Pls only answer if able to fully ans the questions, Pls also give details workings

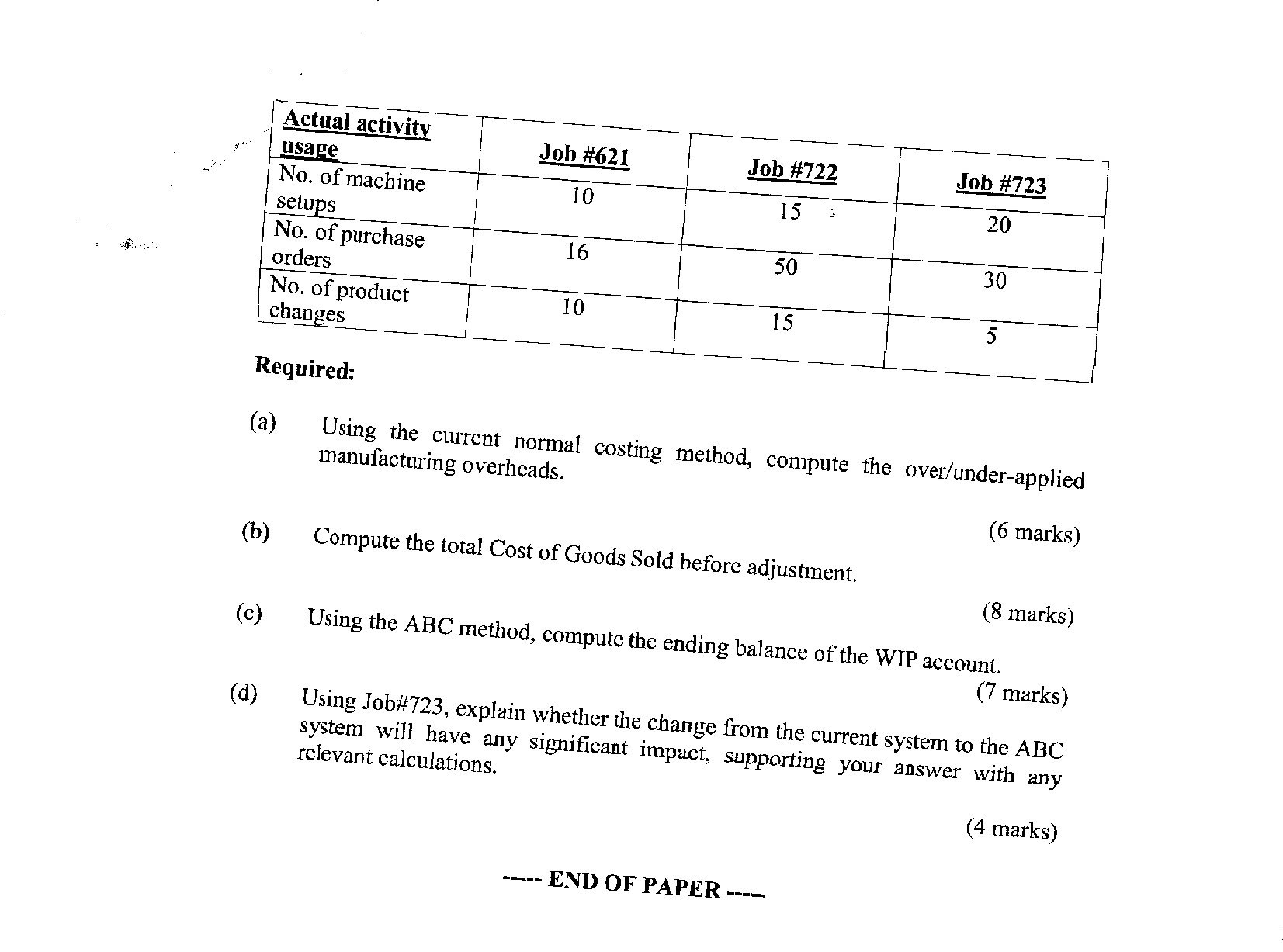

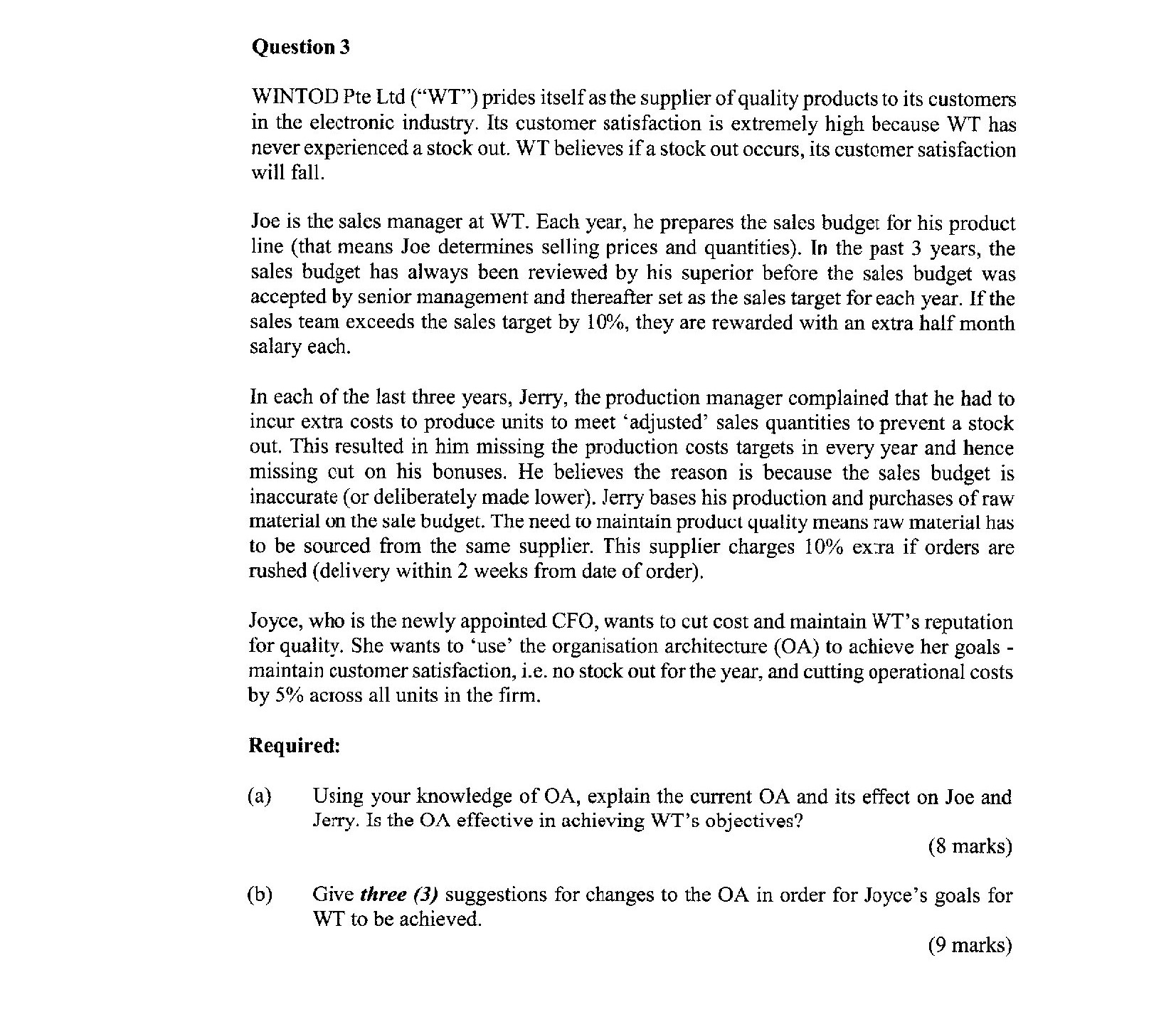

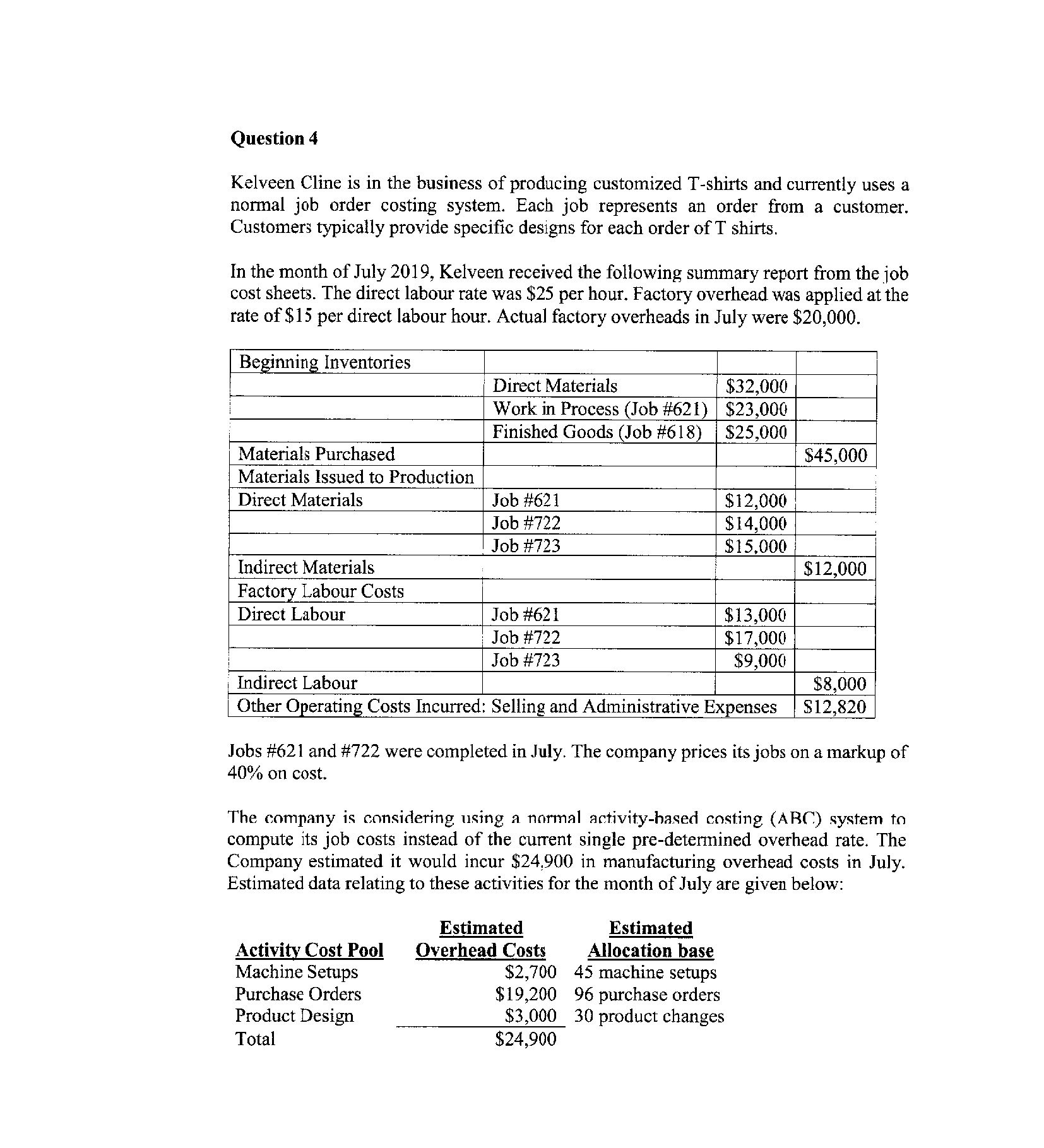

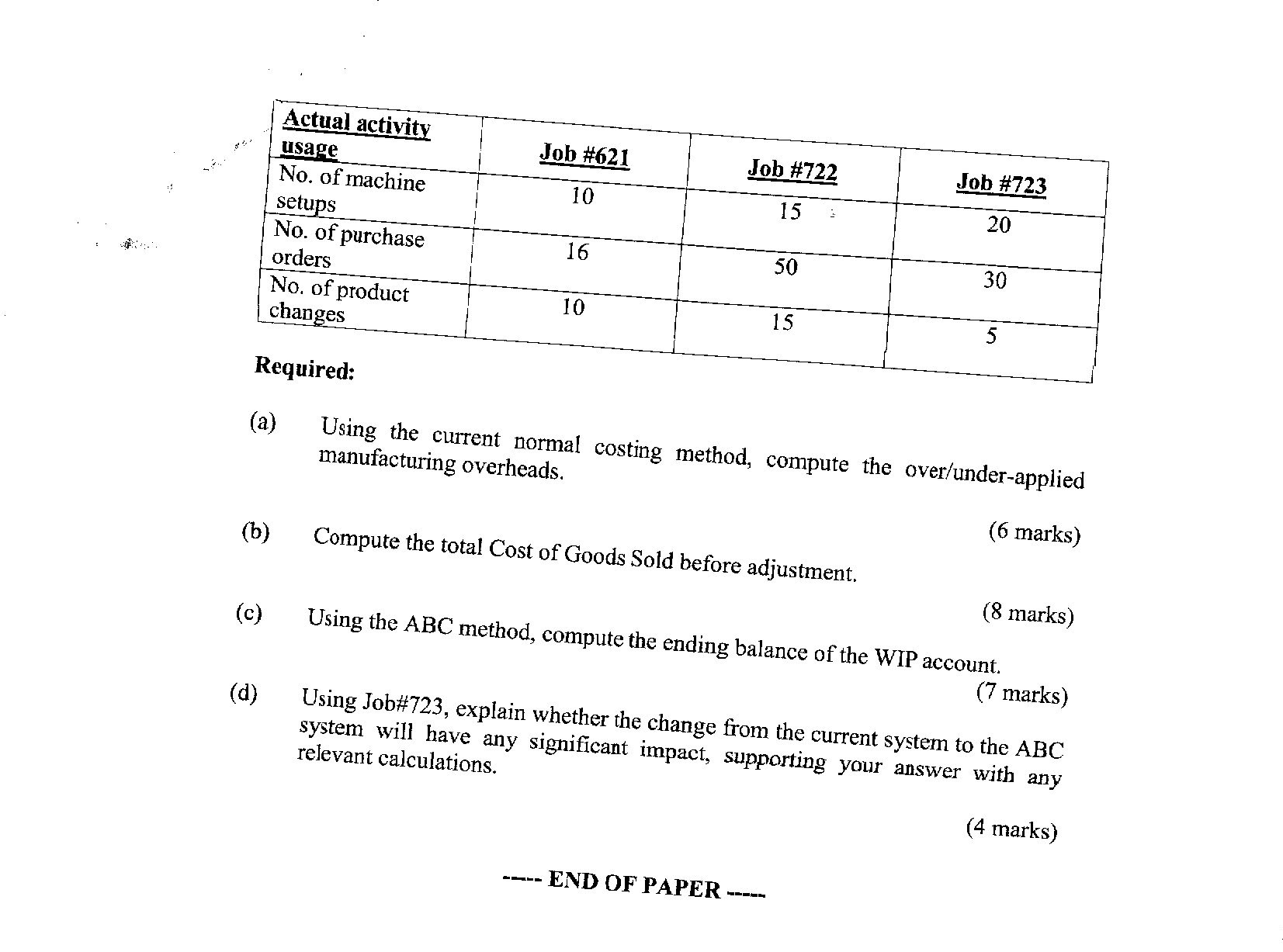

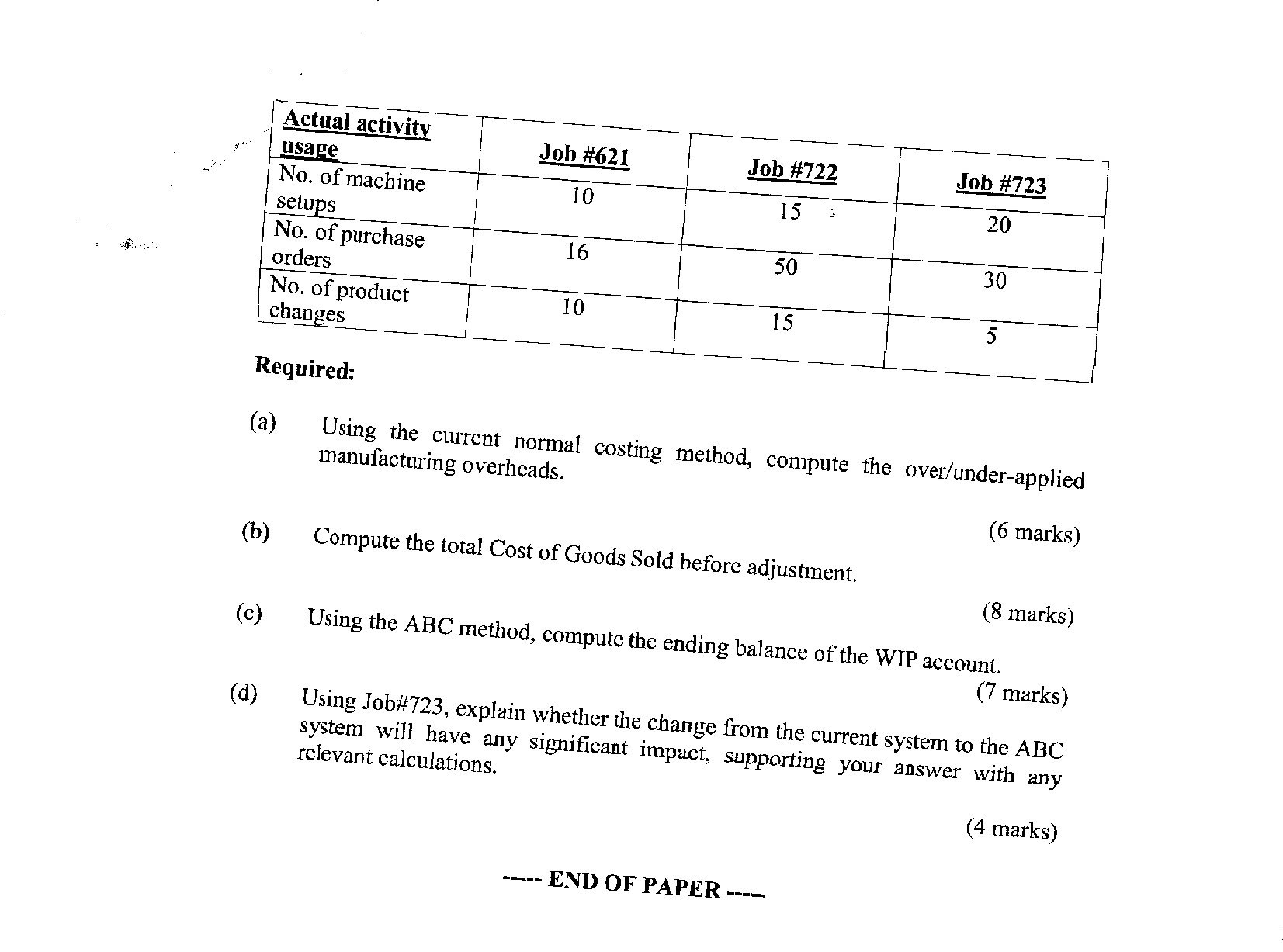

Question 3 WINTOD Pte Ltd (\"WT") prides itself as the supplier of quality products to its customers in the electronic industry. Its customer satisfaction is extremely high because WT has never experienced a stock out. WT believes if a stock out occurs, its customer satisfaction will fall. Joe is the sales manager at WT. Each year, he prepares the sales budget for his product line (that means Joe determines selling prices and quantities). In the past 3 years, the sales budget has always been reviewed by his superior before the sales budget was accepted by senior management and thereaer set as the sales target for each year. If the sales team exceeds the sales target by 10%, they are rewarded with an extra half month salary each. In each of the last three years, Jerry, the production manager complained that he had to incur extra costs to produce units to meet 'adjusted' sales quantities to prevent a stock out. This resulted in him miSSing the production costs targets in every year and hence missing out on his bonuses. He believes the reason is because the sales budget is inaccurate (or deliberately made lower). Jerry bases his production and purchases of raw material on the sale budget. The need to maintain product quality means raw material has to be sourced from the same supplier. This supplier charges 10% exra if orders are rushed (delivery within 2 weeks from date of order). Joyce, who is the newly appointed CFO, wants to cut cost and maintain WT's reputation for quality. She wants to 'use' the organisation architecture (0A) to achieve her goals - maintain customer satisfaction, i.e. no stock out for the year, and cutting operational costs by 5% across all units in the firm. Required: (a) Using your knowledge of OA, explain the current 0A and its effect on Joe and Jerry. Is the 02'. effective in achieving WT's objectives? (8 marks) (b) Give three (3) suggestions for changes to the 0A in order for Joyce's goals for WT to be achieved. (9 marks) Question 4 Kelveen Cline is in the business of producing customized T-shirts and currently uses a normal job order costing system. Each job represents an order from a customer. Customers typically provide specic designs for each order of T shirts. In the month of July 2019, Kelveen received the following summary report from the job cost sheets. The direct labour rate was $25 per hour. Factory overhead was applied at the rate of $15 per direct labour hour. Actual factory overheads in July were $20,000. Be'nnin Inventories _ ' Direct Materials $32,000 Work in Process (Job #621) $23,000 { Finished Goods (Job #618) $25,000 Materials Purchased $45,000 Materials Issued to Production Direct Materials Job #621 $12,000 Job #722 $14,000 ; Job #723 $15,000 ' ' Indirect Materials $12,000 Facto Labour Costs Direct Labour Job #621 3 Job #722 Job #723 i Indirect Labour Other Operating Costs Incurred: Selling and Administrative Expenses $12,820 Jobs #621 and #722 were completed in July. The company prices its jobs on a markup of 40% on cost. The company is considering using a. normal activity-based costing (ARC) system to compute its job costs instead of the current single [ire-determined overhead rate. The Company estimated it would incur $24,900 in manufacturing overhead costs in July. Estimated data relating to these activities for the month of July are given below: Estimated Estimated Activity Cost Pool Overhead Costs Allocation base Machine Setups $2,700 45 machine setups Purchase Orders $19,200 96 purchase orders Product Design $3,000 30 product changes Total $24,900 Actual activity usage Job #621 Job #722 Job #723 No. of machine 10 15 20 setups No. of purchase 16 50 30 orders No. of product 10 15 5 changes Required: (a) Using the current normal costing method, compute the over/under-applied manufacturing overheads. (6 marks) (b) Compute the total Cost of Goods Sold before adjustment. (8 marks) (c) Using the ABC method, compute the ending balance of the WIP account. (7 marks) Using Job#723, explain whether the change from the current system to the ABC system will have any significant impact, supporting your answer with any relevant calculations. (4 marks) ---- END OF PAPER