Question

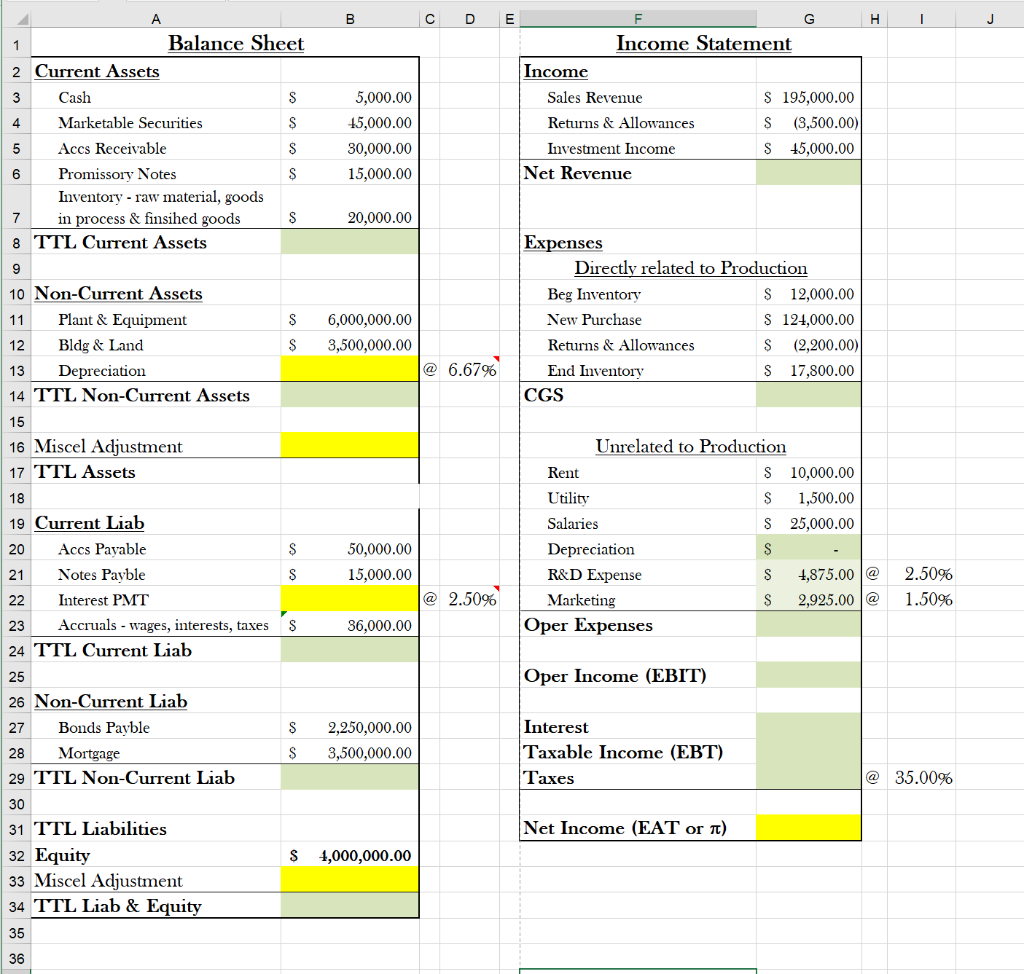

Pls see below for details on problem. Problem #1. The numbers in column D are rates that apply to each line item. - i.e. D13

Pls see below for details on problem.

Problem #1. The numbers in column D are rates that apply to each line item. - i.e. D13 represents the annual depreciation rate. The depreciation during the observation period can be calculated using this rate. Likewise, D22 represents the WAVG (overall) interest rate on the LT debt of the company. In the Income Statement, CGS is of a typical retail business, not manufacture. Depreciation in G20 must correspond to the depreciation in the balance sheet. Numbers in column I are ratios of the corresponding line items which are fractions marked to the sales revenue. Accordingly, I29 represents tax rate.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started