Answered step by step

Verified Expert Solution

Question

1 Approved Answer

pls make it easy to read the results ast Spirit Calendars imprints calendars with college names. The company has fixed expenses of $1,095,000 each month

pls make it easy to read the results

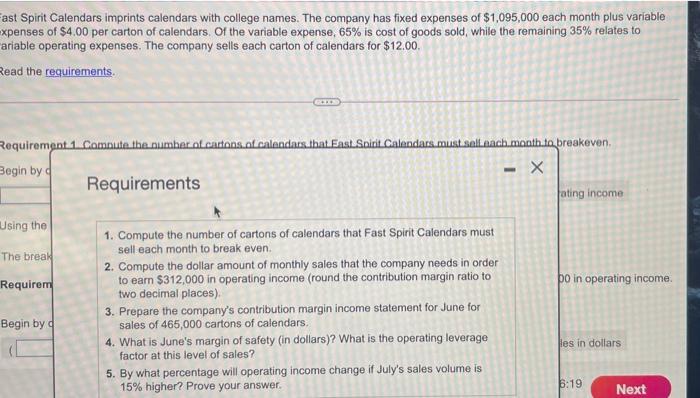

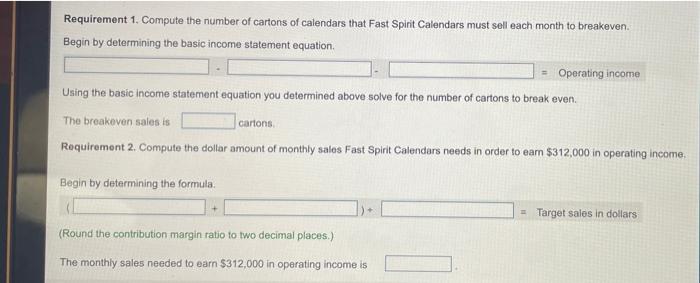

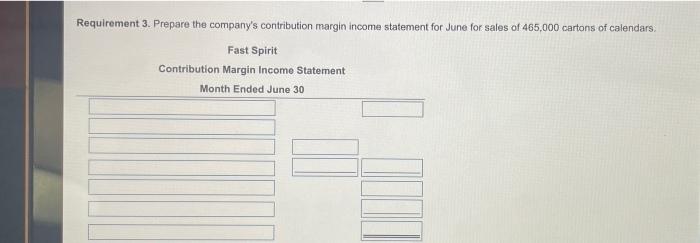

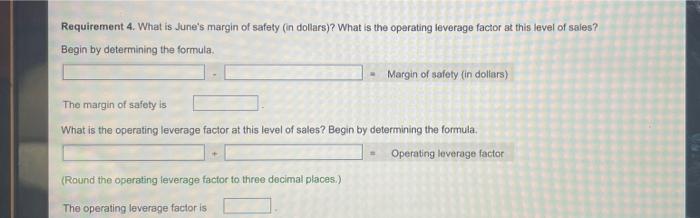

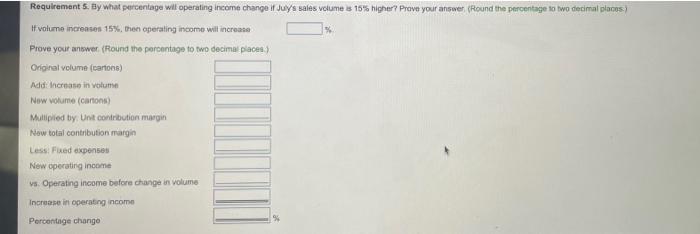

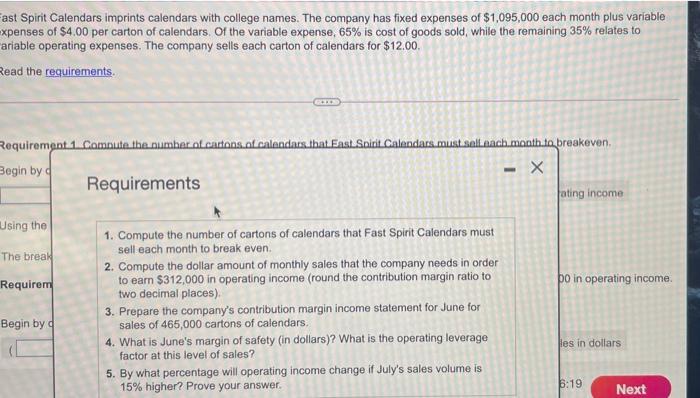

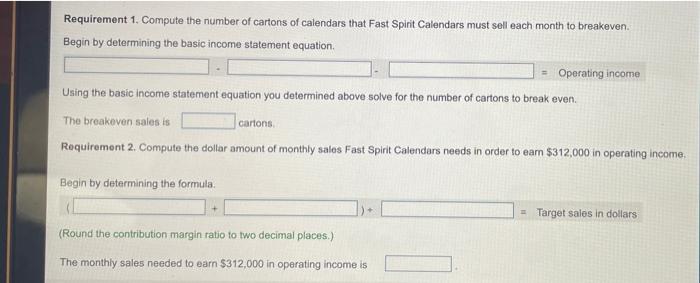

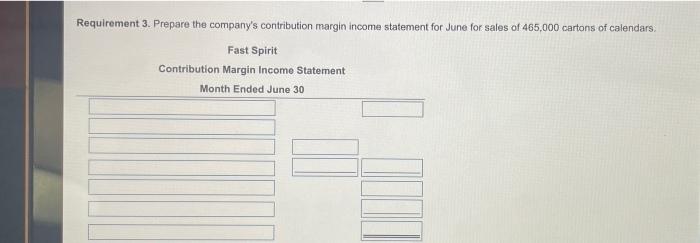

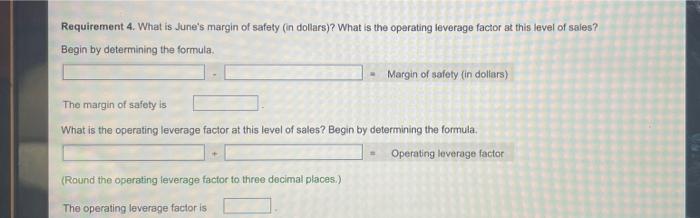

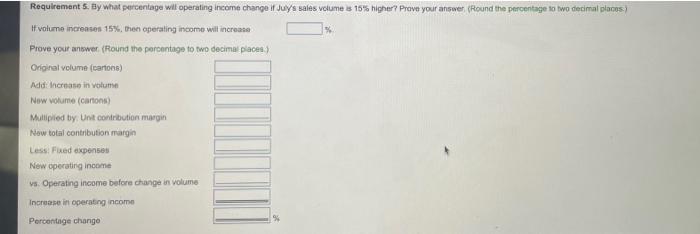

ast Spirit Calendars imprints calendars with college names. The company has fixed expenses of $1,095,000 each month plus variable xpenses of $4.00 per carton of calendars. Of the variable expense, 65% is cost of goods sold, while the remaining 35% relates to ariable operating expenses. The company sells each carton of calendars for $12.00 Read the requirements. Requirement 1. Commute the number of cartons of calendars that East.Spirit Calendars.cust sell.each month to breakeven, Begin by Requirements ating income - Using the The break po in operating income Requirem 1. Compute the number of cartons of calendars that Fast Spirit Calendars must sell each month to break even. 2. Compute the dollar amount of monthly sales that the company needs in order to earn $312,000 in operating income (round the contribution margin ratio to two decimal places) 3. Prepare the company's contribution margin income statement for June for sales of 465,000 cartons of calendars, 4. What is June's margin of safety (in dollars)? What is the operating leverage factor at this level of sales? 5. By what percentage will operating income change if July's sales volume is 15% higher? Prove your answer. Begin by les in dollars 5:19 Next Requirement 1. Compute the number of cartons of calendars that Fast Spirit Calendars must sell each month to breakeven. Begin by determining the basic income statement equation Operating income Using the basic income statement equation you determined above solve for the number of cartons to break even The breakeven sales is Requirement 2. Computo the dollar amount of monthly sales Fast Spirit Calendars needs in order to earn $312,000 in operating income cartons Begin by determining the formula = Target salos in dollars (Round the contribution margin ratio to two decimal places.) The monthly sales needed to earn $312,000 in operating income is Requirement 3. Prepare the company's contribution margin income statement for June for sales of 465,000 cartons of calendars Fast Spirit Contribution Margin Income Statement Month Ended June 30 Requirement 4. What is June's margin of safety (in dollars)? What is the operating leverage factor at this level of sales? Begin by determining the formula Margin of safety (in dollars) The margin of safety is What is the operating leverage factor at this level of sales? Begin by determining the formula. Operating leverage factor (Round the operating leverage factor to three decimal places.) The operating leverage factor is Requirements. By what percentage will operating income change it Juys sales volumes 15% higher? Prove your answer (Round the percentage 10 two decimal planos I volume increases 15%, then operating income will increase Prove your answer (Round the percentage to two decimal places Original volume (cartons) Add: Increase in volume Now volume (cartons Multiplied by Unit contribution margin Now total contribution margin Less: Fixed expenses New operating income vs Operating income before change in volume Increase in operating income Percentage change

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started