Answered step by step

Verified Expert Solution

Question

1 Approved Answer

pls quickly answer pls i will vote pls 1. Naib Company engaged in the following transactions in July 2014: July 1 Sold merchandise to Lina

pls quickly answer pls i will vote pls

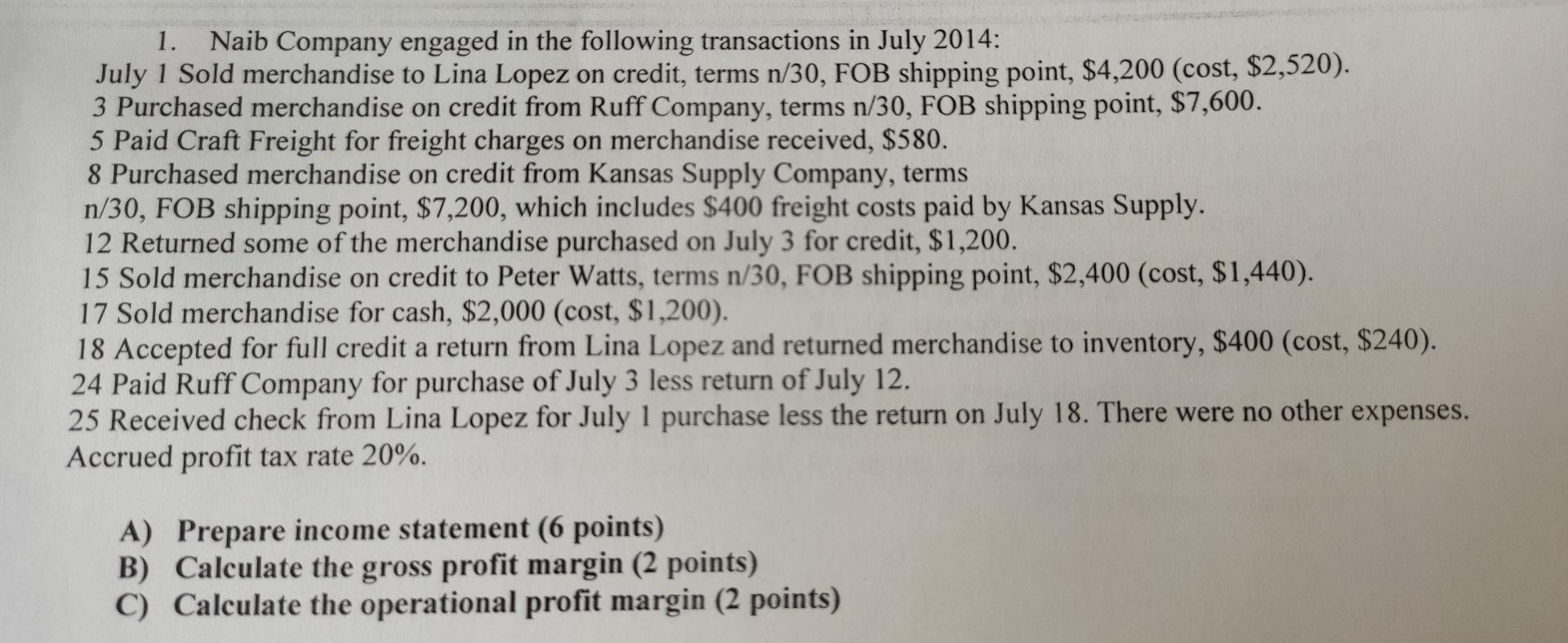

1. Naib Company engaged in the following transactions in July 2014: July 1 Sold merchandise to Lina Lopez on credit, terms n/30, FOB shipping point, $4,200 (cost, $2,520). 3 Purchased merchandise on credit from Ruff Company, terms n/30, FOB shipping point, $7,600. 5 Paid Craft Freight for freight charges on merchandise received, $580. 8 Purchased merchandise on credit from Kansas Supply Company, terms n/30, FOB shipping point, $7,200, which includes $400 freight costs paid by Kansas Supply. 12 Returned some of the merchandise purchased on July 3 for credit, $1,200. 15 Sold merchandise on credit to Peter Watts, terms n/30, FOB shipping point, $2,400 (cost, $1,440). 17 Sold merchandise for cash, $2,000 (cost, $1,200). 18 Accepted for full credit a return from Lina Lopez and returned merchandise to inventory, $400 (cost, $240). 24 Paid Ruff Company for purchase of July 3 less return of July 12. 25 Received check from Lina Lopez for July 1 purchase less the return on July 18. There were no other expenses. Accrued profit tax rate 20%. A) Prepare income statement (6 points) B) Calculate the gross profit margin (2 points) C) Calculate the operational profit margin (2 points)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started