Answered step by step

Verified Expert Solution

Question

1 Approved Answer

pls privide me the answer for the below Q ! thanks Question A) The Alpine Group, Inc. provides the following data for the June 2018,

pls privide me the answer for the below Q ! thanks

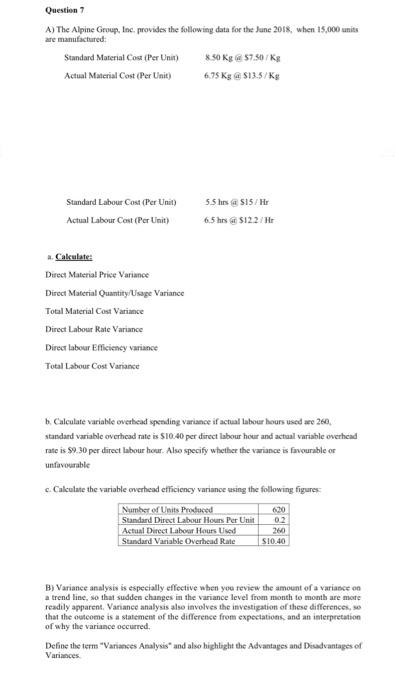

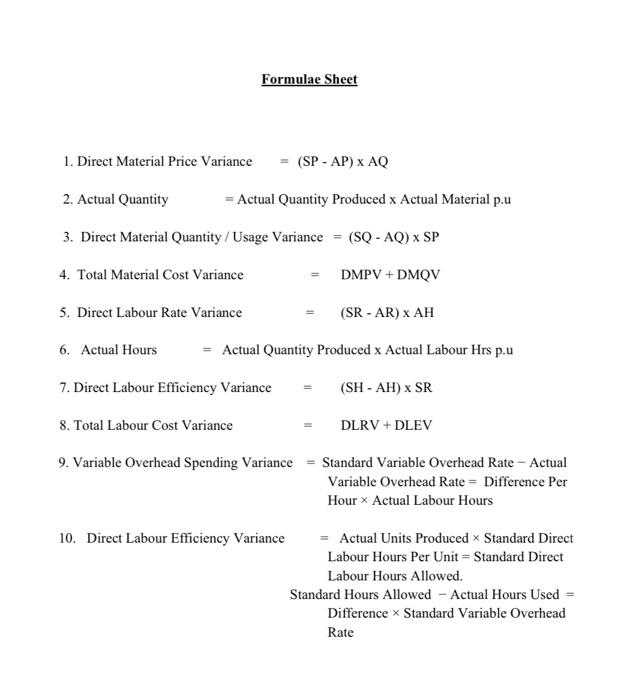

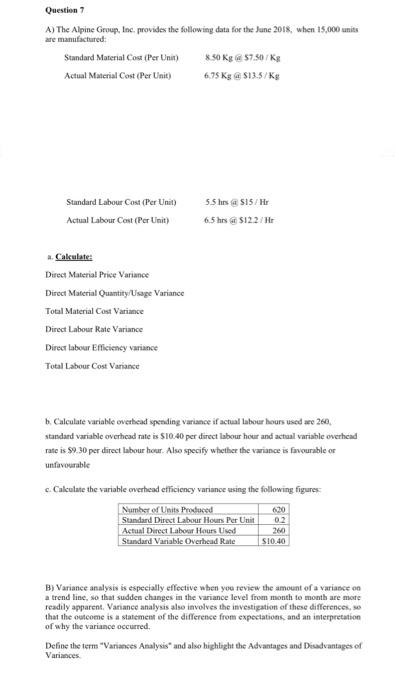

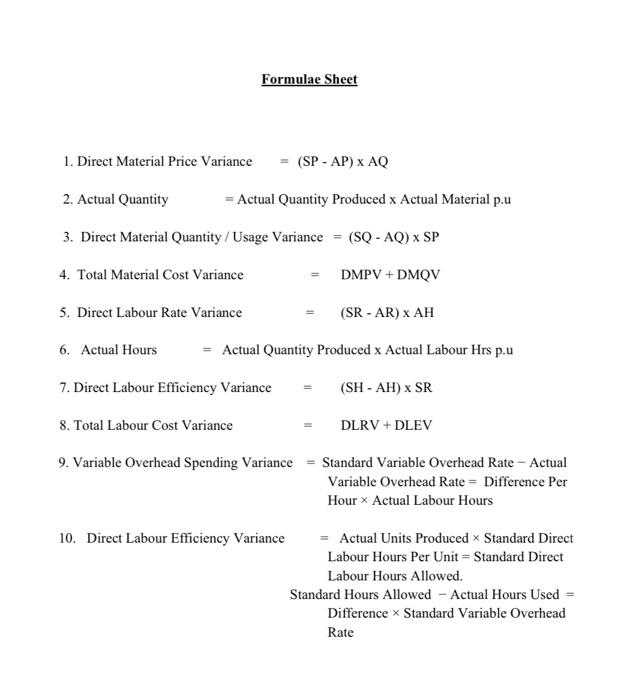

Question A) The Alpine Group, Inc. provides the following data for the June 2018, when 15,000 units are manufactured: Standard Material Cou Per Unit) 8.50 Kg S7.50/kg Actual Material Cost (Per Unit) 6,75 Kg $13.5/ks Standard Labour Cost (Per Unit) Actual Labour Cost (Per Unit) 5.5 hrs 515/ HT 6.5 hrs $122/HT a Calculate: Direct Material Price Variance Direct Material Ouantity/Usage Variance Total Material Cost Variance Direct Labour Rate Variance Direct labour Efficiency variance Total Labour Cost Variance b. Calculate variable overhead spending variance if actual labour hours used are 260, standard variable overhead Tate is $10:40 per direct lsbour hour and actual variable overhead rate is $9.30 per direct labour hour. Also specify whether the variance is favourable or unfavourable c. Calculate the variable overhead efficiency variance using the following figures Number of Units Produced 6.30 Standard Direct Labour Hours Per Unit Actual Direct Labour Hours Used Standard Variable Overhead Rate S10.40 02 260 B) Variance analysis is especially effective when you review the amount of a variance on a trend line, so that sudden changes in the variance level from month to month are more readily apparent. Variance analysis also involves the investigation of these differences, so that the outcome is a statement of the difference from expectations, and an interpretation of why the variance occurred. Define the term "Variances Analysis and also highlight the Advantages and Disadvantages of Variances Formulae Sheet 1. Direct Material Price Variance = (SP-AP) X AQ 2. Actual Quantity = Actual Quantity Produced x Actual Material p.u 3. Direct Material Quantity / Usage Variance = (SQ - AQ) x SP 4. Total Material Cost Variance DMPV + DMOV 5. Direct Labour Rate Variance (SR - AR) X AH 6. Actual Hours Actual Quantity Produced x Actual Labour Hrs p.u 7. Direct Labour Efficiency Variance (SH - AH) x SR 8. Total Labour Cost Variance DLRV + DLEV 9. Variable Overhead Spending Variance - Standard Variable Overhead Rate - Actual Variable Overhead Rate = Difference Per Hour Actual Labour Hours 10. Direct Labour Efficiency Variance = Actual Units Produced Standard Direct Labour Hours Per Unit - Standard Direct Labour Hours Allowed. Standard Hours Allowed - Actual Hours Used = Difference Standard Variable Overhead Rate

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started