Answered step by step

Verified Expert Solution

Question

1 Approved Answer

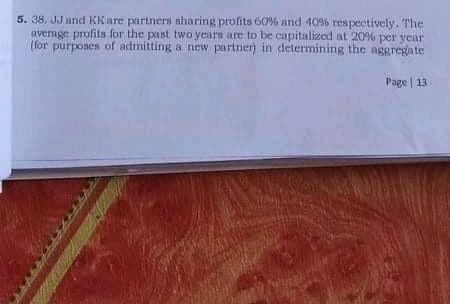

pls provide solution 5. 38. JJ and KK are partners sharing profits 60% and 40% respectively. The average profits for the past two years are

pls provide solution

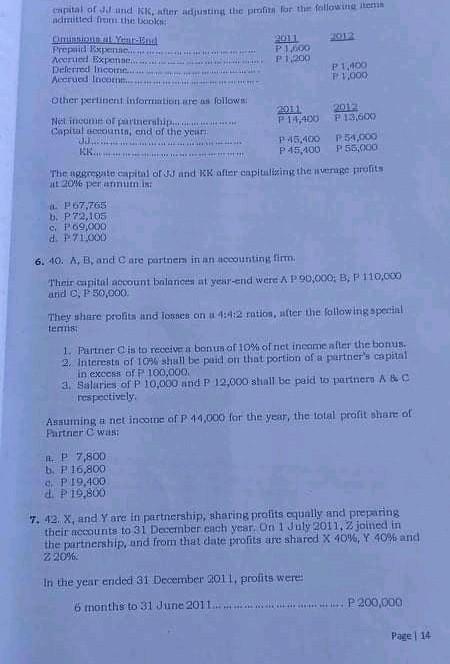

5. 38. JJ and KK are partners sharing profits 60% and 40% respectively. The average profits for the past two years are to be capitalized at 20% per year (for purposes of admitting a new partner) in determining the aggregate Page 13 capital and interacting the pain for the following her ndertitted from the pic Om Yand 2011 Prepaid Expe... P13500 neerud Expande P1200 Deferred Income Accrued Income... 1.000 P1,400 FI other pertinent Information are as follow 2011 2012 Netinem o pership P 1.400 13,600 Capital count and of the yeur P45,400 P 34.000 KK. P45,400 P. 58,000 The aggregate capital of u and after anpituitating the nerage polits 20% per annum P67.765 6. P72,105 c.P69.000 d. 171.000 6. 40. B, and Care partner in an accounting firm Their cainital account balances at year-end were Ap00,000: B, 110,000 and 0.450,000 They share profits and losses on u 4:4:2 ration, after the following sperial tentis 1. Partner is to receiver bonun of 10% of niet income after the bonus. 2. Interests of 1094shall be paid on that portion of a partner's capital in excess of P100,000 3. Salaries of P 10,000 atid P 12,000 shall be paid to partners ABC respectively Assuming a net income of P10,000 for the year, the total profit share of Partner C Wils: 1. P 7,800 b. P 16,800 a P 19.400 di P10,800 7. 42. X, and Yare in partnership, sharing profits equally and preparing their accounts to 31 December cich year. On 1 July 2011 joined in the partnership, and from that date profits are shared x 40%, Y 40% and 220% In the year ended 31 December 2011. profits were 6 months to 31 June 2011... ...P 200,000 Page 14Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started