pls need help with question b) asap, i provided the drop down name list for Income statement normal - absorption costing which is question b)

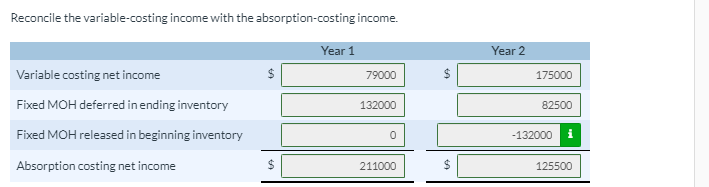

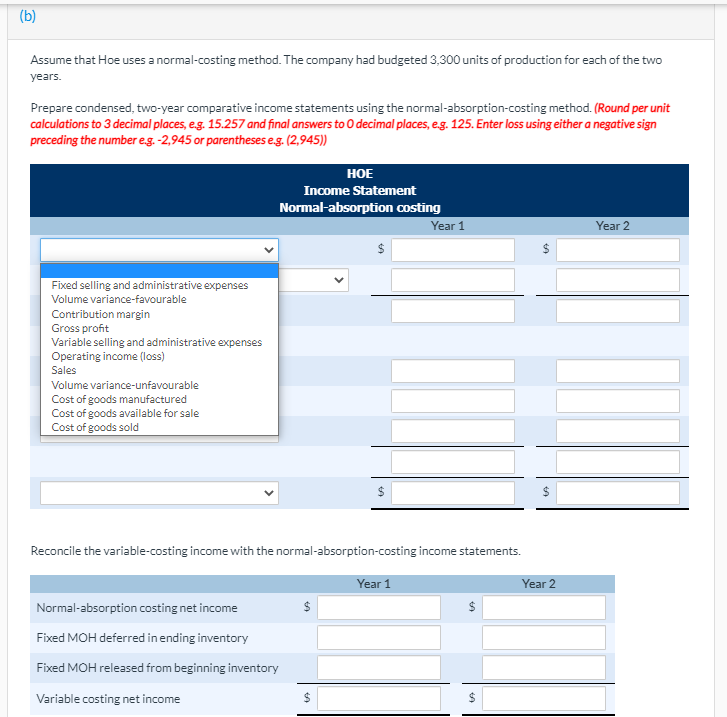

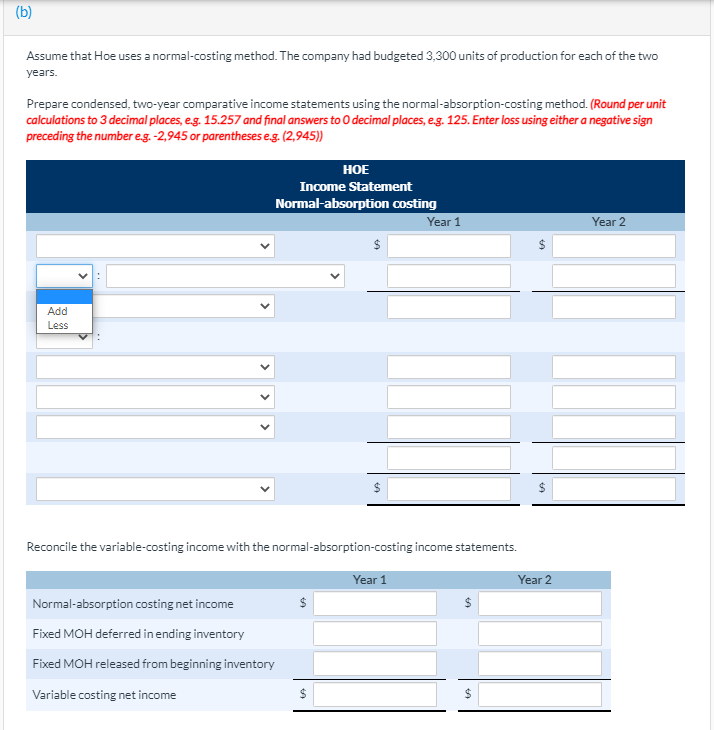

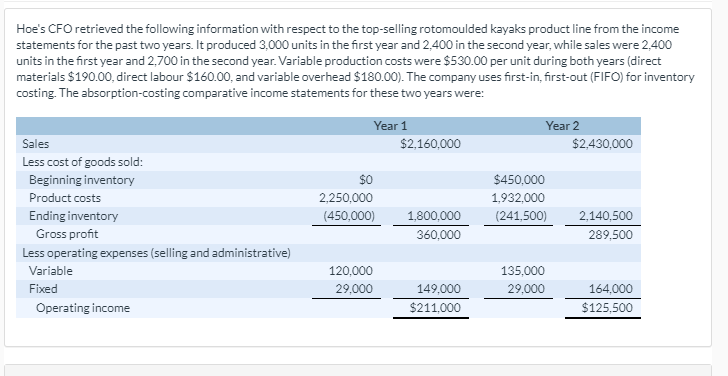

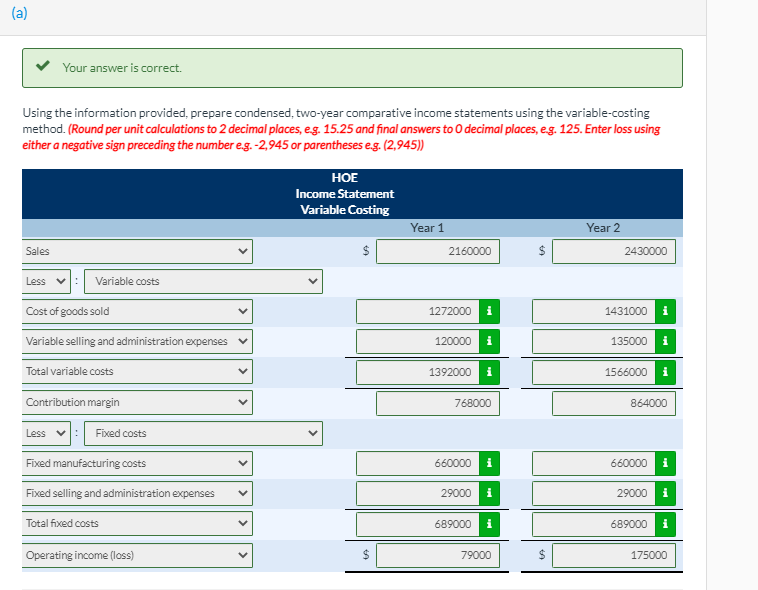

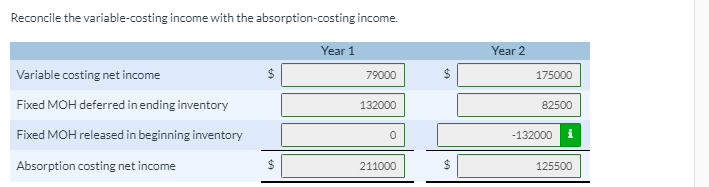

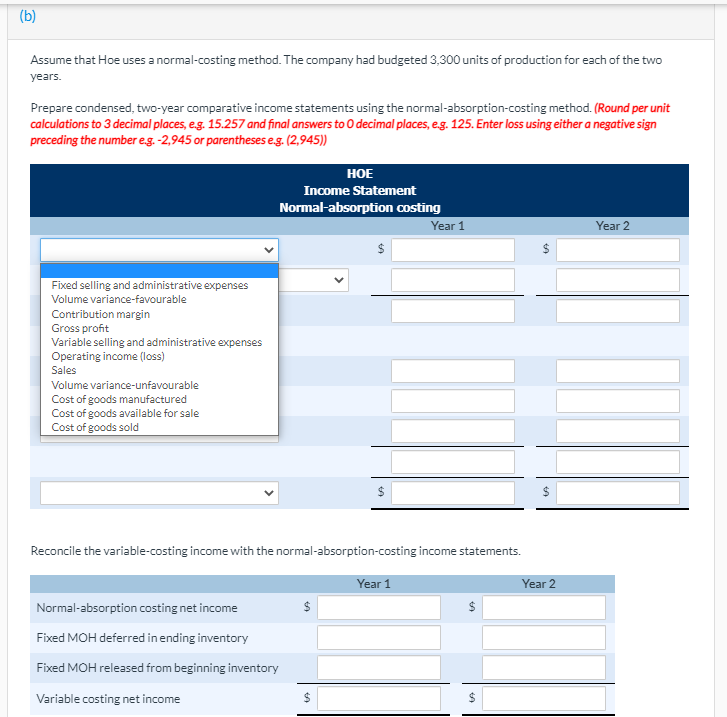

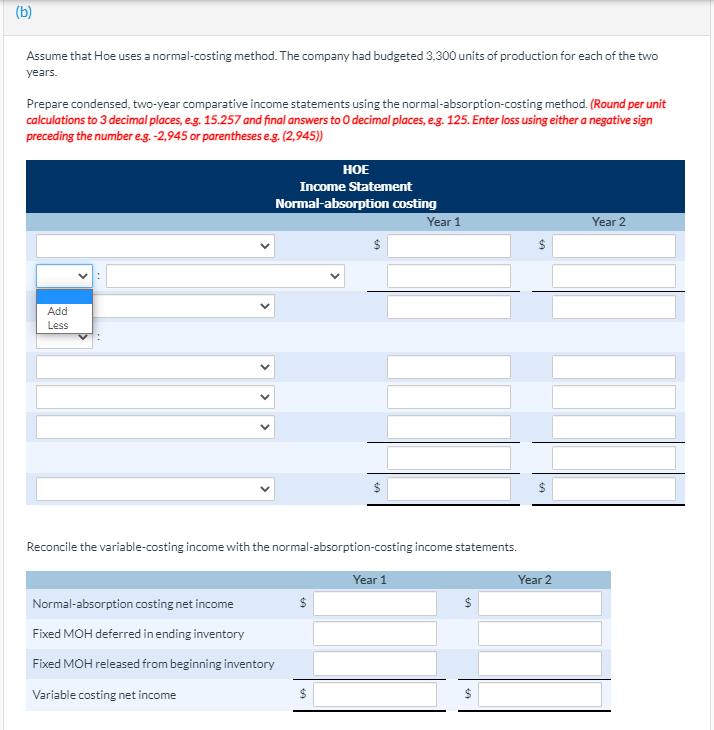

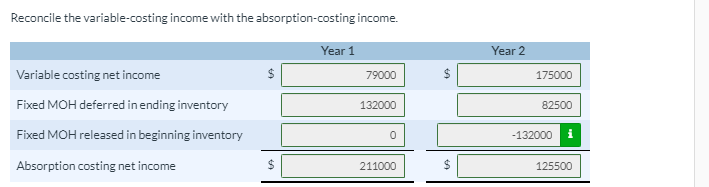

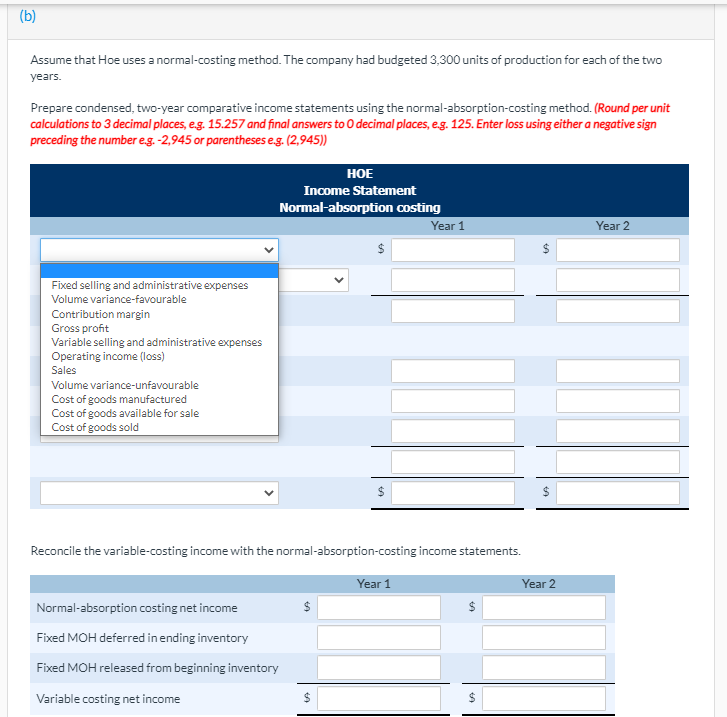

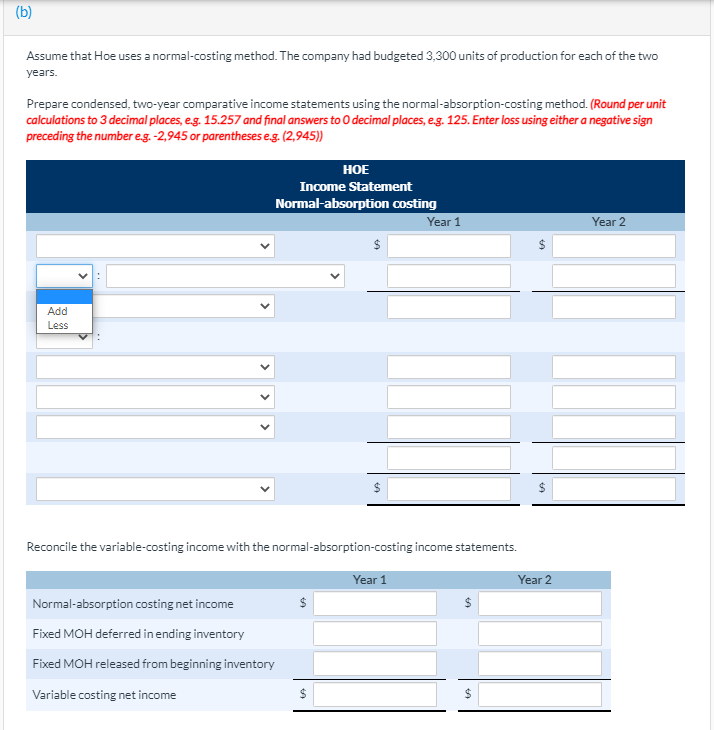

Hoe's CFO retrieved the following information with respect to the top-selling rotomoulded kayaks product line from the income statements for the past two years. It produced 3,000 units in the first year and 2,400 in the second year, while sales were 2,400 units in the first year and 2,700 in the second year. Variable production costs were $530.00 per unit during both years (direct materials $190.00, direct labour $160.00, and variable overhead $180.00). The company uses first-in, first-out (FIFO) for inventory costing. The absorption-costing comparative income statements for these two years were: Year 1 Year 2 Sales $2,160,000 $2,430,000 Less cost of goods sold: Beginning inventory $450,000 Product costs 2,250,000 1,932,000 Ending inventory (450,000) 1,800,000 (241,500) 2,140,500 Gross profit 360,000 289.500 Less operating expenses (selling and administrative) Variable 120,000 135,000 Fixed 29,000 149,000 29,000 164,000 Operating income $211,000 $125.500(a) V Your answer is correct. Using the information provided, prepare condensed, two-year comparative income statements using the variable-costing method. (Round per unit calculations to 2 decimal places, eg. 15.25 and final answers to O decimal places, e.g. 125. Enter loss using either a negative sign preceding the number e.g. -2,945 or parentheses e.g. (2,945)) HOE Income Statement Variable Costing Year 1 Year 2 Sales $ 2160000 2430000 Less Variable costs Cost of goods sold 1272000 1431000 Variable selling and administration expenses 120000 135000 Total variable costs 1392000 1566000 Contribution margin 768000 864000 Less Fixed costs Fixed manufacturing costs 660000 i 660000 Fixed selling and administration expenses 29000 29000 Total fixed costs 689000 i 689000 Operating income (loss) S 79000 S 175000Reconcile the variable-costing income with the absorption-costing income. Year 1 Year 2 Variable costing net income 79000 S 175000 Fixed MOH deferred in ending inventory 132000 82500 Fixed MOH released in beginning inventory 0 -132000 i Absorption costing net income 211000 S 125500(b) Assume that Hoe uses a normal-costing method. The company had budgeted 3,300 units of production for each of the two years. Prepare condensed, two-year comparative income statements using the normal-absorption-costing method. (Round per unit calculations to 3 decimal places, e.g. 15.257 and final answers to O decimal places, e.g. 125. Enter loss using either a negative sign preceding the number e.g. -2,945 or parentheses e.g. (2,945)) HOE Income Statement Normal-absorption costing Year 1 Year 2 $ S Fixed selling and administrative expenses Volume variance-favourable Contribution margin Gross profit Variable selling and administrative expenses Operating income (loss) Sales Volume variance-unfavourable Cost of goods manufactured Cost of goods available for sale Cost of goods sold $ $ Reconcile the variable-costing income with the normal-absorption-costing income statements. Year 1 Year 2 Normal-absorption costing net income Fixed MOH deferred in ending inventory Fixed MOH released from beginning inventory Variable costing net income $(b) Assume that Hoe uses a normal-costing method. The company had budgeted 3,300 units of production for each of the two years. Prepare condensed, two-year comparative income statements using the normal-absorption-costing method. (Round per unit calculations to 3 decimal places, e.g. 15.257 and final answers to O decimal places, e.g. 125. Enter loss using either a negative sign preceding the number e.g. -2,945 or parentheses e.g. (2,945)) HOE Income Statement Normal-absorption costing Year 1 Year 2 $ $ Add Less $ $ Reconcile the variable-costing income with the normal-absorption-costing income statements. Year 1 Year 2 Normal-absorption costing net income $ $ Fixed MOH deferred in ending inventory Fixed MOH released from beginning inventory Variable costing net income S $