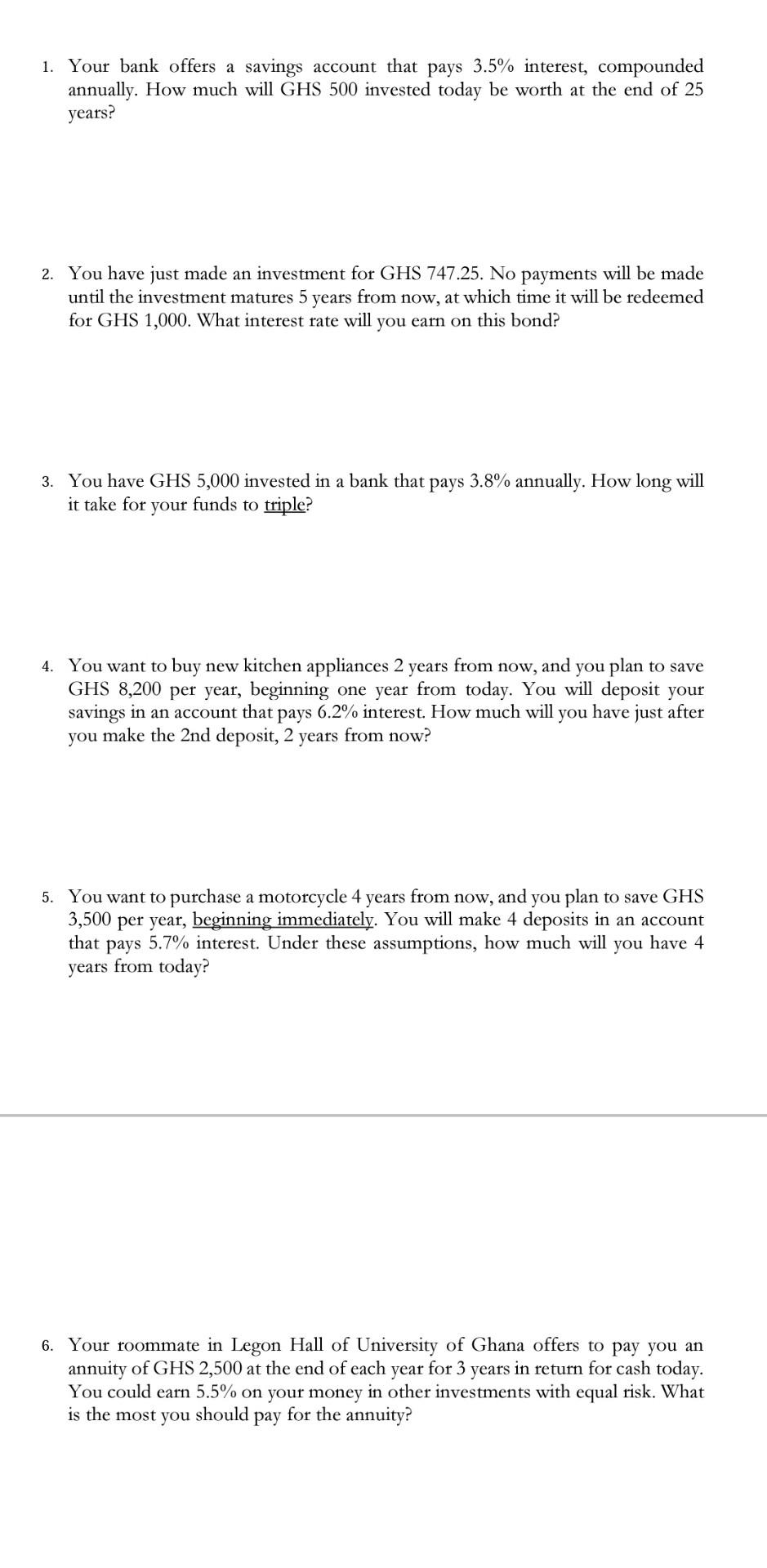

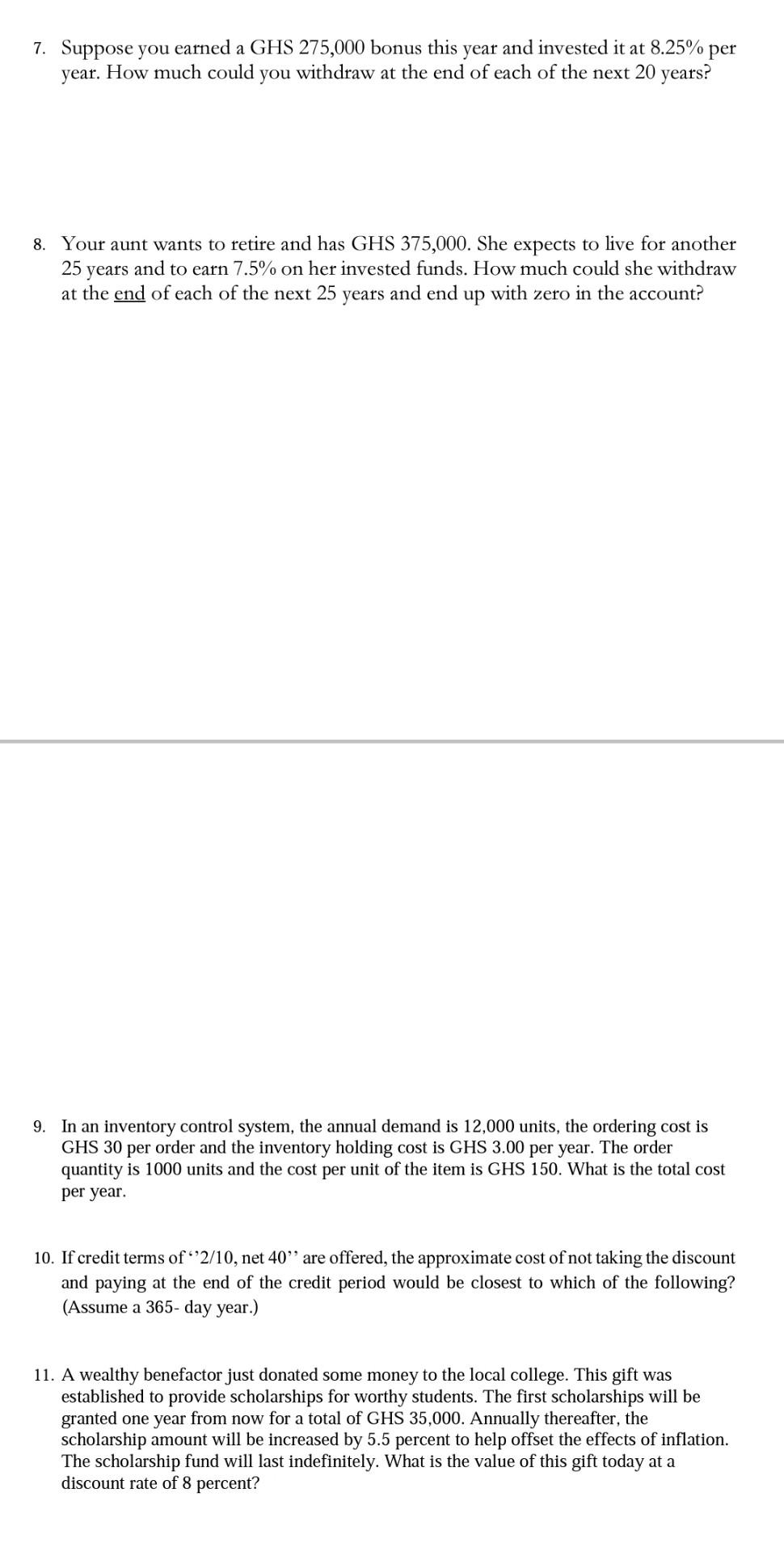

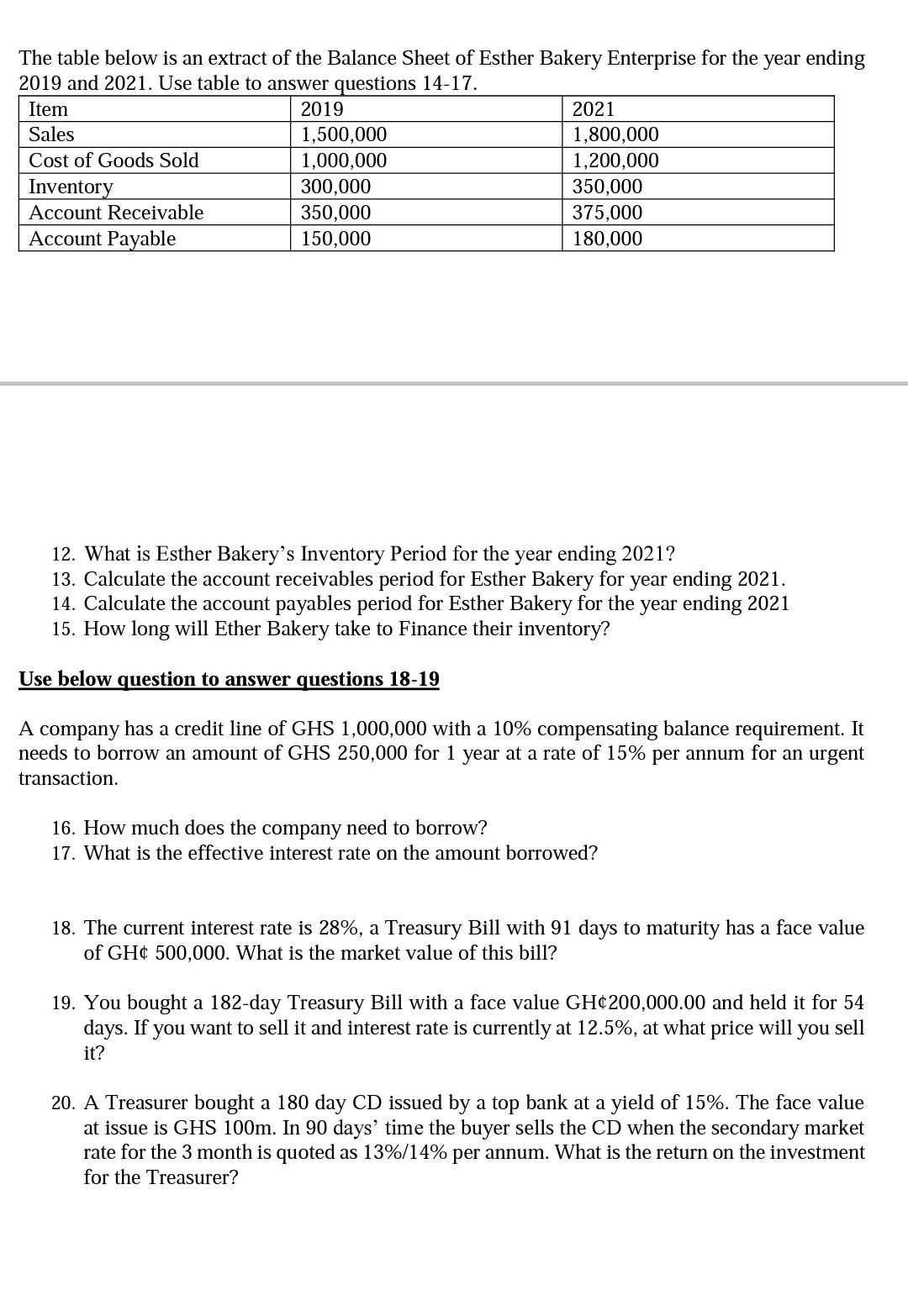

1. Your bank offers a savings account that pays 3.5% interest, compounded annually. How much will GHS 500 invested today be worth at the end of 25 years? 2. You have just made an investment for GHS 747.25. No payments will be made until the investment matures 5 years from now, at which time it will be redeemed for GHS 1,000. What interest rate will you earn on this bond? 3. You have GHS 5,000 invested in a bank that pays 3.8% annually. How long will it take for your funds to triple? 4. You want to buy new kitchen appliances 2 years from now, and you plan to save GHS 8,200 per year, beginning one year from today. You will deposit your savings in an account that pays 6.2% interest. How much will you have just after you make the 2nd deposit, 2 years from now? 5. You want to purchase a motorcycle 4 years from now, and you plan to save GHS 3,500 per year, beginning immediately. You will make 4 deposits in an account that pays 5.7% interest. Under these assumptions, how much will you have 4 years from today? 6. Your roommate in Legon Hall of University of Ghana offers to pay you an annuity of GHS 2,500 at the end of each year for 3 years in return for cash today. You could earn 5.5% on your money in other investments with equal risk. What is the most you should pay for the annuity? 7. Suppose you earned a GHS 275,000 bonus this year and invested it at 8.25% per year. How much could you withdraw at the end of each of the next 20 years? 8. Your aunt wants to retire and has GHS 375,000. She expects to live for another 25 years and to earn 7.5% on her invested funds. How much could she withdraw at the end of each of the next 25 years and end up with zero in the account? 9. In an inventory control system, the annual demand is 12,000 units, the ordering cost is GHS 30 per order and the inventory holding cost is GHS 3.00 per year. The order quantity is 1000 units and the cost per unit of the item is GHS 150. What is the total cost per year. 10. If credit terms of 2/10, net 40 are offered, the approximate cost of not taking the discount and paying at the end of the credit period would be closest to which of the following? (Assume a 365- day year.) 11. A wealthy benefactor just donated some money to the local college. This gift was established to provide scholarships for worthy students. The first scholarships will be granted one year from now for a total of GHS 35,000. Annually thereafter, the scholarship amount will be increased by 5.5 percent to help offset the effects of inflation. The scholarship fund will last indefinitely. What is the value of this gift today at a discount rate of 8 percent? The table below is an extract of the Balance Sheet of Esther Bakery Enterprise for the year ending 2019 and 2021. Use table to answer questions 14-17. Item 2019 2021 Sales 1,500,000 1,800,000 Cost of Goods Sold 1,000,000 1,200,000 Inventory 300,000 350,000 Account Receivable 350,000 375,000 Account Payable 150,000 180,000 12. What is Esther Bakery's Inventory Period for the year ending 2021? 13. Calculate the account receivables period for Esther Bakery for year ending 2021. 14. Calculate the account payables period for Esther Bakery for the year ending 2021 15. How long will Ether Bakery take to Finance their inventory? Use below question to answer questions 18-19 A company has a credit line of GHS 1,000,000 with a 10% compensating balance requirement. It needs to borrow an amount of GHS 250,000 for 1 year at a rate of 15% per annum for an urgent transaction. 16. How much does the company need to borrow? 17. What is the effective interest rate on the amount borrowed? 18. The current interest rate is 28%, a Treasury Bill with 91 days to maturity has a face value of GH 500,000. What is the market value of this bill? 19. You bought a 182-day Treasury Bill with a face value GH200,000.00 and held it for 54 days. If you want to sell it and interest rate is currently at 12.5%, at what price will you sell it? 20. A Treasurer bought a 180 day CD issued by a top bank at a yield of 15%. The face value at issue is GHS 100m. In 90 days' time the buyer sells the CD when the secondary market rate for the 3 month is quoted as 13%/14% per annum. What is the return on the investment for the Treasurer

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started