Pls only answer if able to fully ans the questions, Pls also give details workings

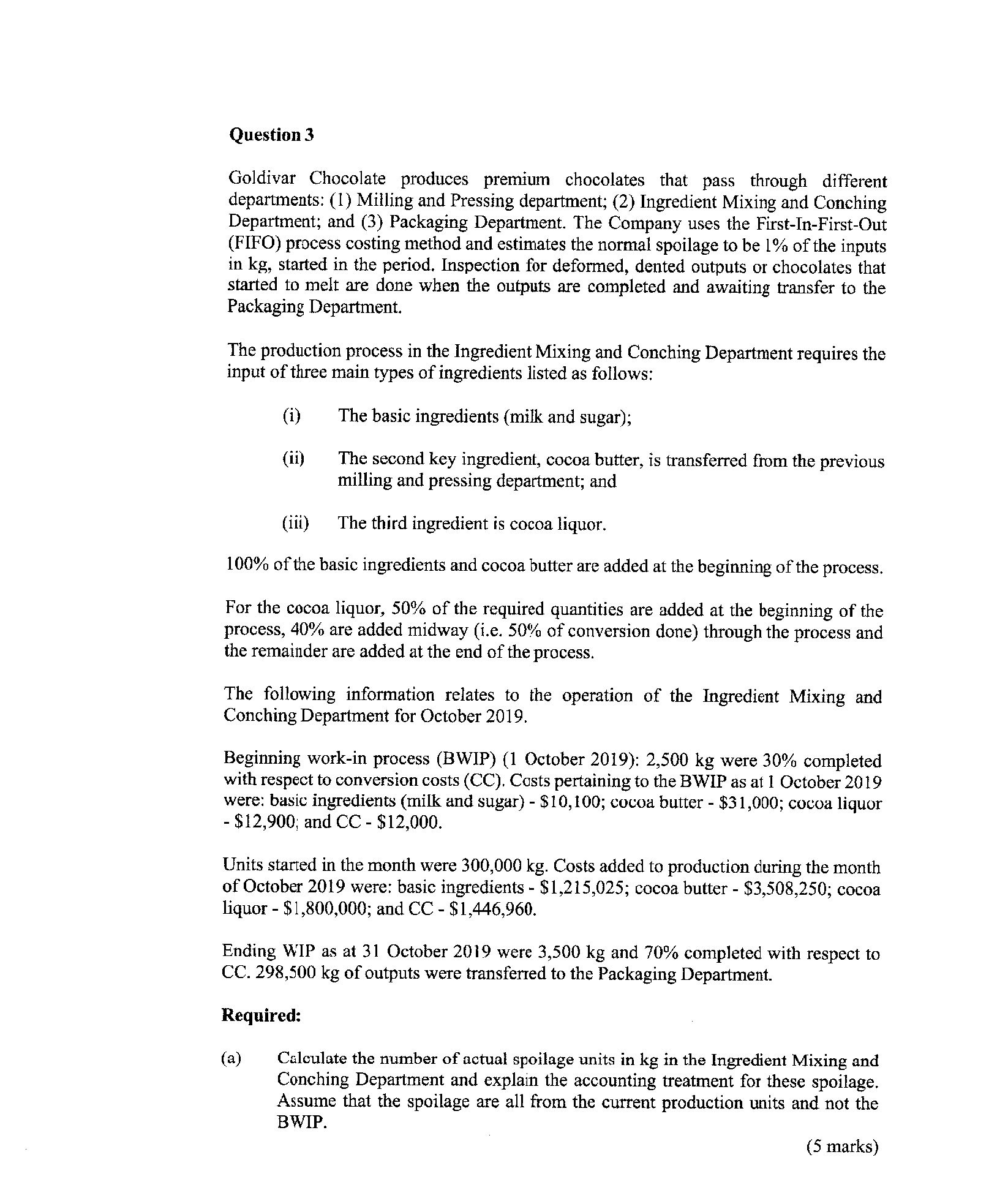

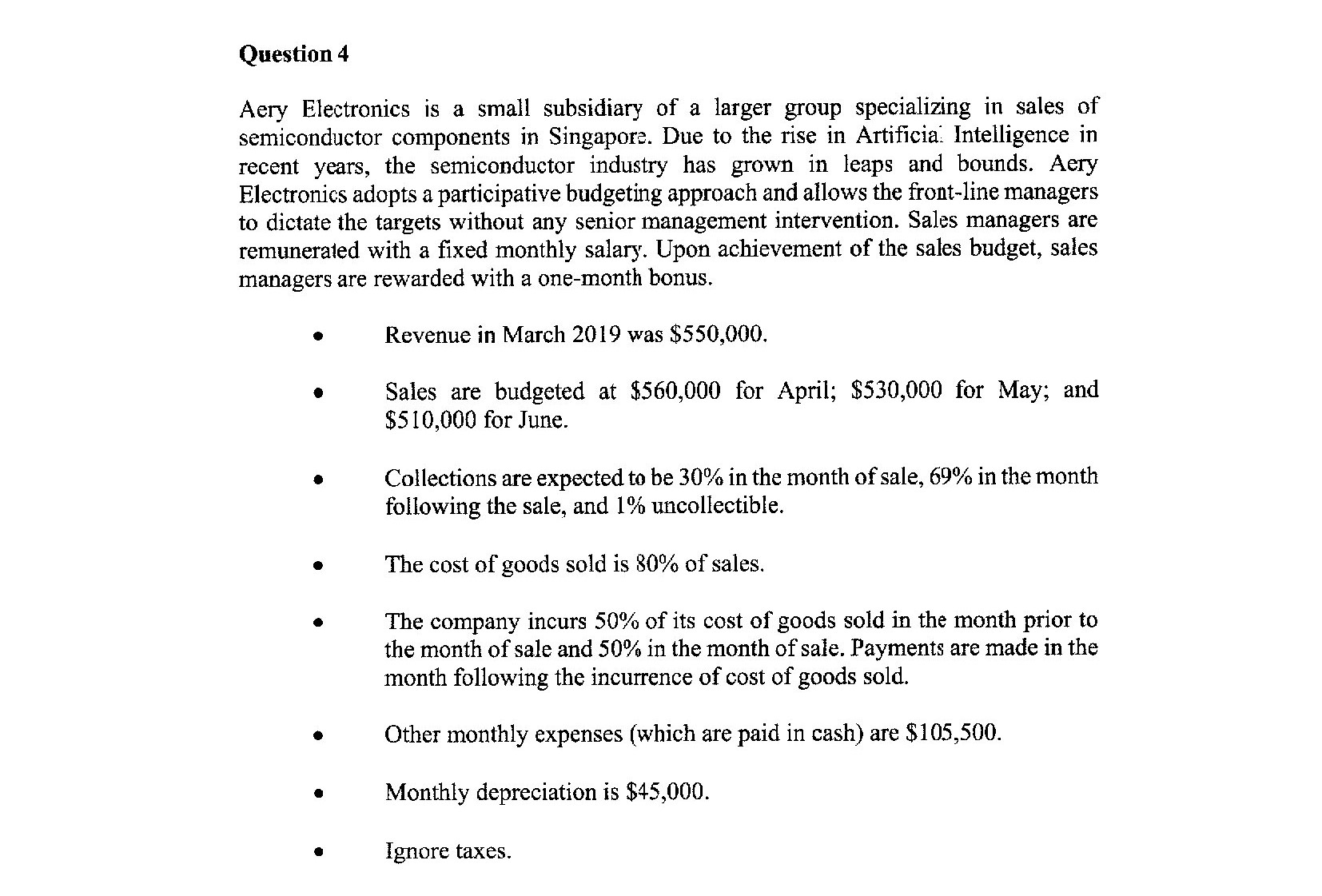

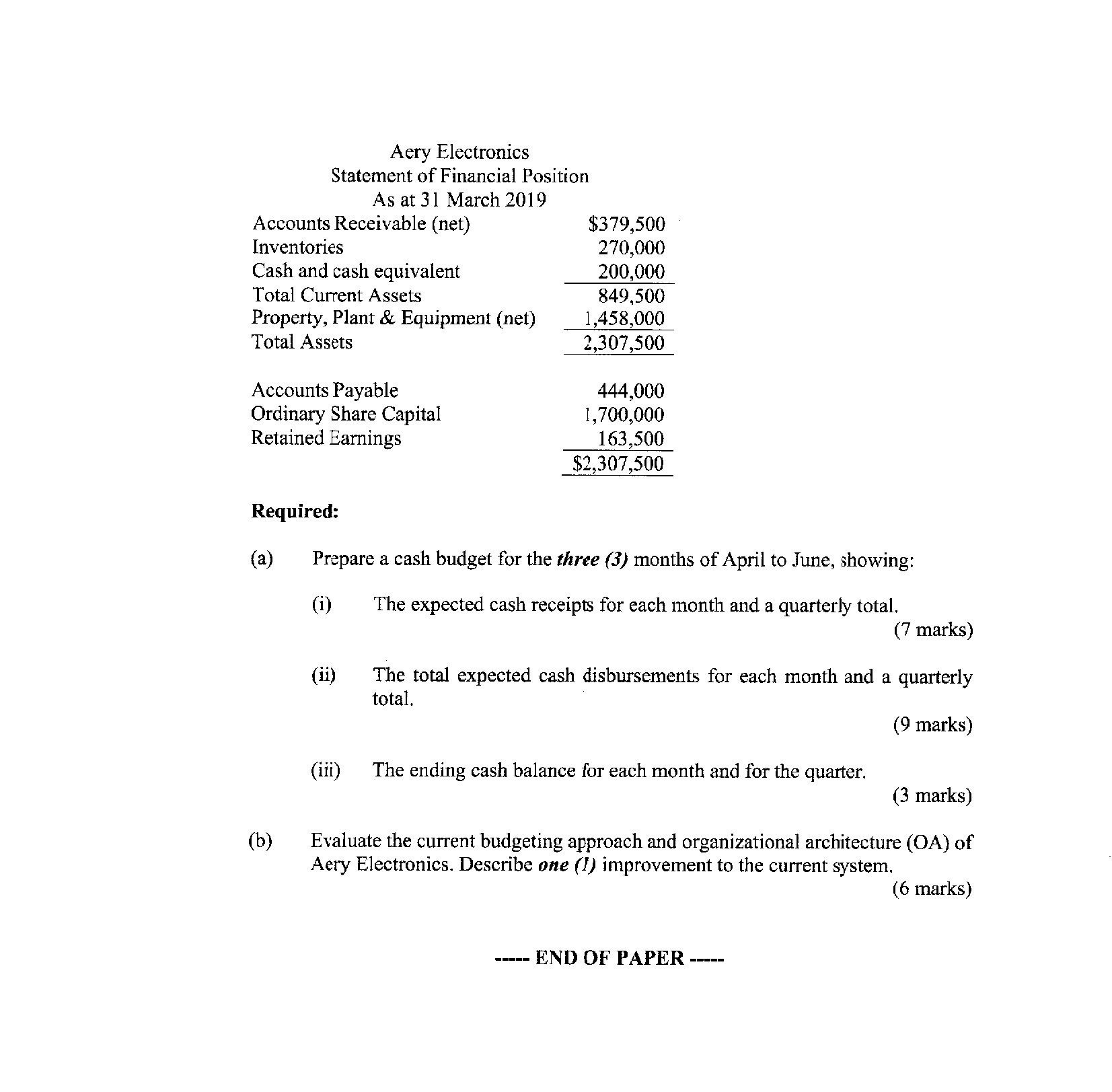

Question 3 Goldivar Chocolate produces premium chocolates that pass through different departments: (1) Milling and Pressing department; (2) Ingredient Mixing and Conching Department; and (3) Packaging Department. The Company uses the First-InFirst-Out (FIFO) process costing method and estimates the normal spoilage to be 1% of the inputs in kg, started in the period. Inspection for deformed, dented outputs or chocolates that started to melt are done when the outputs are completed and awaiting transfer to the Packaging Department. The production process in the Ingredient Mixing and Coaching Department requires the input of three main types of ingredients listed as follows: (i) The basic ingredients (milk and sugar); (ii) The second key ingredient, cocoa butter, is transferred from the previous milling and pressing department; and (iii) The third ingredient is cocoa liquor. 100% of the basic ingredients and cocoa butter are added at the beginning of the process. For the cocoa liquor, 50% of the required quantities are added at the beginning of the process, 40% are added midway (Le. 50% of conversion done) through the process and the remainder are added at the end of the process. The following information relates to the operation of the Ingredient Mixing and Coaching Department for October 2019. Beginning work-in process (BWIP) (1 October 2019): 2,500 kg were 30% completed with respect to conversion costs (CC). Costs pertaining to the BWIP as at I October 2019 were: basic ingredients (milk and sugar) - $10,100; cocoa butter - $31,000; cocoa liquor - $12,900; and CC - $12,000. Units started in the month were 300,000 kg. Costs added to production during the month of October 2019 were: basic ingredients - $1,215,025; cocoa butter - $3,508,250; cocoa liquor - $1,800,000; and CC - $1,446,960. Ending WIP as at 31 October 2019 were 3,500 kg and 70% completed with respect to CC. 298,500 kg of outputs were transferred to the Packaging Department. Required: (9.) Calculate the number of actual spoilage units in kg in the Ingredient Mixing and Conching Department and explain the accounting treatment for these spoilage. Assume that the spoilage are all from the current production units and not the BVVIP. (5 marks) (b) (C) (d) (i) Calculate the equivalent units of production for Goldivar Chocolate in the Ingredient Mixing and Conching department and the costs per equivalent unit for each cost category (give your answers to the nearest two decimal place of dollar) for the month of October. (12 marks) (ii) Calculate the value of completed products transferred to the Packaging Department in the Ingredient Mixing and Conching department at the end of October. (4 marks) Calculate the cost per kg of completed outputs transferred to Packaging Department, rounding your answer to two decimal places of a dollar. (2 marks) Prepare journal entries to illustra:e the transfer of completed outputs to the next department. (2 marks) Question 4 Aery Electronics is a small subsidiary of a larger group specializing in sales of semiconductor components in Singapore. Due to the rise in Articial Intelligence in recent years, the semiconductor industry has grown in leaps and bounds. Aery Electronics adopts a participative budgeting approach and allows the frontline managers to dictate the targets without any senior management intervention. Sales managers are remunerated with a xed monthly salary. Upon achievement of the sales budget, sales managers are rewarded with a onemonth bonus, 0 Revenue in March 2019 was $550,000. 0 Sales are budgeted at $560,000 for April; $530,000 for May; and $510,000 for June. 0 Collections are expected to be 30% in the month of sale, 69% in the month following the sale, and 1% uncollectible. o The cost of goods sold is 30% of sales. 0 The company incurs 50% of its cost of goods sold in the month prior to the month of sale and 50% in the month of sale. Payments are made in the month following the incurrence of cost of goods sold. o Other monthly expenses (which are paid in cash) are $105,500. 0 Monthly depreciation is $45,000. 0 Ignore taxes. Aery Electronics Statement of Financial Position As at 31 March 2019 Accounts Receivable (net) $379,500 Inventories 270,000 Cash and cash equivalent 200,000 Total Current Assets 849,500 Property, Plant & Equipment (net) 1,458,000 Total Assets 2,3 07,500 Accounts Payable 444,000 Ordinary Share Capital l,700,000 Retained Earnings 163,500 Required: (a) Prepare a cash budget for the three (3) months of April to June, showing: (i) The expected cash receipts for each month and a quarterly total. (7 marks) (ii) The total expected cash disbursements for each month and a quarterly total. (9 marks) (iii) The ending cash balance for each month and for the quarter. (3 marks) (b) Evaluate the current budgeting approach and organizational architecture (0A) of Aery Electronics. Describe one (I) improvement to the current system. (6 marks) ----- END OF PAPER