Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Pls show the working. thanks. International Medical Corporation (IMC) is a multi-disciplinary clinic that features specialty centres providing a wide range of comprehensive treatment options

Pls show the working. thanks.

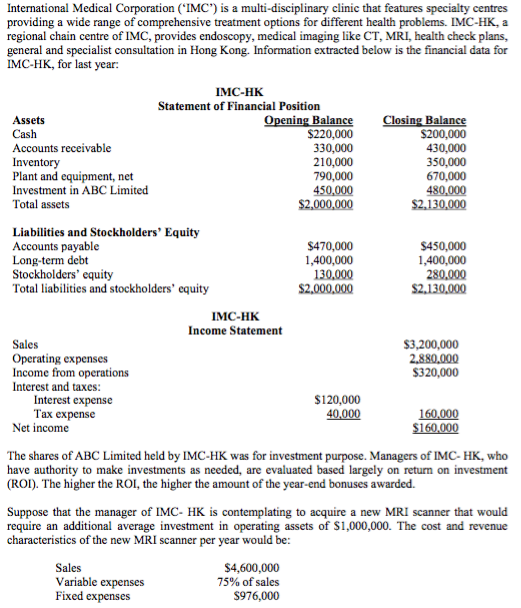

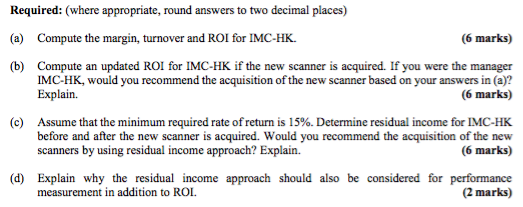

International Medical Corporation ("IMC") is a multi-disciplinary clinic that features specialty centres providing a wide range of comprehensive treatment options for different health problems. IMC-HK, a regional chain centre of IMC, provides endoscopy, medical imaging like CT, MRI, health check plans, general and specialist consultation in Hong Kong. Information extracted below is the financial data for IMC-HK, for last year: Assets Cash Accounts receivable Inventory Plant and equipment, net Investment in ABC Limited Total assets IMC-HK Statement of Financial Position Opening Balance $220,000 330,000 210,000 790,000 450,000 $2,000,000 Closing Balance $200,000 430,000 350,000 670,000 480,000 $2.130,000 Liabilities and Stockholders' Equity Accounts payable Long-term debt Stockholders' equity Total liabilities and stockholders' equity $470,000 1,400,000 130,000 $2,000,000 $450,000 1,400,000 280,000 $2.130,000 IMC-HK Income Statement $3,200,000 2.880,000 $320,000 Sales Operating expenses Income from operations Interest and taxes: Interest expense Tax expense Net income $120,000 40.000 160.000 $160.000 The shares of ABC Limited held by IMC-HK was for investment purpose. Managers of IMC- HK, who have authority to make investments as needed, are evaluated based largely on return on investment (ROI). The higher the ROI, the higher the amount of the year-end bonuses awarded. Suppose that the manager of IMC- HK is contemplating to acquire a new MRI scanner that would require an additional average investment in operating assets of $1,000,000. The cost and revenue characteristics of the new MRI scanner per year would be: Sales Variable expenses Fixed expenses $4,600,000 75% of sales 5976,000 Required: (where appropriate, round answers to two decimal places) (a) Compute the margin, turnover and ROI for IMC-HK. (6 marks) (b) Compute an updated ROI for IMC-HK if the new scanner is acquired. If you were the manager IMC-HK, would you recommend the acquisition of the new scanner based on your answers in (a)? Explain. (6 marks) (c) Assume that the minimum required rate of return is 15%. Determine residual income for IMC-HK before and after the new scanner is acquired. Would you recommend the acquisition of the new scanners by using residual income approach? Explain. (6 marks) (d) Explain why the residual income approach should also be considered for performance measurement in addition to ROL. (2 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started