Answered step by step

Verified Expert Solution

Question

1 Approved Answer

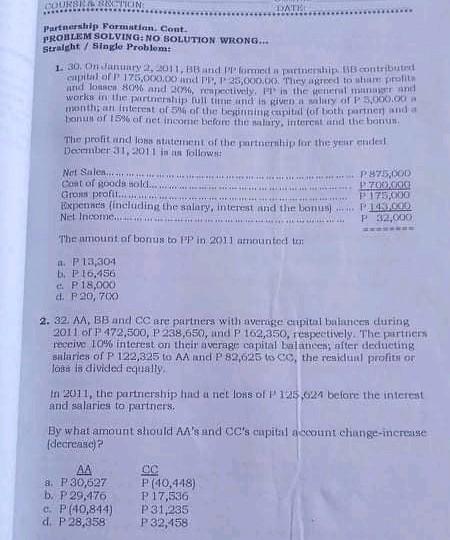

pls provide solutions BOURSIERINNON DATE Partnership Formation. Cont. PROBLEM SOLVING: NO SOLUTION WRONG... Straleht / Single Problem: 1. 30. ON.2011, and petom pameship contributed capital

pls provide solutions

BOURSIERINNON DATE Partnership Formation. Cont. PROBLEM SOLVING: NO SOLUTION WRONG... Straleht / Single Problem: 1. 30. ON.2011, and petom pameship contributed capital of 1715,000.00 25,000.00 They agreed to share und lounen 80% and 2 othely, in the wee minastrand works in the partnership oltiind in die y of P5,000.00 months an intent of or the beginning capital of both partner and Ionus or 15% of net income before the way. Interest and the bonum The profit und tons attendent of the partnership for the year endel December 31, 2011 in lui Tollow Net Sales......... P875,00D Coat of goods sold... HOS Grons profil P1000 Expenne's (including the salary, interest and the bonus)... PAX.COD Net Income P32.000 - The amount of bonus to PP in 2011 amounted to a. P13,304 b. P16,456 c. P18,000 d. P20,700 2. 32. AA, BB and CC are partners with average capital balancen during 2011 of P472,500, P 238,650, and P 162,350, respectively. The parties receive 10% interest on their average capital balance; nfter deducting salaries of P122,325 to AA and P 89,626 to ce, the residual profit or late is divided equally In 2011, the partnership hnd u niet loss of P 125,621 before the interest and salaries to partners. By what amount should A's and ce's capital account change-increuse (decrease? AA CC a. P30,627 P(40,448) b. P 29,476 P 17,536 c. P(40,844) P31 235 d. P 28,358 P 32,458

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started